The global rout in equities continued into June as elevated inflation levels and tighter monetary policy exacerbated concerns around a recession. In the U.S., headline CPI unexpectedly accelerated, jumping 8.6% over the 12 months ending in May, while core CPI (excluding food and energy) was up 6%. In response, the Federal Reserve raised its benchmark interest rate by 75 basis points—the largest rate hike since 1994—to a range of 1.50% to 1.75%. Furthermore, policymakers revised rate projections higher with median forecasts for 2022 increasing to 3.4% from 1.9% in March.

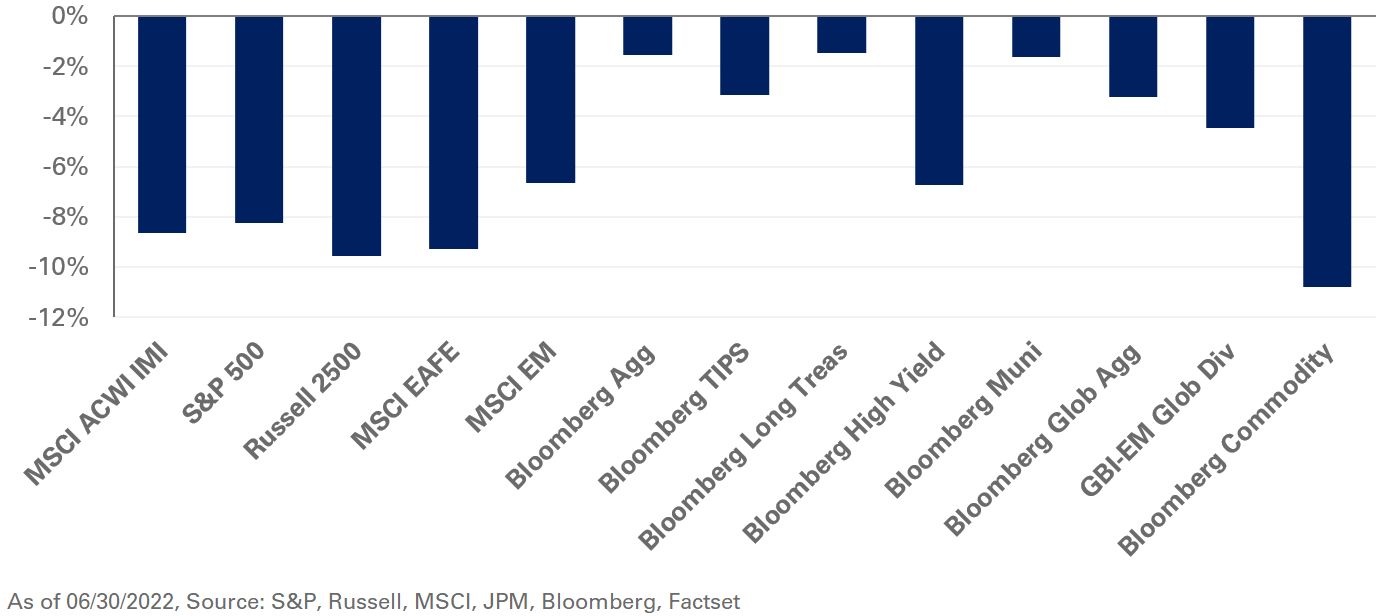

The S&P 500 Index fell 8.3% last month, pushing year-to-date losses to 20%, underscoring the worst first six months of a year since 1970. Outside the U.S., the dollar strengthened in June, weighing down returns for non-U.S. assets. As a result, the MSCI EAFE Index and the Emerging Market Index fell 9.3% and 6.6%, respectively. Notably, the MSCI China Index outperformed, returning 6.6%, as a more accommodative monetary policy, easing lockdown restrictions, and signs of improving policies for the technology sector boosted market sentiment.

In fixed income, global yields moved higher, weighing down returns. In the U.S., the two- and 10-year Treasury yields increased 39 and 13 basis points, respectively. Real yields on 10-year U.S. TIPS rose 44 basis points to 0.65%. As a result, the Bloomberg U.S. TIPS Index fell 3.2%. Additionally, return-seeking fixed-income assets underperformed as credit spreads on the Bloomberg U.S. Corporate High Yield Index widened 163 basis points to 569 basis points, resulting in losses of 6.7% in June.

In real assets, commodity prices declined as the higher likelihood of a recession weighed on demand outlook. Spot WTI Crude Oil fell 7.5% during the month, lowering year-to-date gains to 40.4%.

NEPC’s stance towards risk assets remains unfavorable given the uncertain growth and inflation dynamics. We recommend building exposure to short-term investment-grade credit as higher yields offer an attractive defensive position. We also suggest adding exposure to value stocks in U.S. large-cap equity to mitigate the portfolio impact of rising interest rates and inflation normalizing above market expectations. In addition, we still encourage a dedicated allocation to assets that support liquidity needs in periods of stress.