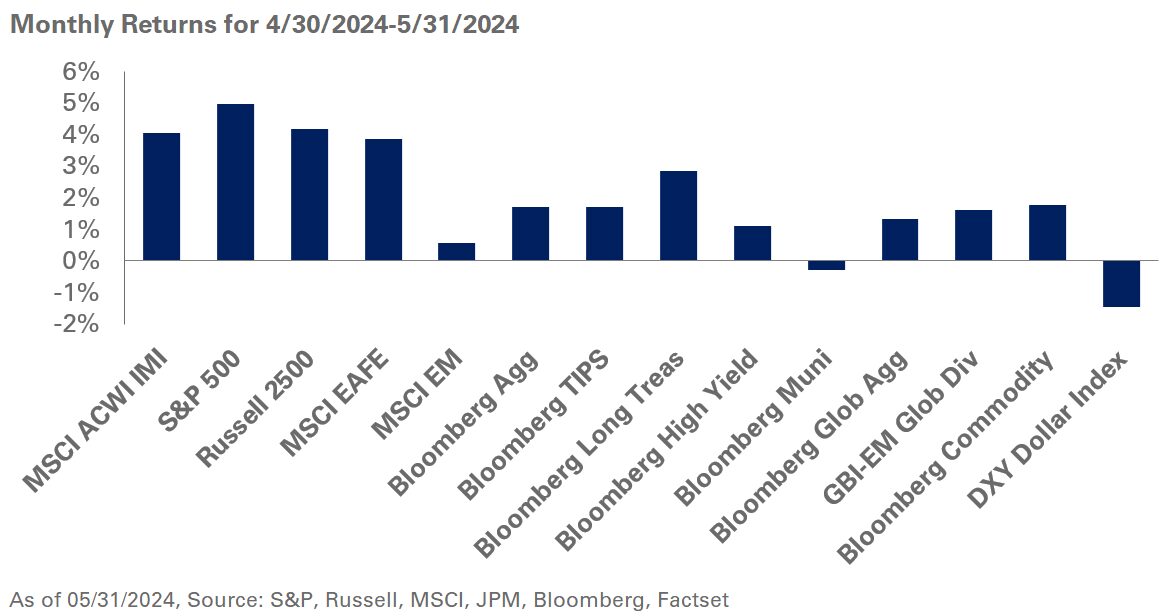

Stocks and bonds defied the adage, “sell in May and go away,” ending the month in the black. The much anticipated earnings of Nvidia beat expectations again, fueling a rally in growth stocks and supporting broader market returns. The S&P 500 Index returned 5% in May, pushing year-to-date gains to 11.3%. Outside the United States, some softening in the U.S. dollar bolstered local currency returns with the MSCI EAFE and MSCI Emerging Markets indexes up 3.9% and 0.6%, respectively.

Meanwhile, mixed economic data and signs of softening inflationary pressures rejiggered the market’s expectations for Fed rate cuts later this year, fueling a broad rally in fixed income. The 10- and 30-year U.S. Treasury yields fell 19- and 15-basis points, respectively. Longer-duration indexes outperformed as they benefitted from the decline in the long end of the yield curve: the Bloomberg Long U.S. Treasury Index added 2.9% last month.

Volatility persisted within real assets as ongoing geopolitical tensions and an uncertain outlook around global growth weighed on energy prices: spot WTI Crude Oil fell 6.6% in May. Despite the decline, the Bloomberg Commodity Index gained 1.8% last month, bolstered by strong performance from natural gas and grains.

We continue to recommend investors hold a blend of S&P 500 and value exposure within U.S. large-cap stocks. We suggest evaluating the risk-return benefit of fixed income and encourage a review of duration positioning relative to strategic goals. We also advocate investors add strategic exposure to U.S. TIPS given the current level of real interest rates.