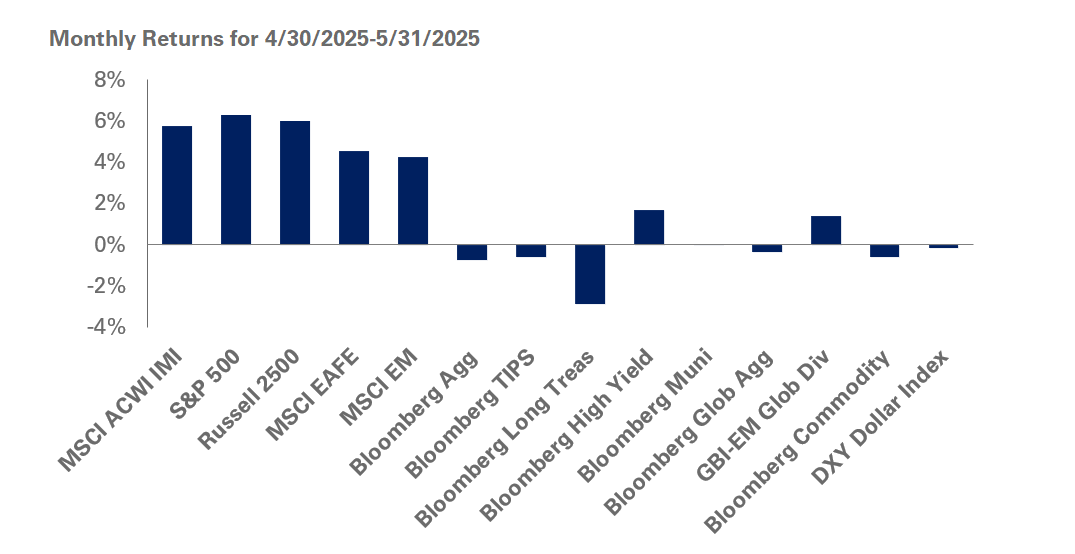

The adage, “Sell in May and go away,” did not hold in 2025 as global equities posted strong returns on the back of a broad de-escalation in tariff rhetoric following news of a 90-day tariff truce between the U.S. and China, an agreement with the U.K. to cut tariffs, and delayed implementation of a 50% tariff on the European Union. In response, investor sentiment rebounded from recent lows, fueling a rally in stocks. The S&P 500 Index added 6.3% for the month–marking its best month since November 2023— fully erasing losses incurred in early April.

Within the U.S., growth names outperformed with strong earnings from some of the mega-cap names, along with a reaffirmed positive outlook for artificial intelligence that bolstered returns. The Russell 1000 Growth Index added 8.8% in May, while the Russell 1000 Value returned 3.5%. Markets outside the U.S. also gained against this backdrop, with the MSCI EAFE and MSCI Emerging Markets indexes adding 4.6% and 4.3%, respectively.

Despite the reprieve, bonds were challenged last month as yields moved higher amid fiscal concerns following the ratings downgrade of U.S. sovereign credit by Moody’s, and ongoing negotiations around budget reconciliation. That said, by month-end, fixed-income markets responded positively to moderating inflation concerns and a de-escalation of potential trade conflicts, pushing yields down from intra-month highs. The 10- and 30-year Treasury yields ended the month 24 and 22 basis points higher, respectively, fueling a 1% decline in the Bloomberg U.S. Treasury Index. As a result, longer-duration indexes underperformed during this period, with declines of 2.9% for the Bloomberg Long U.S. Treasury Index. Credit indexes benefitted from the risk-on environment, with spreads tightening, particularly within the lower quality space. The option-adjusted spread on the Bloomberg U.S. Corporate High Yield Index tightened by 70 basis points, fueling a return of 1.7% in May.

Meanwhile, within real assets, oil prices reversed course, adding 2% last month. So far this year, oil has been weighed down by weak sentiment amid uncertainty around supply stemming from OPEC+ production announcements.

Given recent market dynamics, we encourage investors to remain disciplined and stick to long term strategic asset allocation targets. We believe volatility is likely to persist until greater clarity emerges around the administration’s policy on tariffs and tariff rates. As a result, we recommend investors hold adequate liquidity on hand for cash flow needs, while taking advantage of opportunities to rebalance into equities and Treasuries.