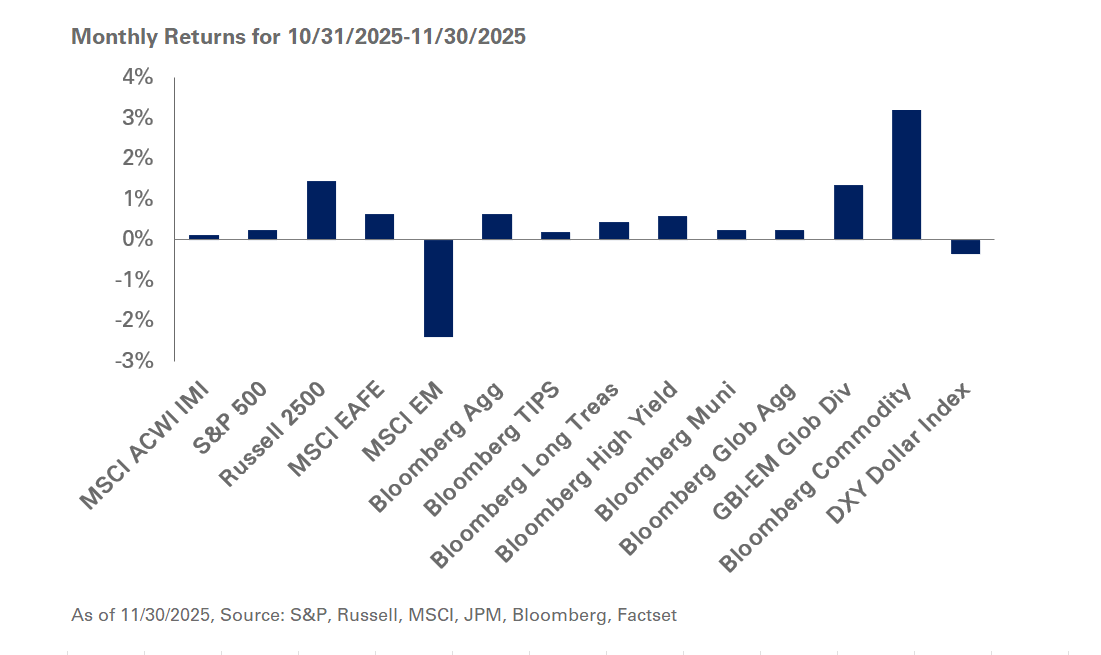

Following months of strong returns, global equities took a pause in November. During this period, the S&P 500 Index eked out a modest 0.2% gain amid a relatively positive backdrop of robust corporate earnings, rising expectations for interest rate cuts in the near term, and an end to the longest U.S. government shutdown on record. Despite these tailwinds, concerns around elevated valuations and AI-related spending dominated sentiment, putting significant pressure on growth stocks relative to value: the Russell 1000 Growth Index fell 1.8%, while the Russell 1000 Value Index added 2.7% in November. These dynamics also carried through to markets outside the U.S. with the value-oriented MSCI EAFE Index adding 0.6%, while the MSCI Emerging Markets Index lost 2.4%, further underscoring the scrutiny around AI expenditures in markets like Taiwan and Korea that had benefited from these trends for most of 2025.

In fixed income, U.S. markets were relatively quiet as investors parsed through delayed data releases. Short- and intermediate-Treasury yields fell with the 10-year Treasury yield down eight basis points last month; in response, the Bloomberg U.S. Treasury Index added 0.6%. Japanese government bond yields stood out as the yield on the 10-year rose 17 basis points for the month, reflecting expectations for an uptick in interest rates in the near term given ongoing currency and inflationary pressures in the Japanese economy. Global bond markets are often sensitive to large changes in Japan’s yield curve and further upward pressure in Japanese bond yields may be a source of volatility in the near term.

Within real assets, most commodity prices moved higher reflecting seasonality within certain parts of the complex and continued momentum in the precious metals space. The broad Bloomberg Commodity Index added 3.2% in November but saw significant dispersion beneath the surface: spot WTI Crude Oil prices fell 5.4%, while spot gold prices gained 5.3% during this period.

Given recent market dynamics, we encourage investors to remain disciplined and stick to long-term strategic asset allocation targets. Should price instability among U.S. large-cap stocks persist, we suggest investors rebalance back into weaker segments of the equity market and potentially use non-U.S. stocks that have outperformed as a funding source. We also recommend investors hold adequate liquidity on hand for cash flow needs, underweight non-investment-grade public debt, and maintain equity exposure in-line with policy targets.