Investors may need to prepare for the new normal as the US economy settles into the late stage of its expansionary cycle. After an extended period of calm and rising asset prices, markets are experiencing greater volatility and fluctuating values.

At NEPC, we believe defensive equity strategies can provide meaningful downside protection and can be a natural fit for corporate pension plans that are pursuing a de-risking strategy after reaching funded status goals.

We highlighted defensive equity strategies in January last year and, for the most part, these strategies successfully weathered market shocks in 2018. Within the four different types of defensive equity approaches—equity long-short, options-based, multi-asset and traditional—equity long-short strategies provided the most downside protection over long periods of time, losing 3% compared to 10% for the Standard & Poor’s 500 Index, while traditional strategies fell 7% with corresponding declines of 10% for the S&P 500.

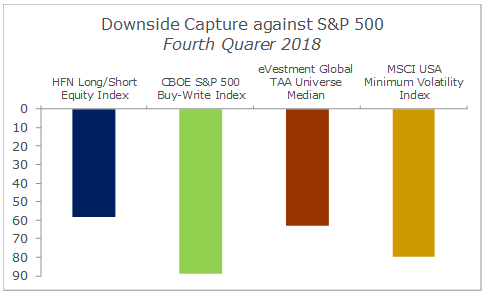

Last year saw two meaningful periods of market disruption. One, in the first quarter, when volatility spiked in late January, spilling into February. While this was a relatively brief time span, we see that the downside protection provided during this period across the different strategies was consistent with long-term results relative to the S&P 500 (Exhibit 1).

Exhibit 1: 1Q 2018 Downside Capture against S&P 500

Source: eVestment Alliance

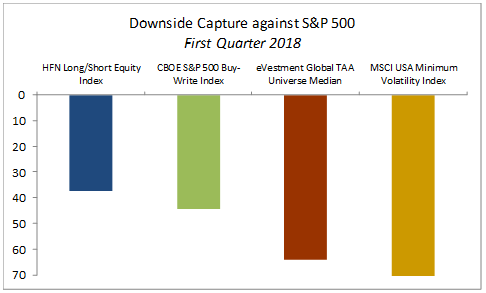

This was followed by a challenging fourth quarter which ended with the worst December for equities since 1931 (Exhibit 2); the long-term relationship holds again except for the buy-write index, which captured more downside than we would expect over longer drawdown periods. The steep decline of the S&P 500 limited the benefits from selling options during this brief period. Option premiums tend to recover after periods like these and deliver higher income going forward.

Exhibit 2: 4Q 2018 Downside Capture against S&P 500

Source: eVestment Alliance

Stay tuned for a white paper we have in the works on options-based and traditional defensive equity strategies. Please contact your NEPC consultant if you would like to discuss defensive equity strategies in more detail.