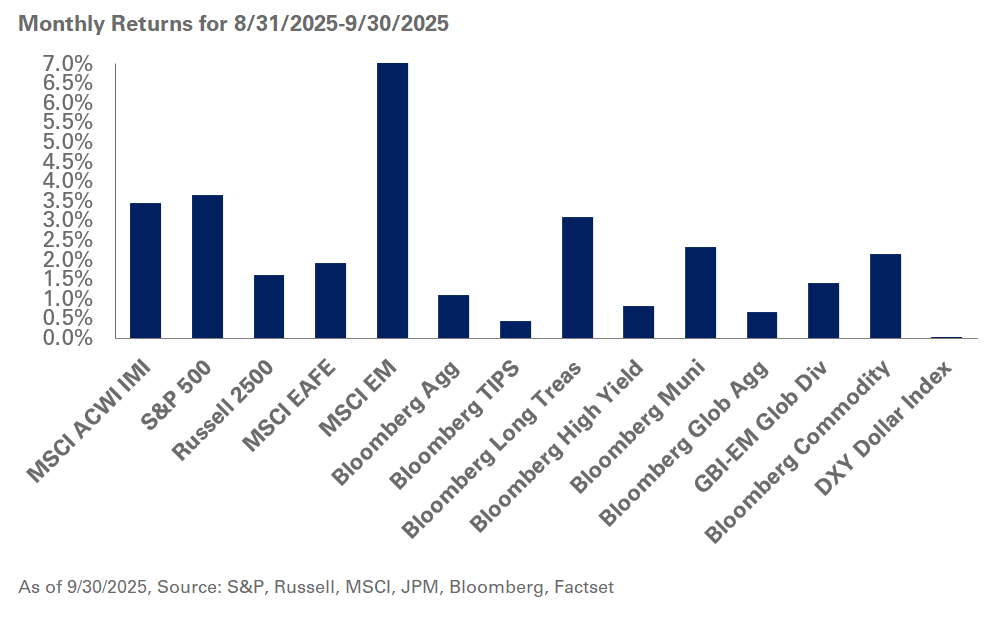

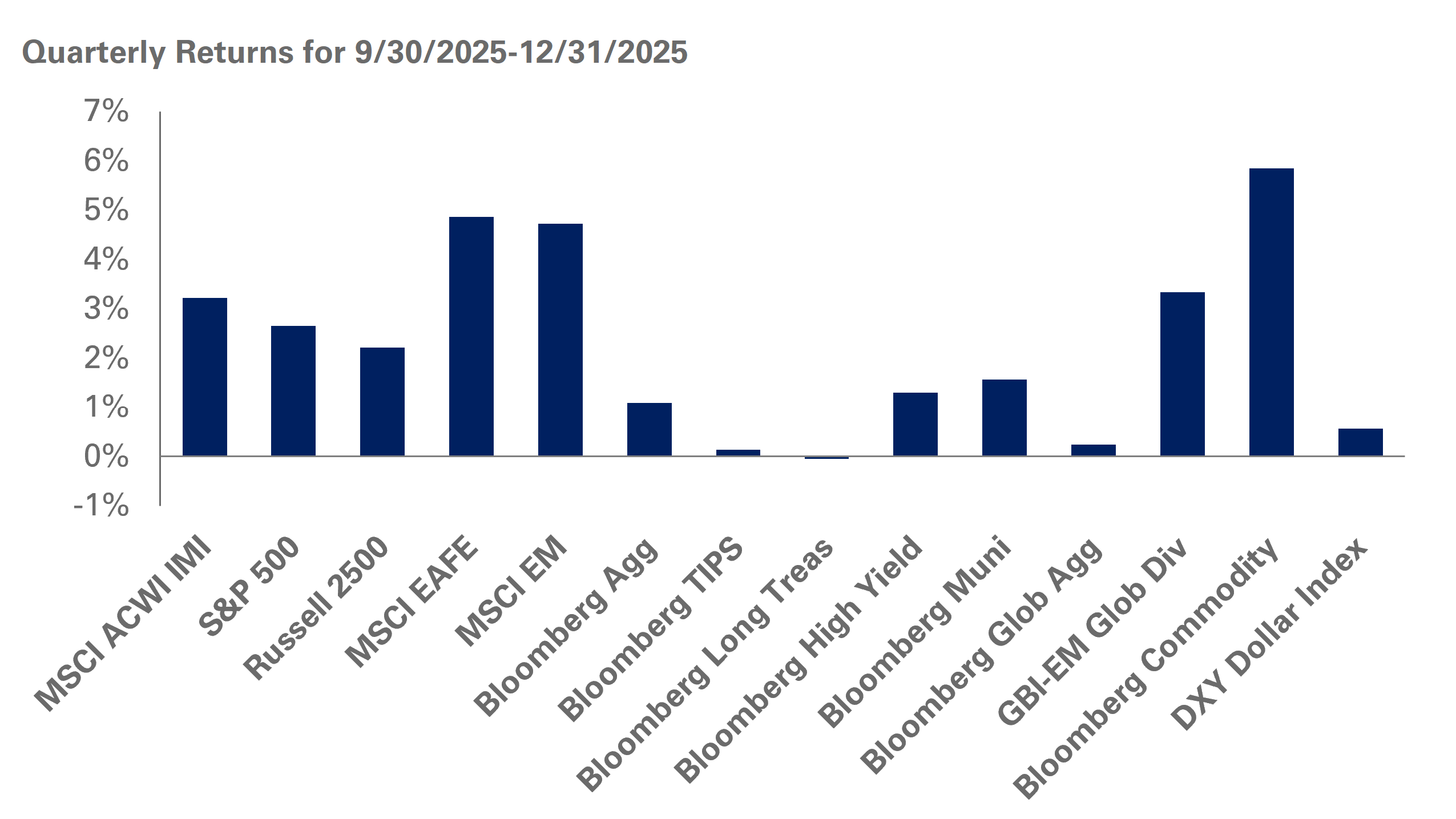

Equities posted another strong month in September with the S&P 500 gaining 3.7% while hitting a new high; large- and small-cap growth indexes were up 5.3% and 4.2%, respectively. Meanwhile, international equities were also in the black with the MSCI EAFE Index returning 1.9% and MSCI Emerging Markets outperforming with gains of 7.2%; both international indexes continue to maintain their lead over U.S. equities so far this year.

Elsewhere, fixed-income markets were positive in September on the heels of an expected rate cut by the Federal Reserve in addition to future cuts getting priced in. Fed Chair Jerome Powell characterized the rate cut as a preemptive risk management measure to off set a potential economic slowdown amid increasing signs of weakness in the labor market. The move also underscored the central bank’s shifting priority to bolster the labor market over its attempts to rein in inflation back to its target of 2%.

During the month, the yield on the 10-year Treasury fell 10 basis points to 4.1% while investment-grade spreads ground tighter to 74 basis points leading to gains of 1.1% posted by the Bloomberg Aggregate Bond Index; high-yield spreads also remain compressed at 267 basis points, leaving little room for upside.

Commodities were broadly positive in September with the index rising 2.2% despite oil prices being down 3.1%. During this period, gold continued to shine, up 11.9% for the month and crossing $3,800/oz; the asset class is leading so far this year with gains of 47%.

With worries around inflation receding into the background, investors are turning their attention to the labor market to assess the health of the economy. However, their efforts to parse through critical data to determine levels of employment and job creation have been complicated by the federal government shutdown as it prevents the Department of Labor from compiling and publishing its monthly jobs report, a timely and vital data point; the ADP employment report, which covers only the private sector, showed a loss of 32,000 private sector jobs in September, underscoring the slowdown in the labor market.

Given recent market dynamics, we encourage investors to remain disciplined and stick to long-term strategic asset allocation targets. We believe volatility is likely to persist until greater clarity emerges around the impact from tariffs. As a result, we recommend investors maintain adequate liquidity for their cash flow needs, while taking advantage of opportunities to rebalance into equities and Treasuries.