Markets surged in June, setting new records, amid fading concerns around tariffs, and the passing of Trump’s so-called Big Beautiful Bill.

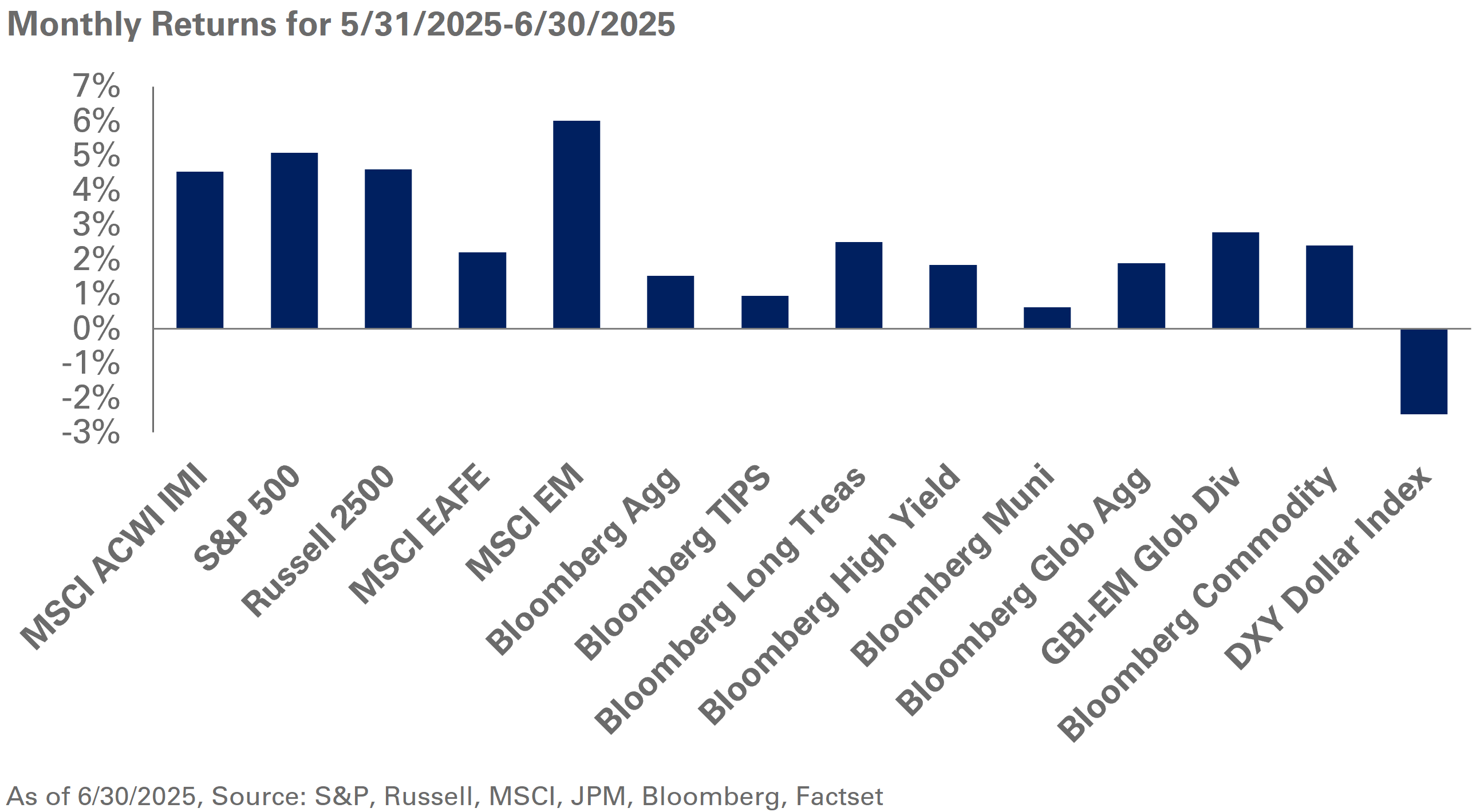

During this period, the S&P 500 gained 5.1%, hitting a new high. Small-cap equities led the way with the Russell 2000 up 5.4%; growth outperformed value with the Russell 1000 Growth returning 6.4% compared to gains of 3.4% for the Russell 1000 Value. International equities continued their march upward with the MSCI EAFE Index up 2.2% and MSCI Emerging Markets outperforming all regions with returns of 6%.

Despite an improving inflation backdrop, labor markets offered conflicting signals. Nonfarm payrolls added 147,000 jobs in June, higher than consensus expectations of 110,000, with gains mostly in government and healthcare sectors. However, ADP private payrolls showed a loss of 33,000 jobs for the month, suggesting weakening private sector employment. The ADP data—a representative sample excluding public sector employment—underscores the narrative of a cooling labor market.

As expected, the Federal Reserve held rates steady at its June meeting while emphasizing its data-dependent approach to monetary policy. The central bank’s economic projections showed a narrower split among committee members, with the median projection now indicating just one rate cut in 2025 versus two previously, as Fed Chair Powell reiterated inflationary concerns around fiscal, trade and immigration policies.

Fixed-income returns were in the black last month as a result of modestly lower yields across the U.S. Treasury yield curve. The 10-year Treasury yield fell to 4.23% from 4.39% as Treasuries gained 1.3% in June. Within credit, both investment-grade and high-yield bonds gained 1.8% for the month with spreads remaining tight.

Meanwhile, commodities turned in a mixed performance in June with the broad index rising 2.4%, driven by a 14% increase in natural gas prices and offset by a decline of 7.4% in the prices of softs, a term for agricultural commodities, for instance, sugar, cocoa and coffee, traded on futures markets. Gold was mostly flat for the month, up 0.2%, holding just under $3,300/oz.

Given the recent market dynamics, we encourage investors to remain disciplined and stick to long-term strategic asset allocation targets. We believe volatility is likely to persist until greater clarity emerges around the administration’s policy on tariffs and tariff rates. As a result, we recommend investors hold adequate liquidity on hand for cash flow needs, while taking advantage of opportunities to rebalance into equities and Treasuries.