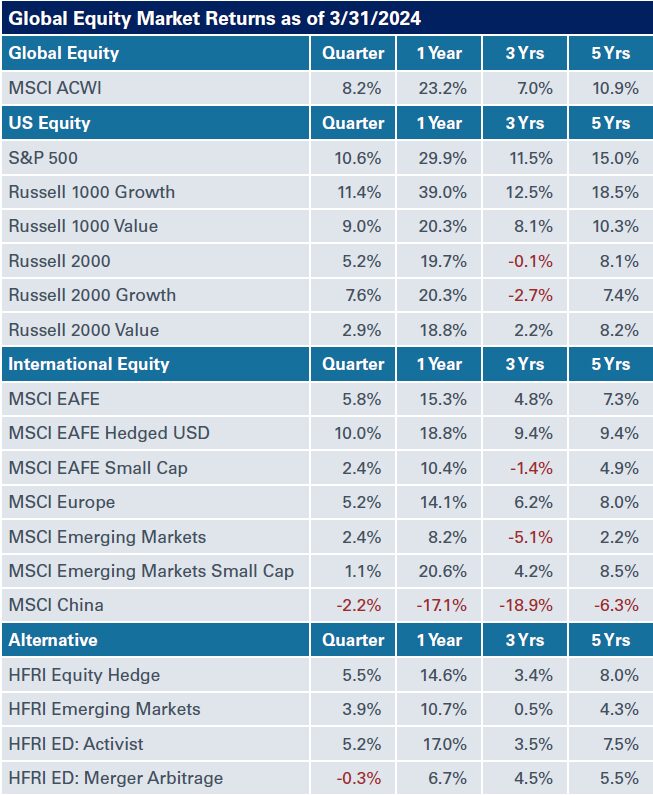

Global Equities

Equities continued their winning streak, posting strong gains in the first quarter. U.S. stocks led performance, bolstered by stronger-than-expected economic data, robust corporate profits, a resilient labor market and consumer confidence. The S&P 500 Index fueled gains of over 10% for the three months ended March 31, while the NASDAQ was up around 9%. During this period, over half the stocks—dominated by growth and technology names—in the S&P 500 hit new 52-week highs. Domestic small-cap equities returned around 5% in the first quarter, lagging their large-cap counterparts.

Outside the U.S., the MSCI EAFE Index finished the first quarter nearly 6% higher, bolstered by gains of 21% from the Japanese Nikkei Index; during the same period, the MSCI Emerging Market Index returned 2.4%, weighed down by weakness in China’s property and credit markets.

Meanwhile, fundraising activity in U.S. private equity totaled $77 billion in the first quarter, while U.S. venture capital fundraising remained depressed at $9 billion, according to data from Preqin. The total number of funds has remained below historical norms, with 63 private equity funds and 100 venture funds closing fundraises; the trend of less capital being raised by a smaller number of funds appears to be spilling over into 2024.

New deal activity in U.S. private equity dropped to $145 billion in the first quarter, from $188 billion a year earlier. Exit volume in private equity-backed companies for the three months ended March 31 totaled $67 billion, down from $82 billion in the fourth quarter but up from $53 billion a year ago. U.S. venture deal activity declined to $36 billion from $40 billion in the fourth quarter and $52 billion a year earlier. Exit activity was up for venture-backed companies, reaching $18 billion in the first quarter, up from $10 billion in the fourth quarter.

U.S. private deal activity, at $145 billion, was down 15% from the prior quarter, according to estimates from PitchBook. U.S. venture deal activity fell to $37 billion in the first quarter, down 9% from the fourth quarter; during this period, private equity-backed exit activity dropped $67 billion, a 19% decline from the fourth quarter. Exit value in U.S. venture capital stood at $18 billion for the three months ended March 31, a 76% jump from the earlier quarter.

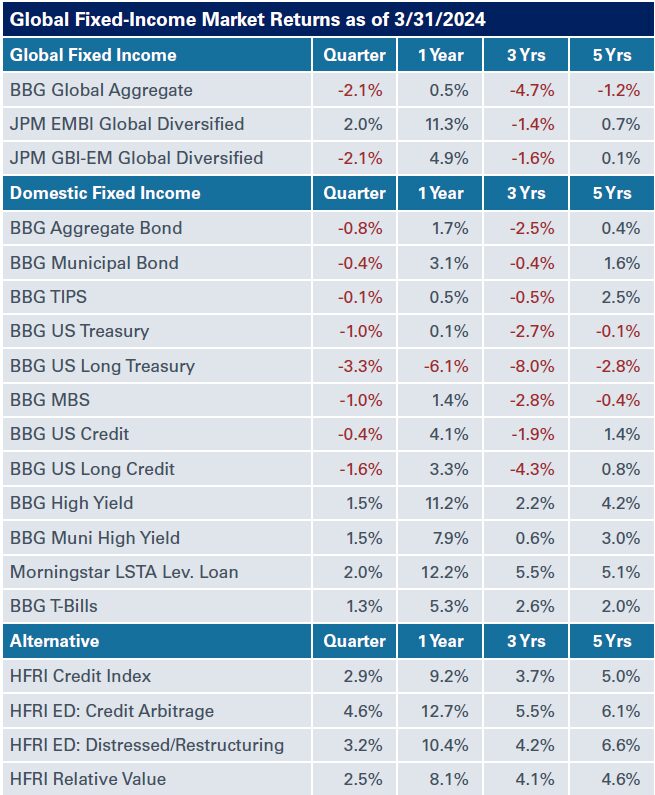

Global Fixed Income

Fixed-income markets continued to be volatile in the first quarter. Treasuries reversed course (again) following the rate rally in the fourth quarter, which was spurred by the Federal Reserve’s dovish pivot. Strong economic data had the market walking back its aggressive stance on Fed easing, bringing implied expectations back towards three cuts in 2024. The Treasury market sold off across the yield curve with yields moving higher by 30-40 basis points.

Unlike Treasury yields, credit spreads continued to tighten; for the three months ended March 31, the spread on investment-grade corporate bonds tightened by nine basis points, while high-yield corporate bonds were tighter by 24 basis points.

Shorter-duration and lower-quality indexes were in the black in the first quarter, while full-maturity investment-grade indexes posted negative total returns. During this period, high-yield debt, bank loans and emerging markets were up in the 1.5%-2.5% range, while higher-quality, short-duration indexes posted smaller gains; the Bloomberg U.S. Aggregate Index lost 0.78% in the first quarter.

Real Assets

The liquid real assets market rebounded in the first quarter after a mixed 2023. The Bloomberg Commodity Index was up 2.2% for the three months ended March 31, though it was overshadowed by crude oil—the star of the show—with a 15.7% return. The Alerian Midstream Index was up 10.2%, while gold posted gains of 8.2% for the quarter.

During this period, global natural resources were also in the black, up 2.2%, while the S&P Global Infrastructure Index gained 1.4%. NEPC maintains a favorable view of natural resources and infrastructure equities due to the potential for sustained inflation. We also continue to prefer private markets when it comes to implementing infrastructure in an investment portfolio.

Meanwhile, real estate fared less favorably. On the public side, the NAREIT Global REIT Composite Index was down 1.5%, continuing its bumpy ride since the rate hikes in 2022. Private real estate returns fared worse, posting their sixth-straight negative quarter, with the NCREIF ODCE posting a 2.4% preliminary gross loss for the three months ended March 31. The negative total return is inclusive of 3.3% asset depreciation, as the effects of rising interest rates maintain their pressure on asset values following the historically high returns prior to 2022. Persisting challenges for traditional office continue to drag down returns across the board.

Real estate debt—despite its more conservative position in the capital stack—remains a bright spot as higher interest rates, impending loan maturities, and pullback from traditional lenders have led to higher return expectations that rival potential gains from value-add real estate equity. On the other end of the spectrum, opportunistic and distressed real estate investors may be able to capitalize on these same factors to acquire high-quality assets suffering from capital structure issues. NEPC remains committed to a barbell approach to investing in closed-end real estate funds.

Private infrastructure strategies continue to garner increased interest among investors, and we are particularly constructive on tailwinds driving digital and communications infrastructure, renewable energy and energy transition strategies.