Risk assets outperformed in July as better-than-expected economic data and moderating inflation bolstered expectations around a potential economic soft landing. The U.S. economy exceeded expectations, growing 2.4% in the second quarter, amid robust consumer spending and non-residential fixed investments. At the same time, inflation cooled with the core PCE Price Index rising less than 0.2% in June, the most recent period for which data is available, marking a significant milestone in reaching the Federal Reserve’s long-term annual inflation target of 2%; the Fed is looking for consecutive monthly gains below 0.2% before reversing its policy.

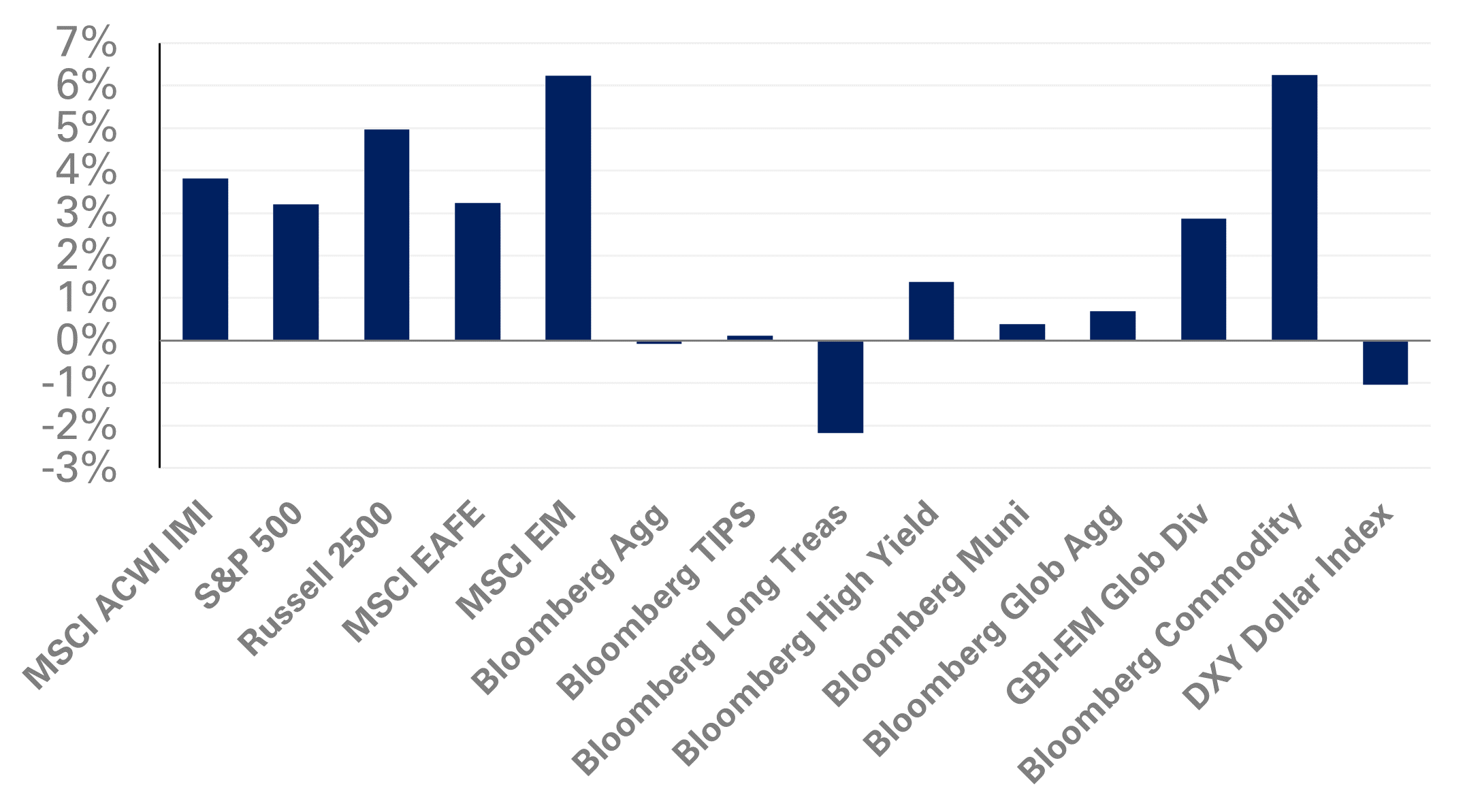

In equities, the S&P 500 Index trended higher last month, rising 3.2%, and within striking distance of reaching an all-time high. The Russell 2000 Index outperformed, gaining 6.1%, as regional bank stocks recovered from their March lows. Meanwhile, a weaker U.S. dollar supported non-U.S. stocks with the MSCI EAFE Index rising 3.2% and 1.7% in dollar- and local-terms, respectively. Notably, the MCSI Emerging Markets Index outperformed, returning 6.2% in July, after China pledged support to boost consumer spending and real estate amid a weaker-than-expected economic recovery; the MSCI China Index was up 10.8%, bringing year-to-date gains to 4.7%.

In fixed income, the 10-year Japanese government bond (JGB) yield rose to 61 basis points—marking the highest level since 2014—after the Bank of Japan made a surprise announcement aimed at increasing flexibility around its policy to control the yield curve and repurchase 10 JGB at a 1% yield, up from 0.5%. Notably, Japan is the largest foreign holder of U.S. government debt – representing approximately 15% of total debt owned overseas. As a result, 10-year Treasury yields rose 14 basis points, reaching 4% in July.

Elsewhere, the Bloomberg Commodity Index rose 6.3% last month. These gains were fueled by a 15.8% jump in WTI crude oil spot prices, which ended the month at $82 per barrel after waning recessionary concerns improved sentiment. In addition, a voluntary reduction in oil production by OPEC and a supply outage in Nigeria further reduced the supply glut.

Keeping in mind the dynamics of U.S. equities, we suggest investors reduce exposure to the S&P 500, while maintaining U.S. large-cap value positions. We also recommend investors increase exposure to U.S. high-yield bonds and broadly evaluate the risk-return benefit of fixed income. Lastly, we suggest holding greater levels of cash within safe-haven fixed-income exposures and encourage investors to maintain greater levels of portfolio liquidity.