It’s open season for the U.S. elections as Republicans in Iowa cast their votes on Monday to select a presidential candidate to run against President Joe Biden in November.

While the 2024 presidential election will affect the U.S. economy, taxes, foreign policy, immigration and climate change, it is not the driving force behind long-term market dynamics that form the bedrock of investment portfolios. Individual election outcomes are not as transformative as macroeconomic factors such as growth, inflation and monetary policy, which tend to drive long term investment returns.

At NEPC, we remind clients that the impending election cycle shouldn’t warrant shifts in portfolio allocations. Our advice: stay focused on long-term core investment objectives and do not deviate from your strategic targets that were a result of thoughtful deliberation and governance initiatives. We also encourage investors to capitalize on portfolio rebalancing opportunities that could arise as a result of short-term volatility around key election dates.

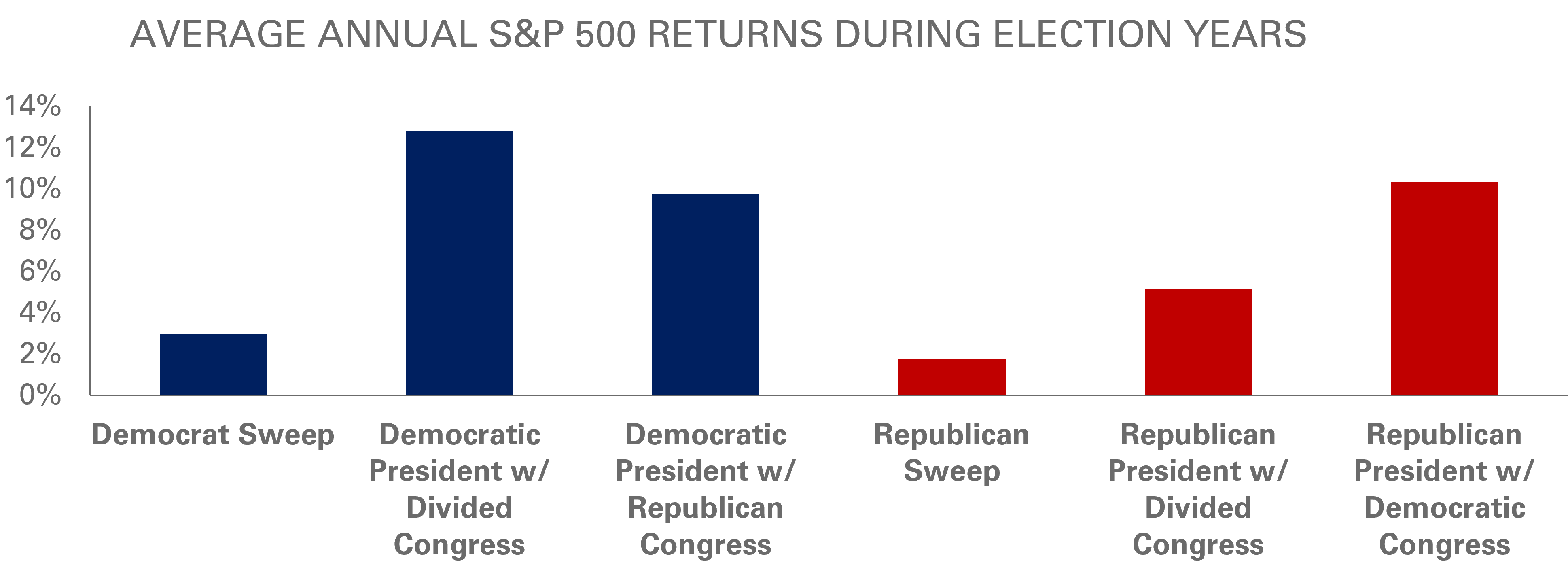

We believe the most important and relevant outcome for investors is whether or not there’s a divided government. Gridlock is good for markets as it reduces uncertainty by lowering the likelihood of sweeping policy changes and underscores the likely preservation of the status quo. A divided government can offset market concerns or even enthusiasm related to a specific candidate’s policies.

The elections are slated for November 5 of this year. At stake is the Presidency, and the control of the House of Representatives and the Senate. Currently, the country has a divided government with the House narrowly controlled by the Republicans and a razor thin majority for the Democrats in the Senate. There are 34 Senate contests on the ballot but only a few that are truly deemed competitive; all the House seats are up for election this year.

The winning presidential candidate must receive 270 or more electoral votes. As always, the focus will be on the battleground states with one additional nuance: the 2020 census has shifted the composition of the electoral college as electoral votes and Congressional seats are allocated among states based on population. For instance, Texas has gained electoral votes, while California and New York have lost votes.

By mid-March, the final nominees from each party should be clear. While things can change, it looks like the 2024 presidential race will likely be a repeat of 2020 with current President Biden facing off against his predecessor Donald Trump. This rematch between Biden, 81, and Trump, 77, would pair the oldest candidates to date.

President Biden is facing an electorate frustrated by inflation and, more recently, divided on foreign policy around China, Ukraine and Israel. Meanwhile, Trump is facing a litany of legal challenges around his efforts to overturn the 2020 election results; he was recently disqualified from state ballots in Maine and Colorado, which will likely end up with the Supreme Court, determining his eligibility to run for President.

Widespread frustration among voters could fuel support for a third-party candidate and divert electoral votes away from these other candidates. While this idea has gained some traction, history suggests that third-party candidates have difficulty achieving a meaningful number of votes; still, it can influence the election outcome by drawing voters away from Trump or Biden.

We anticipate the following issues will be key this election year:

- Economy: A top issue for voters in 2024, underscoring the toll that higher prices have taken on the electorate as business and consumer sentiment metrics remain fairly challenged despite the U.S. economy defying expectations in 2023.

We expect Biden to build on some of his legislative accomplishments like the CHIPS Act or Inflation Reduction Act, which are focused on domestic public investment in manufacturing and clean energy. We also anticipate a renewed focus on these areas in addition to healthcare and education, which he has pledged to support. Trump will likely remind voters of the positive economic momentum that was achieved pre-COVID through deregulation and reduced tax corporate and individual tax rates.We believe taxes will be a hotly debated election issue given that Trump’s Tax Cuts and Jobs Act, signed in 2017, has numerous provisions set to expire in 2025. However, we think taxes are set to rise over the course of the next decade amid a ballooning fiscal deficit. Generally speaking, higher taxes will likely ratchet up the appeal of tax-deferred investments, potentially pushing taxable investors away from more income-oriented areas that are less attractive after taxes. - Foreign policy: As geopolitical tensions intensify with the ongoing wars in Ukraine and Israel, foreign policy will be at the forefront. The Biden administration has pushed for funding both Ukraine and Israel, while we believe Trump will adopt a more isolationist stance. Another key aspect of foreign policy will be around the relations between the United States and China. While not a new election issue, this is the one area where views of both political parties have converged. That said, we expect Trump will take a harsher approach towards China.

- Immigration: For Trump, immigration was a cornerstone of his first term, and he advocated for stricter policies. This will likely play a vital role in his reelection bid, and we anticipate that he will push for finishing the U.S.-Mexico border wall and imposing asylum limits. Biden, on his part, has sought to discourage unauthorized entries into the country and has accelerated deportations.

- Abortion rights: Following the 2022 Supreme Court decision to overturn Roe versus Wade, abortion rights have taken center stage. Biden is pro-choice and supports women having access to abortions and Democrats have leveraged their position in key states. Trump is yet to weigh in, but his Supreme Court appointees played a pivotal role in toppling over Roe versus Wade.

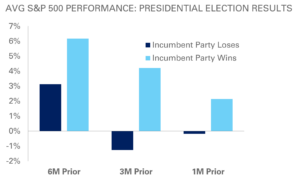

Sources: S&P, FactSet, NEPC

We believe these issues will play a critical role in determining the U.S. Presidential elections, and the control of the House and Senate.

Moving on to some market metrics, we have historically observed that the behavior of the stock market in the three months leading up to the election have been a fairly reliable predictor of the election outcome, with a (surprisingly accurate) 90% hit rate. Specifically, when the returns of the S&P 500 Index are positive in the three months leading up to the election, it signals a high likelihood of the incumbent party returning to power; on the other hand, if the Index is in the red during this same period, the incumbent will likely lose the election.

Watch Jennifer Appel’s full 2024 Election Overview Thoughts video here.