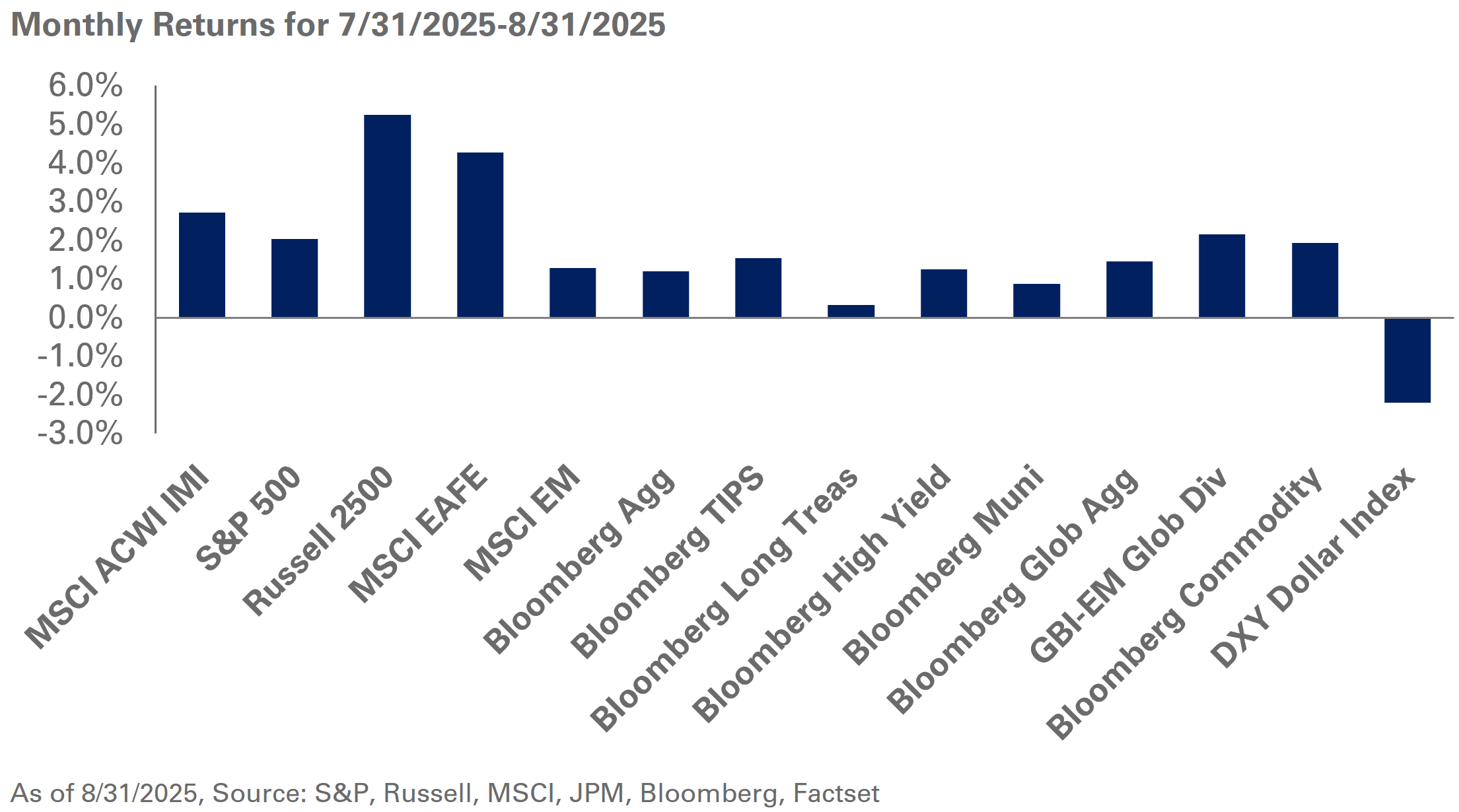

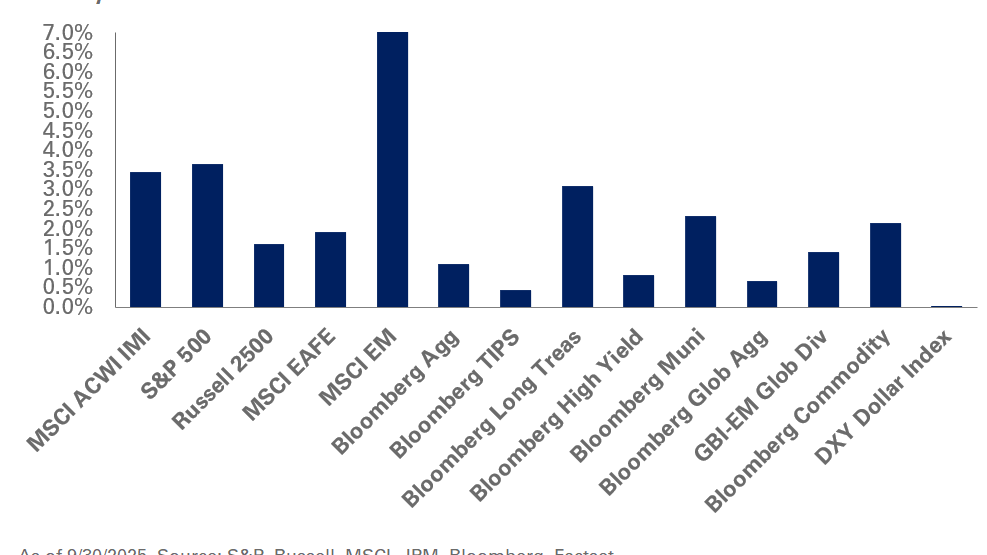

Stocks and bonds ended August broadly in the black on the back of resilient corporate earnings, and heightened expectations for interest rate cuts by the Federal Reserve amid mixed economic data. Notably, the July non-farm payrolls report indicated the addition of a modest 73,000 jobs along with downward revisions of 258,000 jobs to the May and June jobs’ reports. The severity of these adjustments reflects the increasing vulnerability of the labor market, inviting a more dovish-than-expected Fed policy statement from the annual Jackson Hole Symposium.

As a result, market expectations for a September rate cut jumped, reflecting an 87% likelihood of a cut at month-end. This backdrop put downward pressure on the front end of the yield curve with the policy-sensitive two-year yield falling 32 basis points in August. That said, the Treasury curve steepened during the month as the 30-year yield added four basis points, weighing on longer-duration indexes on a relative basis: the Bloomberg U.S. Treasury Index added 1.1% in August, while the Bloomberg Long Treasury Index gained just 0.3% during the same period.

Resilient corporate earnings in the second quarter and easing policy expectations provided a tailwind for risk assets, fueling a strong rally across global equity indexes. The S&P 500 Index posted its fourth consecutive monthly gain – adding 2% in August. Small-cap stocks meaningfully outperformed given their greater sensitivity to interest rates: the Russell 2000 Index added 7.1%, marking its best month since the post-election rally in November 2024. Outside the U.S., the MSCI EAFE and MSCI Emerging Markets indexes added 4.3% and 1.3%, respectively, on the heels of continued weakness in the U.S. dollar and an easing geopolitical backdrop that supported returns.

Within real assets, spot gold prices continued to shine, adding 4.8% in August. In contrast, the energy complex remained under pressure with spot WTI crude oil prices losing 9% amid price pressures stemming from a global supply glut.

Given recent market dynamics, we encourage investors to remain disciplined and stick to long-term strategic asset allocation targets. We believe volatility is likely to persist until greater clarity emerges around the U.S. administration’s policy on tariffs and the outlook for the economy. As a result, we recommend investors hold adequate liquidity on hand for cash flow needs, underweight non-investment-grade public debt, and maintain equity exposure in-line with policy targets.