The Outsourced Chief Investment Officer, or OCIO, is becoming a popular partner for nonprofits.

Nonprofits face a tricky challenge when it comes to their assets. Their mission is to grow their financial resources and, if they are successful, they must take on large responsibilities around the proper management of those assets. Some nonprofits try to hire the expertise needed internally; others engage a full-service financial advisor. However, there is another option: the OCIO.

OCIO, or Outsourced Chief Investment Officer, is an approach to investment management that allows your organization to set a strategic direction and then rely on a qualified OCIO partner to execute. The OCIO brings a range of investment expertise to the role, as well as an extensive network of relationships with investment managers.

Nonprofits are already flocking to OCIOs – a recent report from Western Asset Management and Cerulli anticipates that OCIO assets under management are set to double between 2018 and 2025, underscoring the many benefits offered by OCIOs.

OCIO Solutions for Nonprofits

Nonprofits that have experience with an OCIO typically identify three key benefits:

1) An opportunity to save on fees

Investment managers value working with OCIOs with multiple client relationships that represent a significant amount of assets. OCIOs also manage many aspects related to governance and relationship management. For that reason, OCIOs can negotiate major fee reductions from investment managers.

Fee reductions vary by strategy, and different OCIOs may have different capabilities related to fee negotiation. But given the scale of fee discounts, in many cases, the savings on management fees can cover a sizable portion of the cost of the OCIO engagement itself.

2) Greater access to exclusive, popular, or unique investments

OCIOs often have the size and strength to access a wider range of investment talent than any single nonprofit can, including top-tier managers with excellent track records. Nonprofits who engage an OCIO can typically access capacity constrained strategies, particularly in private markets, and risk management strategies that might otherwise not be available to them.

OCIOs can also find and vet unique strategies that might be a fit for nonprofits with special missions or specific investment criteria. That might include those with demanding liquidity requirements or those desiring mission-aligned investing.

3) Reduced fiduciary pressures on your trustees

One major advantage of OCIOs is that they are empowered to make investment decisions on behalf of their clients, based on a collaboratively constructed and client-approved investment strategy. But nonprofits who engage OCIOs aren’t just bringing on an investment decision-maker; they are adding a fiduciary who can enhance the quality of governance over your critical assets.

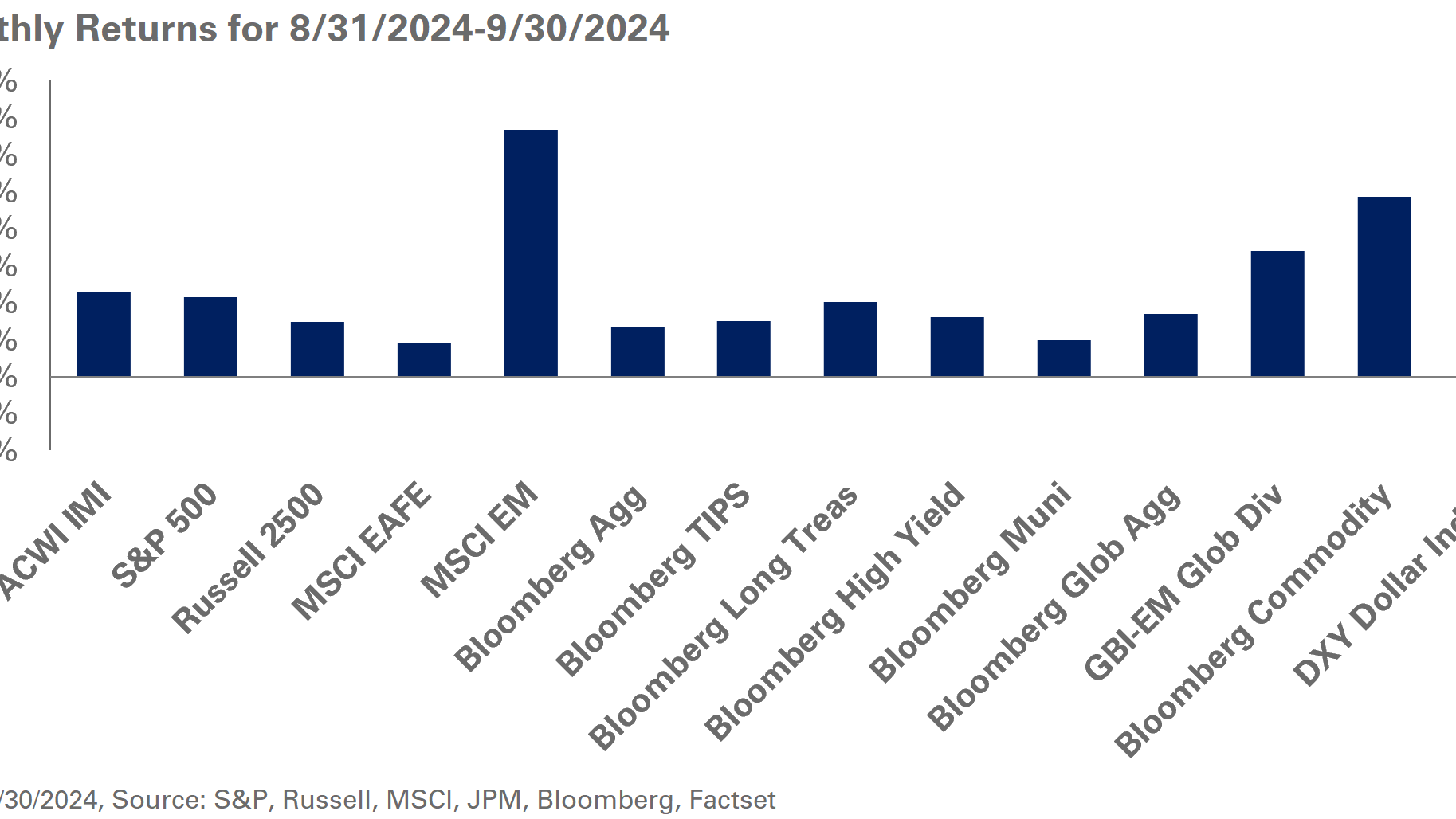

For example – when markets decline, timely tactical decisions and rebalancing strategies can help mitigate negative portfolio impact. They can also position accounts to benefit from a subsequent market recovery or opportunities that arise from the volatility.

OCIOs have research teams and asset allocation committees already in place to help them make faster and more consistent decisions. High governance standards, experienced talent, and the ability to respond quickly to market changes combine to give nonprofits a strong backbone of fiduciary oversight.

Taking Advantage of an Outsourced Chief Investment Officer

OCIO services tend to work best for nonprofits with endowments between $100 million and $1 billion – that is, large enough to need investment expertise, but not so large as to hire their own internal resources for portfolio-management.

If your organization is in that sweet spot, you may want to look for an OCIO that you can trust to help you achieve long-term success. To build that trust, we recommend asking the following key questions to assess the OCIO’s operations:

Resources: Does the OCIO have the experience and resources to provide the optimal levels of support for your organization? Does the organization serve as a fiduciary?

Track record: Has the OCIO added value through its track record and risk management? Does it possess a client base of similar organizations with similar objectives? Is it able to partner with organizations like yours to help with activities outside of portfolio management?

Investment strategies: Has the OCIO demonstrated that it has access to desirable, best-in-class strategies? How successful has the OCIO been in negotiating fees?

Customization: How well does the OCIO understand your return goals, risk concerns and tolerances, and liquidity needs? Is it prepared to collaborate with you on any other special considerations you desire?

OCIO Services for Endowments and Nonprofits

In an increasingly complex investment market, it’s challenging for nonprofits to build the expertise they need internally to ensure their long-term financial success. In these instances, the OCIO could be a strong option to acquire that expertise at modest cost, while also connecting you with investment strategies that can potentially enhance your mission.

Please reach out to your NEPC consultant to discuss options for an OCIO and for any questions you may have.