In these times, consensus is hard to come by. But there is one thing everyone can agree on: equities are seemingly unstoppable, scaling new highs one after another.

While the bull market may continue, this could be an ideal time for employers to consider reducing risk in their pension plans, especially since equities typically make up a sizable part of a return-seeking allocation. However, reducing the equity allocation may not be acceptable from a total portfolio expected return standpoint.

Enter: defensive equity strategies. Over time, this approach can help investors achieve gains similar to a market cap-weighted benchmark with potentially better performance in down markets. This may be especially attractive to investors who want to balance a relatively high expected return on asset assumption with downside protection. This approach can be particularly useful during the most difficult times for funded status, that is when both equity markets and interest rates are falling, making it a potentially useful de-risking strategy.

Defensive equity strategies take many forms. On one hand, this provides a number of options for investors to consider; on the other, it also makes for a tricky decision-making process given the varied ways to implement this approach in a portfolio and the different degrees of expected downside protection.

At NEPC, we take a broad view, considering traditional and alternative equities, and multi-asset strategies that can deliver equity-like returns over time with potentially less risk than a market cap-weighted benchmark.

Traditional defensive equity strategies are long only and include many different types of approaches such as active, passive, low volatility and multi-factor strategies. Traditional strategies may be fundamental, quantitative or a blend of both in their implementation.

Alternative defensive equity strategies include long/short and options-based strategies. Alternative equity strategies tend to be structurally defensive in that their beta is meaningfully and consistently below one. Manager skill tends to drive long/short strategies while options-based strategies tend to incorporate either skill or rules-based approaches to combine market exposures and the volatility risk premium via option selling.

Multi-asset strategies typically incorporate elements of the other approaches and may hold stocks, bonds, currencies, commodities and alternative strategies in an attempt to achieve high-absolute returns over time with much lower drawdowns than traditional equity approaches.

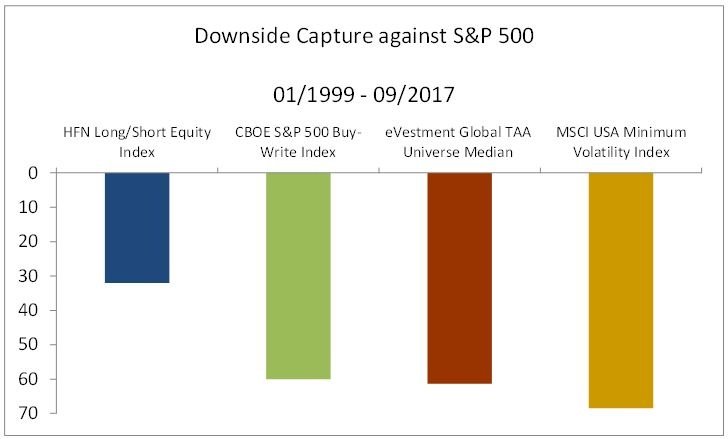

The chart below compares the downside capture of various indexes representing the different strategies referenced above to the S&P 500 over the longest common time period available.

Source: eVestment Alliance

As shown in this illustration, alternative defensive equity strategies provided the most downside protection followed by minimum volatility equities. This relationship is consistent with expectations from the different strategies. This example is based only on index and median manager results. Actual results will vary based on implementation.

We believe defensive equity strategies can potentially help investors improve risk-adjusted returns, protect capital in down markets, and reduce volatility in funded status. It is vital for investors to pick a defensive equity strategy that is suitable to them. Their primary goal, while adopting this approach, should be risk reduction as opposed to an expectation of consistently outperforming the market cap benchmark. If you want to know more, please contact your NEPC consulting team.