Investors couldn’t have asked for more last year. Or, for that matter, the last 10 years.

Accommodative monetary policies, falling interest rates and subdued inflation not only helped them meet their return objectives, but also, in many instances, exceed them. The S&P 500 Index—the largest holding in most portfolios—was up more than 30% in 2019, scaling new peaks and setting records. Domestic stocks have posted annualized gains of over 13% in the last 10 years, while high-yield credit has delivered more than 7% in the same period. Even more impressive, in a historical first, the US economy completed a calendar decade without a recession.

This protracted winning streak has benefitted investors in different ways, be it hefty risk-adjusted returns for the total portfolio or improvements in overall funded status. It may have also lulled them into believing this current period of elevated US equity valuations and low market volatility will persist into the new decade; that this extended economic expansion can keep a recession at bay even in this late phase of the market cycle. Many have embraced this leap of faith as they wrestle with a fear of missing out as equities continue their march upward. This fear is most acute for diversified investors as recent market performance has punished the prudent who dared to question the longevity of the returns.

At NEPC, we ask investors to take a different leap of faith as we step into the next 10 years: with interest rates near rock-bottom, corporate profit margins hovering around cyclical highs, and easy monetary policies, we encourage a renewed emphasis on strategic asset allocation to ensure overall investment objectives align with long-term risk-return parameters. We continue to strongly advocate portfolio diversification despite the relative disappointment of that approach in 2019.

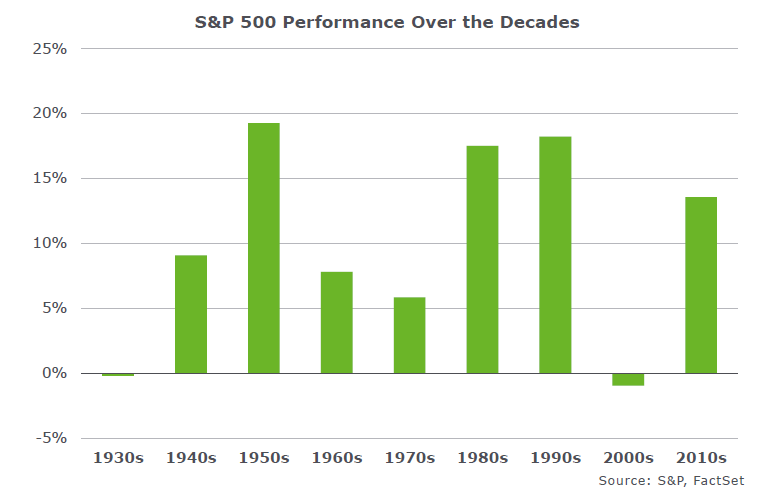

This is because history tells us that the market environment of the last decade is unlikely to be repeated. Robust equity returns of one decade are rarely followed by another stellar 10-year period. In fact, the stellar gains of the last year alone have triggered declining 10-year return expectations for nearly all assets. To this end, a weak decade is often fol-lowed by a strong one, and vice versa, with markets appearing to take about 10 years to find their new equilibrium.

To be sure, the 1980s and 1990s are a notable exception with back-to-back decades of robust returns. This 20-year stretch was buoyed by falling interest rates and disinflation, with 10-year yields falling five percentage points–a phenomenon unlikely to be repeated. As a result, we expect investment returns to be broadly lower over this decade.

Our subdued outlook and market valuations for the long term, a 10-year horizon, are informed by our key market themes that influence asset allocation and portfolio implementation. For instance, the US economy—amid a prolonged economic expansion—remains ensconced in the late stage of a market cycle. We also expect China’s complex transition into a service- and consumption-oriented economy from the manufacturing behemoth that it was (and still is) to continue into this decade. Similarly, we believe the backlash against globalization—expressed through populism and trade wars—is here to stay.

In addition, we have a new theme this year, inspired by the willingness of governments and central banks to step in to bolster market sentiment and prolong the lifespan of an economic cycle. These seemingly permanent interventions have created a new normal, where accommodative monetary policies and fiscal debt growth appear to exist in perpetuity, supporting equities relative to fixed income. These permanent monetary and fiscal interventions could mute the normal fluctuations of an economic cycle, but they leave few safety nets in a downturn. While investors have welcomed the support for equities, we expect subdued returns over the long term as starting valuations remain high.

While our forecast for investment returns over the next 10 years is relatively muted, we are willing to take a tiny leap, or rather, hop of faith in 2020: A recession in the United States appears unlikely while low interest rates and inflation levels continue to power higher equity valuations. However, given that we are in the late phase of this economic cycle, diversification and balance remain paramount.

To this end, we believe emerging markets provide diversification while offering the high-est potential for total returns. Furthermore, the opportunities for active management and excess returns appear more abundant in emerging economies. Lastly, the growth premium relative to the developed world persists as economic conditions in emerging markets remain supportive. As a result, we encourage investors to overweight emerging market equities relative to developed market stocks.

Our key market themes and outlook for 2020 suggest an investment landscape marked by low interest rates, high price-to-earnings multiples and lofty profit margins. While these factors could collectively indicate a pricing peak, the expected ongoing monetary and fiscal support, and the extended economic expansion favor equities over fixed income. While current market dynamics may reward taking risks, uncertainties remain, making it critical for investors to consistently align their strategic asset allocation to their long-term objectives and mission. Safe-haven fixed income and other defensive assets, despite low yields, remain vital in balancing risks within a diversified portfolio.

While the benefits of diversification can be questioned at certain times, we are unwavering in our view that over the long term, investment programs are best served by maintaining portfolio balance and discipline. We urge our investors to do the same as we step into this new decade.