There was nowhere to hide in September as bonds and equities sold off amid market expectations of interest rates staying higher for longer; the optimism that rates will revert to under 3% sooner rather than later seemingly dissipated last month.

So far, the Federal Reserve has increased rates by over 500 basis points, and appears to have reached the end of its tightening cycle. Meanwhile, Congress has continued to provide fiscal stimulus with no material reduction in spending. With rates ticking up higher, the effect of higher interest burdens on budgets and their impact on capital markets remains to be seen; the markets started discounting the risks associated with this dynamic in September.

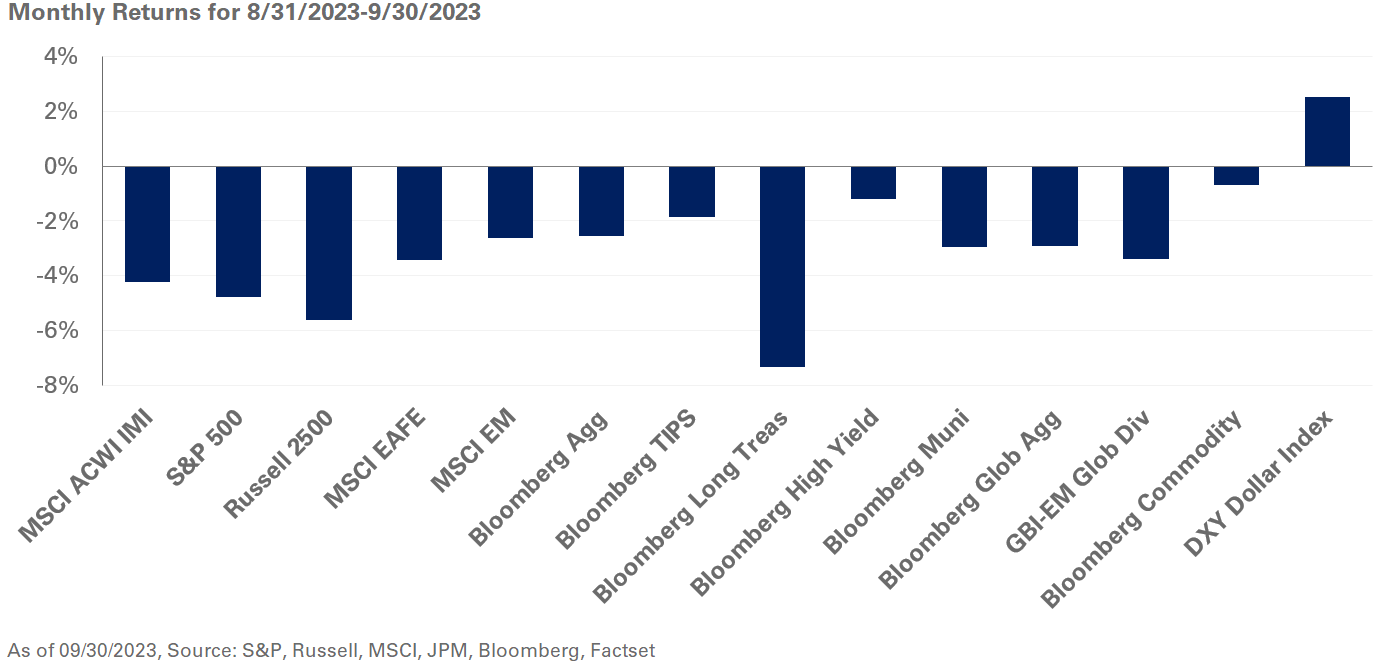

Interest rate duration drove returns in fixed income last month as the sell-off in longer-dated Treasuries fueled losses in bonds. Treasury yields rose sharply in September with the 10-year yield rising 48 basis points and the 30-year yield up 50 basis points. During this period, investment-grade credit spreads widened modestly by three basis points, while spreads on high-yield bonds widened 22 basis points; the duration effect drove investment-grade and high-yield debt down 2.7% and 1.2%, respectively.

Typically, a selloff in bonds is indicative of a risk-on sentiment but with inflation above target, large fiscal deficits, and cash yielding above 5%, equity valuations are experiencing a repricing. As interest rates rose nearly 50 basis points in September, U.S. equities fell 4.8%, according to the S&P 500 Index. Global equities fared relatively better with the MSCI ACWI down 4.1%; emerging market stocks outperformed with losses of 2.6%.

Elsewhere, energy markets ended last month higher with WTI Crude Oil spot prices up 9.8%; so far WTI Crude Oil spot prices have risen almost 30% since June. Overall, the Bloomberg Commodity Index gained 4.1% in September.

Keeping in mind the market dynamics, we suggest investors reduce S&P 500 exposure, while maintaining U.S. large-cap value positions. We also recommend investors increase exposure to U.S. high-yield bonds and broadly evaluate the risk-return benefit of fixed income.

Real interest rates have risen to attractive levels and, given the continued uncertainty surrounding inflation, we encourage taking advantage of the available real yields of 2.5% and adding exposure to TIPS. Lastly, we suggest holding greater levels of cash within safe-haven fixed-income exposures to enhance portfolio liquidity.