Global equities moved sharply lower at the beginning of April on the heels of stiff tariffs announced by the U.S. administration. On April 2, President Trump declared a 10% baseline tariff rate on imported goods from all countries and higher reciprocal tariffs on around 60 countries and regions with which the U.S. has significant trade deficits. The news and subsequent announcement of retaliation by China spooked investors, with the S&P 500 posting its worst week since the onset of the Covid pandemic, while the VIX Index, a reliable gauge of market volatility, crossed 40.

Markets heaved a sigh of relief in subsequent weeks as the Trump administration walked back on the timing and intensity of the new tariffs. The S&P 500 finished the month with a seven-day winning streak and the VIX Index ended the month below 25 as volatility levels reset. While the initial tariff announcements were harsher than expected, we remind investors that many questions remain around their implementation and the outcome of negotiations with U.S. trade partners. As a result, we expect market volatility to continue, especially as it relates to the U.S. and China.

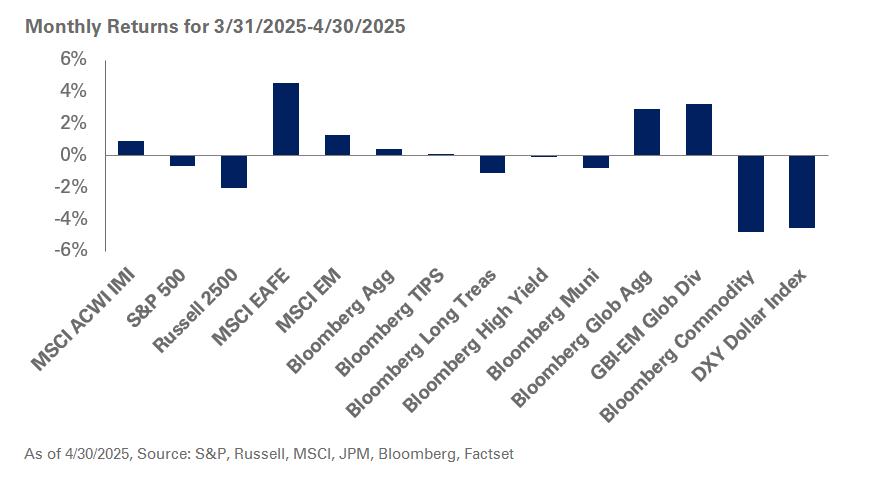

Most U.S. equity indexes finished the month in the red with the S&P down 0.7% in April, and small-cap stocks losing 2.3% during the same period, according to the Russell 2000 Index. Equity markets outside the U.S. outperformed on a relative basis as weakness in the U.S. dollar provided a tailwind to returns. The MSCI EAFE Index was up 4.6% for the month, while the MSCI Emerging Market Index ended 1.3% higher in April.

After the challenging start to the month, Treasury yields responded favorably to economic uncertainty with the 10-year yield down five basis points to 4.16%. As speculation and rumors of investors losing confidence in Treasuries as a safe haven roiled markets, the final weeks of April served as a reminder of the undisputed status of U.S. Treasuries as a safe harbor in times of economic distress. Meanwhile, Federal Reserve Chair Jerome Powell reiterated the central bank’s stance of being in no hurry to lower interest rates; he also emphasized the Fed’s need for greater clarity on growth and inflation implications from tariffs before adjusting monetary policy.

Given the volatility and modest steepening in the Treasury yield curve, fixed-income returns were mixed in April. Within credit markets, investment-grade spreads rose 12 basis points to 106 basis points and high-yields spreads increased 37 basis points to 384 basis points.

Meanwhile, commodities bore the brunt of the market volatility with the Bloomberg Commodity Index down 4.8%. Amid rising economic turmoil, the price of oil declined dramatically and was down 19% for the month, with the WTI Crude falling below $60 a barrel. Gold continued its stellar run so far the year, offsetting the weakness in commodities, with gains of 5.3% in April.

Given the recent market dynamics, we encourage investors to remain disciplined and stick to long-term strategic asset allocation targets. We believe volatility is likely to persist until greater clarity emerges around the administration’s policy on tariffs and tariff rates. As a result, we recommend investors hold adequate liquidity on hand for cash flow needs, while taking advantage of opportunities to rebalance into equities and Treasuries. We suggest maintaining neutral duration positioning relative to strategic targets as bond yields price in a higher probability of economic weakness.