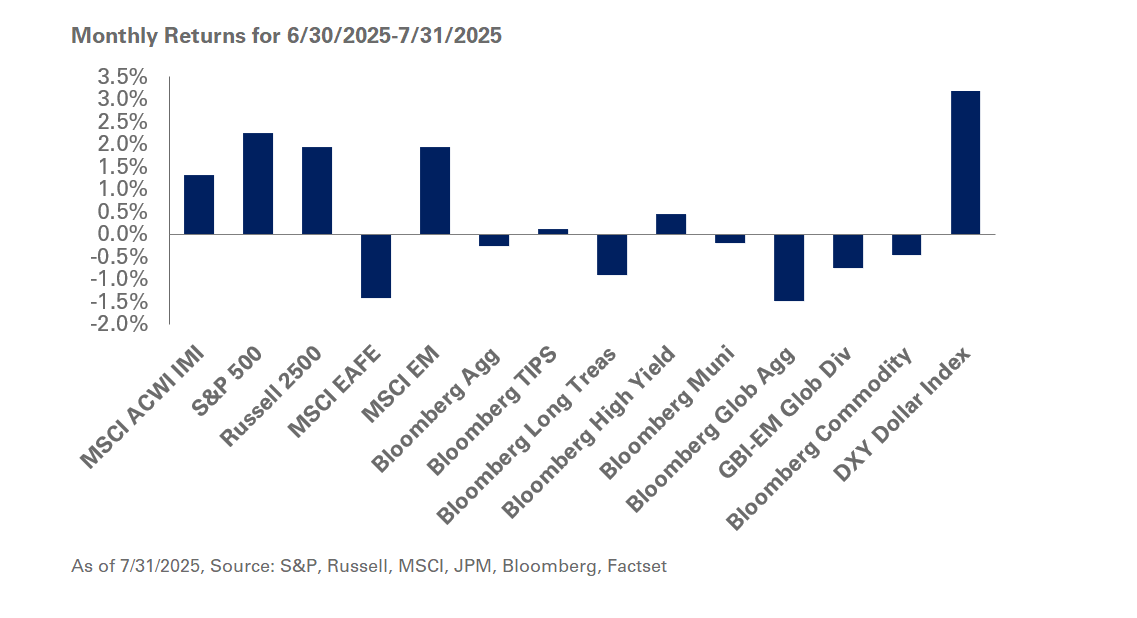

Stocks hit all-time highs in July, with the S&P 500 and the NASDAQ repeatedly setting new records. Corporate earnings were a bright spot last month as the S&P 500’s blended earnings growth rate overshot expectations with over 80% of companies reporting earnings that exceeded street estimates. During this period, the S&P 500 gained 2.2% with growth stocks outperforming value; small-cap equities, as represented by the Russell 2000 Index, were up 1.7% but are significantly trailing large-cap stocks so far this year. Non-U.S. equities were mixed with the MSCI EAFE down 1.4% in July due to weakness in the euro, sterling, and yen; emerging markets were in the black in July bolstered by Chinese equities.

On the economic front, the U.S. announced trade deals with key partners, including Japan and the European Union. Meanwhile, the U.S. economy grew at an annualized rate of 3% in the second quarter, benefiting from an uptick in consumer spending and a decrease in imports. The Federal Reserve met in July, and as expected, held interest rates steady despite two dissenting FOMC members voting to lower interest rates.

The July jobs report upstaged this flurry of news and data, with the addition of 73,000 new non farm payroll jobs coming in below expectations, according to data released August 1. Of greater importance, downward revisions to the May and June reports by 258,000 indicated growth of just 35,000 jobs in the three-month average payroll, underscoring the increasing vulnerability of the labor market; with the exception of the early months of the Covid pandemic, the scale of payroll revisions were the largest since the late 1970s, pointing to potential trouble in the labor market. The weak jobs’ report puts the labor market, tariff policies, and the Fed on a collision course for mid-September at the central bank’s next meeting. Over the course of the next 40 days, we could see material shifts in the market’s expectations for Fed rate cuts in 2025, with the jobs report serving as a potential catalyst for a reset in monetary policy.

Elsewhere, fixed-income returns trended lower in July as interest rates were modestly higher with the 10-year Treasury yield rising to 4.36%. As a result, Treasury indexes were negative in July while TIPS eked out a modest gain. Across credit, investment-grade and high-yield bonds benefited as credit spreads declined, but the impact of rising Treasury rates was a headwind for the investment grade credit index, which gained 0.1%; high-yield bonds continued their upward trajectory, up 0.5% in July. Within real assets, performance was mixed last month with commodities down 0.5% but oil prices, WTI Crude, moved 4.5% higher, ending July just under $70 a barrel. During this period, gold returned 1.4%, and is now up over 25% for the year. The REIT complex still lagged in July, down 1%, with performance nearly flat for the year. The equity indexes of global infrastructure and global natural resource carved out a moderate gain for the month but felt the headwinds of a stronger U.S. dollar as most major currencies weakened relative to the dollar.

Given recent market dynamics, we encourage investors to remain disciplined and stick to long term strategic asset allocation targets. We believe volatility is likely to persist until greater clarity emerges around the economic impact of U.S. tariffs, the outlook for the labor market, and the path of monetary policy. As a result, we recommend investors hold adequate liquidity on hand for cash flow needs, underweight non-investment grade public debt, and maintain equity exposure in line with policy targets.