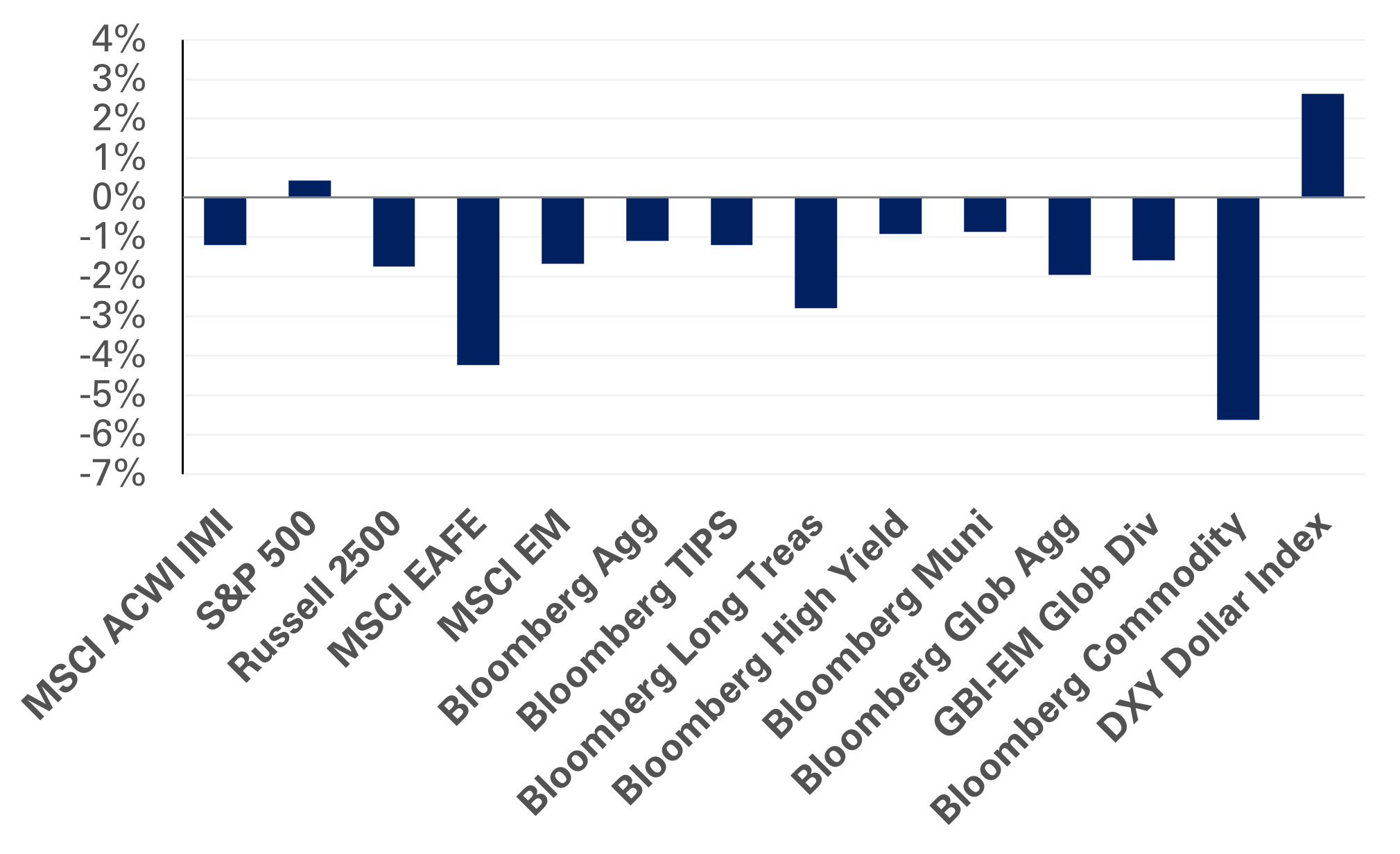

Global equities were mixed in May, with U.S. markets outperforming despite continued concerns around economic growth and the protracted negotiations on the debt ceiling. The S&P 500 Index ended the month up 0.4%, pushing year-to-date returns to 9.6%. These gains come despite weakness in index breadth: a concentration of mega-capitalization technology companies have accounted for an outsized portion of returns. Growth handily outperformed value with the Russell 1000 Growth Index gaining 4.6%, while the Russell 1000 Value Index fell 3.9% last month. Outside the U.S., a stronger dollar and broader concerns around economic growth weighed on stocks with the MSCI EAFE Index losing 4.2% and the MSCI Emerging Markets Index down 1.7%. Notably, Chinese equities fell 8.4% in May amid weaker than expected economic data.

Meanwhile, fixed-income returns were also challenged with U.S. yields moving higher during the month following another 25-basis points rate hike by the Federal Reserve at the beginning of May. While expectations for the near-term Fed Funds rate have softened, they continue to reflect a tighter policy bias by the central bank amid persisting inflationary pressures. In response, the U.S. yield curve further inverted with the spread between the 10- and two-year yield ending the month at -75 basis points. Further, the 30-year Treasury yield gained 18 basis points, fueling a 2.8% decline in the Bloomberg Long Treasury Index in May.

In real assets, the commodity complex came under pressure with the Bloomberg Commodity Index losing 5.6% last month. Energy prices continued to decline, reflecting broad recessionary concerns; spot WTI Crude Oil fell 11.3% in May.

Against this market backdrop, we encourage investors to reduce S&P 500 exposure, while maintaining positions in U.S. large-cap value. We also recommend investors increase exposure to U.S. high-yield bonds and broadly evaluate the risk-return benefit of fixed income. Lastly, we suggest holding greater levels of cash within safe-haven fixed-income exposures and urge investors to maintain higher levels of portfolio liquidity.