Markets are on a tear—seemingly immune to the pandemic still raging in many parts of the globe—as investors pin their hopes on an economic recovery on the back of potentially successful COVID-19 vaccines and their quick dissemination.

While the speedy delivery and implementation of an effective vaccine will certainly give economies a much-needed shot in the arm, it will not cure all that ails the global economy. Even when combined with government help, significant vulnerabilities remain with no easy fixes within reach. Investors must recognize that portfolios cannot be inoculated against these risks and the uncertainties they pose. That said, they do possess a valuable tool: rebalancing, which offers a measure of immunity against temperamental markets.

At NEPC, we would like to remind our clients that disciplined rebalancing is not only about buying undervalued or overlooked assets, but also selling them when they have delivered robust returns and outperformed the rest of a diversified portfolio. To that end, we recommend rebalancing today just as we did in March in the depths of a market drawdown fueled by uncertainty and volatility.

To be sure, we continue to see our key market theme of permanent interventions driving financial markets with the potential for further monetary and fiscal stimuli bolstering asset prices. However, their efficacy is less certain as a potentially divided U.S. government could limit the scope and scale of fiscal programs. Furthermore, the Federal Reserve and its peers in the developed world could find their powers weakened with monetary policies that have already pushed rates to zero or negative, exacerbating existing structural challenges especially in Europe and Japan.

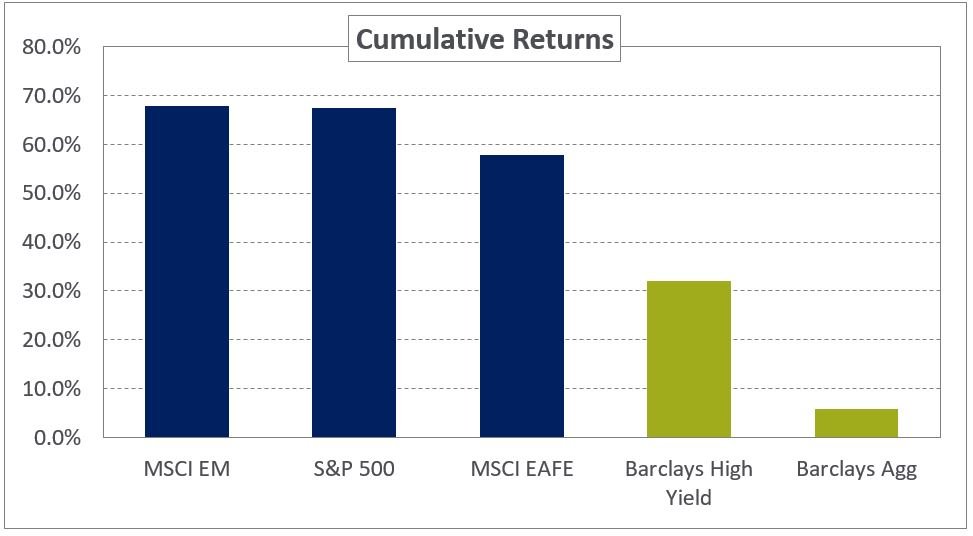

While there is no sure shot in the investing world, we believe rebalancing and maintaining investment discipline will go a long way in mitigating these portfolio risks. To that end, we are constantly on the lookout for rebalancing opportunities in our clients’ portfolios where we have discretion. In real time, we are acting on rebalancing plans across many of these portfolios as equities continue to outperform after their steep fall in March (Chart 1); in November, stocks were generally up more than 10%, while bonds gained less than 2%.

Chart 1: Performance of Equities and Bonds since March Selloff (03/23/2020—12/04/2020)

Source: S&P, MSCI, Bloomberg and FactSet

As always, a decision to rebalance does not imply a change to one’s risk profile; rebalancing is a decision to return to an investment program’s strategic risk tolerance. Rebalancing is a disciplined portfolio activity, not an expression of a tactical view. Given the strong rally in equities since March, including last month, we believe investors should proactively consider rebalancing before the end of this year.