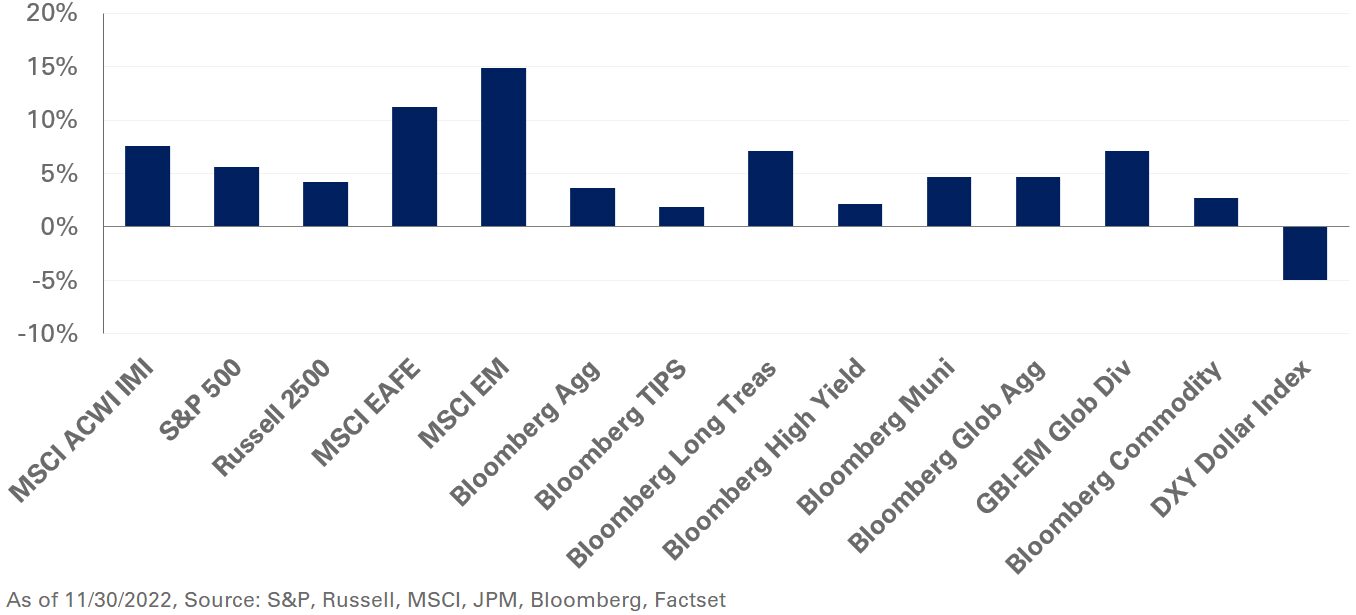

Global equities moved higher in November, cementing gains from the prior month, as the MSCI ACWI Index added 7.8%. In the U.S., softer-than-expected inflation data fueled expectations that rate hikes by the Federal Reserve may end earlier than anticipated. Monthly headline and core CPI rose 0.4% and 0.3%—equating to annualized increases of 7.7% and 6.3%, respectively. Non-U.S. equities were supported by the weakening U.S. dollar; the DXY Index fell 5.1% during the month. Notably, the MSCI China Index gained 29.7% in November as policymakers began easing some COVID-related restrictions, bolstering investor sentiment.

Despite some initial signs of inflation pressures easing, central banks around the world continued tightening monetary policy. The Fed raised rates by 75 basis points to a range of 3.75%-4%. The central bank reiterated its tough stance on inflation, while highlighting a higher terminal rate forecast than what was signaled in September. In response, the front-end of the yield curve increased, while longer-dated yields fell. The Treasury curve remains dramatically inverted with the 10- and two-year yield spreads falling 69 basis points.

Within credit, option-adjusted spreads tightened across the board, reflecting broad risk-on sentiment. The rate reprieve and tighter spreads resulted in positive returns across fixed-income assets, with the Bloomberg U.S. Credit Index adding 5% in November. Emerging market debt also benefitted from these dynamics and U.S. dollar weakness, with the JPM EMBI Global Diversified and JPM GBI-EM Global Diversified indexes gaining 7.6% and 7.1%, respectively.

Meanwhile, volatility still reigned in real assets. Spot WTI Crude Oil fell 6.9% for the month amid a flurry of OPEC+ headlines and growing concerns over the demand outlook given China’s diminished economic activity. Additionally, gold prices gained 8.3%— marking their strongest month since May 2021—amid signs that less aggressive interest rate hikes may be in the cards.

NEPC’s stance towards risk assets remains unfavorable given the uncertain growth and inflation dynamics. We recommend building exposure to short-term investment-grade credit as higher yields offer an attractive defensive position. We also suggest adding exposure to value stocks in U.S. large-cap equity to mitigate the portfolio impact of rising interest rates and inflation normalizing above market expectations. In addition, we still suggest maintaining adequate portfolio liquidity with safe-haven exposure and encourage a neutral portfolio-level duration posture relative to policy targets.