Risk-off sentiment washed over markets in February as fresh economic data paved the way for continued rate hikes and a tighter monetary policy backdrop. In the U.S., inflation data softened at a slower rate than anticipated, while labor market numbers remained robust.

In response, the Federal Reserve hiked interest rates by 25 basis points to a range of 4.50%-4.75%. Market expectations for peak interest rates also increased with the market now anticipating a peak Fed Funds rate of 5.25%-5.50% mid-year and no rate cuts through the end of 2023.

In fixed income, returns were challenged by the upward pressure on interest rates. In particular, U.S. Treasury yields moved higher with 10- and 30-year yields increasing 37 and 27 basis points, respectively, weighing down longer-duration indexes.

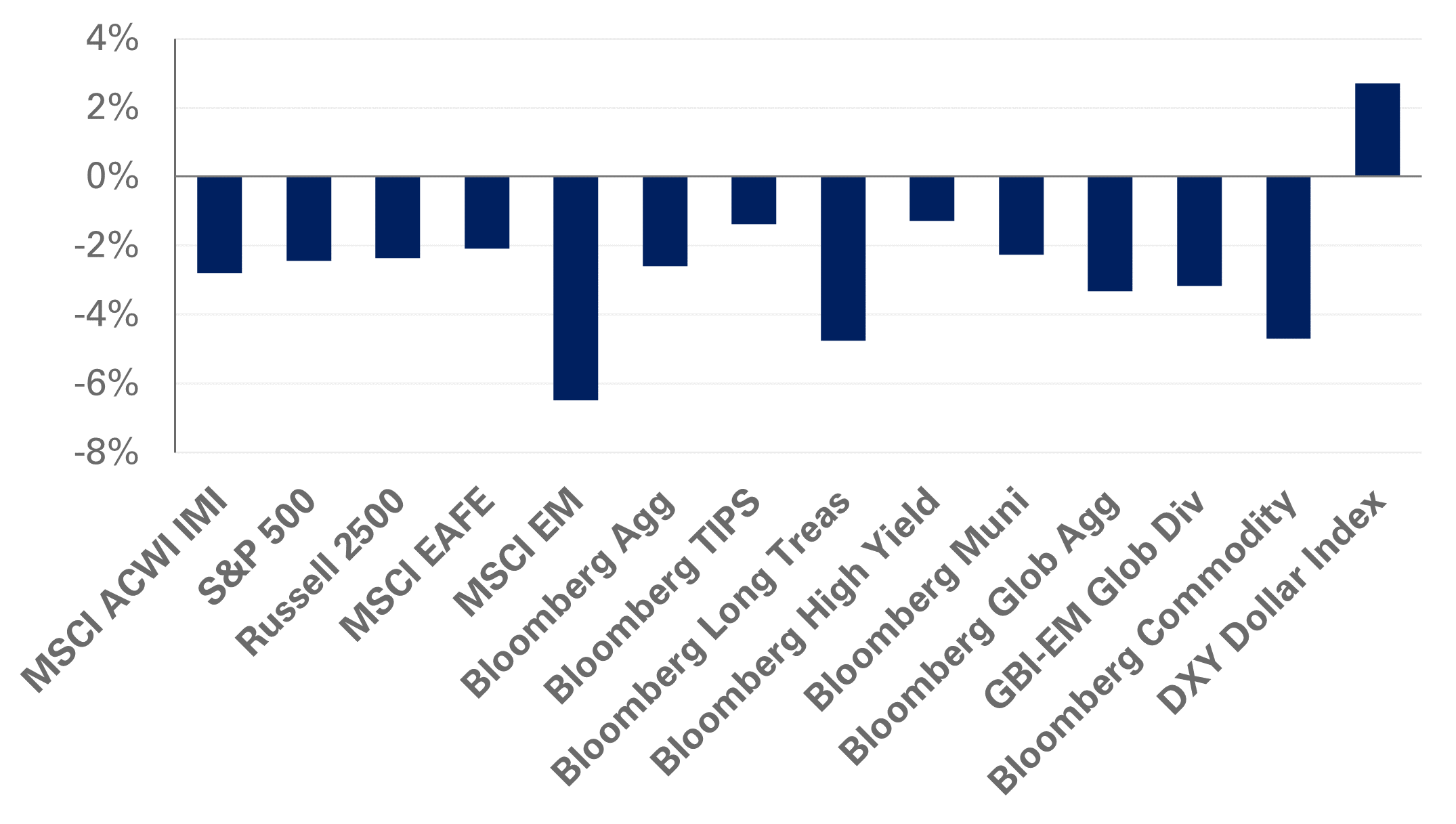

Meanwhile, developed markets outperformed on a relative basis with the S&P 500 Index losing 2.4% and the MSCI EAFE Index falling 2.1% in February. Emerging markets experienced a larger decline as geopolitical tensions negatively impacted sentiment around China; the MSCI Emerging Markets Index fell 6.5% last month, while the MSCI China Index fell 10.4% in the same period.

Elsewhere, real assets were also in the red for the month as growth concerns and rising inventory levels dragged down commodity markets, with the Bloomberg Commodity Index losing 4.7%.

NEPC’s market outlook reflects a defensive bias. We recommend investors hold greater levels of liquidity. We expect to see more frequent opportunities to rebalance equity and encourage investors to be prepared to trim or add equity exposure following extended market drawdowns or rallies. We continue to recommend holding high-quality short-term credit and our conviction remains high regarding U.S. large-cap value exposure. In addition, we encourage investors to assess the risk-return profile of fixed income and explore the benefit of diversifying asset classes in the portfolio.