Risk assets traded higher in April as positive economic data and better-than-expected earnings supported market sentiment. In the U.S., the economy expanded at an annualized rate of 2.2% in the first quarter as an increase in consumption and government spending offset a decline in inventories. Inflation levels moderated, with headline PCE increasing 0.1% over March, while core PCE, which excludes food and energy, rose 0.3%. While the labor market remains robust, JOLTS data showed signs of cooling as job openings fell for the third consecutive month to 9.6 million in March – marking its lowest level since April 2021.

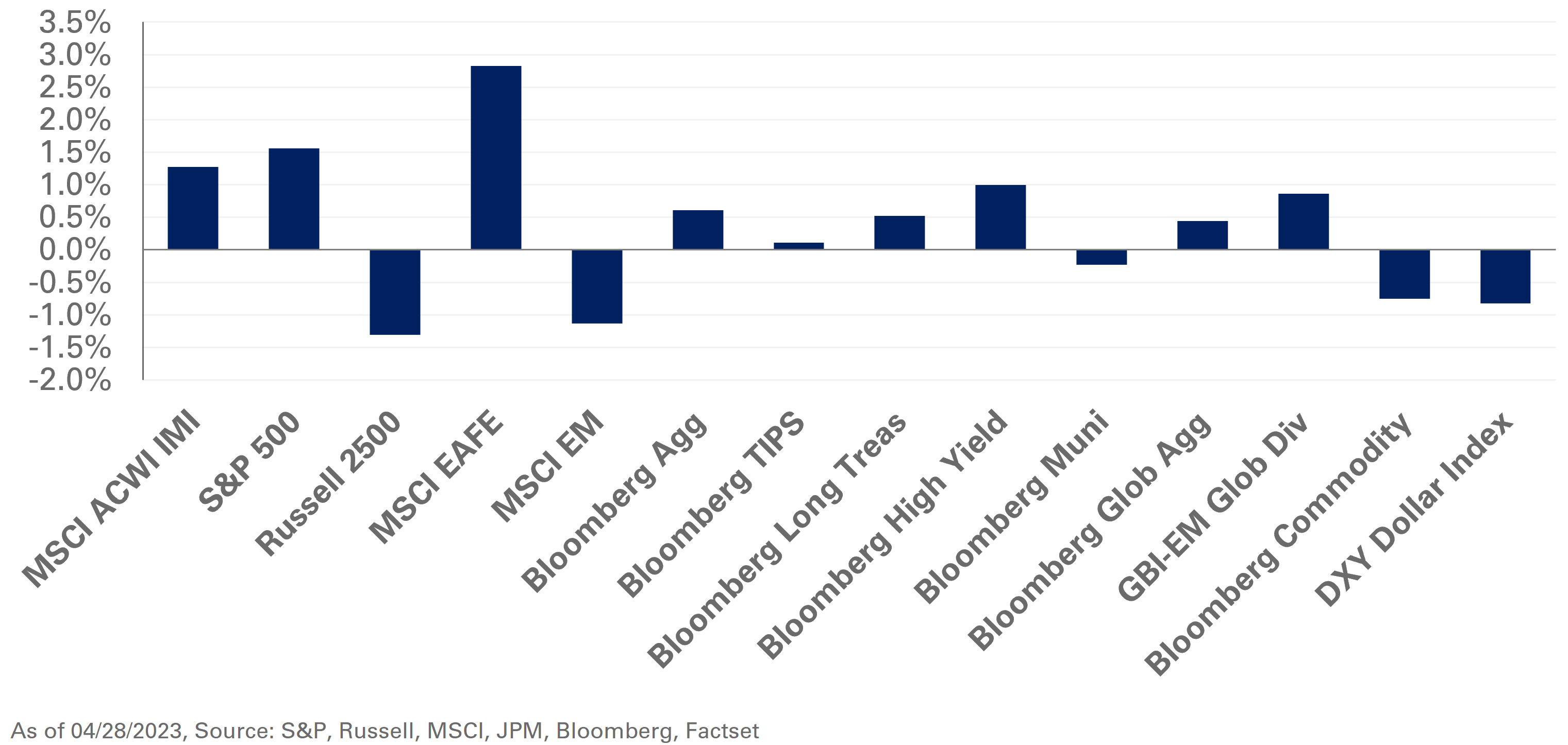

In equities, the S&P 500 Index gained 1.6% in April, bolstered by better-than-expected earnings and continued outperformance by the mega-capitalization technology companies. Of the 269 companies within the S&P 500 that reported, over 70% of the companies posted a positive revenue surprise, while approximately 79% companies recorded a positive earnings surprise. In addition, the largest five companies contributed to approximately half of the broader index return. Outside of the U.S., the MSCI EAFE Index outperformed with gains of 2.8%, supported, in part, by a weaker U.S. dollar.

In fixed income, the U.S. Treasury curve shifted slightly lower with the two- and 10-year yields down one and five basis points, respectively. Higher-carry assets outperformed with rates and spreads relatively flat. As a result, the Bloomberg U.S. High Yield Corporate Index was up 1% last month.

Against a backdrop of encouraging economic data and dissipating concerns around the banking sector, we suggest investors hold equity allocations near strategic targets. Given our upward bias in terminal rate projections relative to the market’s pricing amid softening—though still elevated—inflation levels, we also recommend exposure to U.S. large-cap value stocks.