Private markets investments make up an increasingly larger share of institutional and individual investor portfolios, as investors have sought broader market exposure in search of higher returns amid an extended period of low interest rates.

Private markets investments can generate a return premium to public markets but require tradeoffs in liquidity, fees and complexity. In this quarterly report, NEPC’s investment team outlines our views on private markets. As always, we remain committed to help our clients successfully run private market investment programs in the face of uncertainty and change.

Private markets strategies today exhibit these common themes:

Geopolitical uncertainty: nearly all LPs and GPs struggle with today’s geopolitical uncertainty, leading to fewer deals being done and lower exit activity across venture, buyouts, private credit and real assets.

Liquidity: slower exit activity means LPs have fewer dollars to commit to new private market funds, and non-traditional exit options are taking root, for instance, continuation vehicles, secondary sales and credit restructurings.

Flight-to-quality: large GPs make up the lion’s share of fundraising and are also competing against one another for the largest, highest-quality deals. We see opportunities in smaller funds and deals across credit, equity and real assets.

Artificial intelligence: this investment theme is now woven into many private market strategies, from venture capital to buyouts to real estate and infrastructure. AI valuations are high, and we are careful to parse quality AI investments from those swept up in the market’s enthusiasm.

Rise of wealth: individual investors increasingly seek private markets exposure in their portfolios. GPs have responded to this demand by creating semi-liquid private market vehicles geared toward individual investors.

Buyouts

Buyouts are a core part of many investors’ private markets portfolios. Returns remain strong over the long term but have slowed (along with deal activity) in recent years due to market volatility, limited IPO exits, higher rates, a valuation disconnect between buyers and sellers and uncertainty regarding the future economic and regulatory environment. High quality assets are trading hands, while lower quality assets are taking more time to exit. Prolonged slower-than-expected distributions may constrain liquidity for some investors, and we recommend clients conduct a liquidity study to understand their illiquidity risk.

NEPC’s buyout team is focused on the smaller end of the market, which offers higher growth opportunities and wider exit opportunities. Note: Periods of volatility, such as this, can be excellent opportunities to deploy new capital into private markets.

Market Anecdotes

- Endowments and pensions—for instance, Yale, Harvard and CalPERS—running large secondary sales, underscore NEPC’s stance that the current environment makes it is an opportune time to be a provider of capital.

- PSG Equity led a $2 billion continuation vehicle, the largest in the U.S. in 2025.

- Large high-quality deals are transacting: GTCR sold Worldpay to Global Payments for $24 billion, 2025’s largest private equity deal.

Performance

- Performance has strengthened after bottoming out in 2023.

- Distributions remain sluggish, and the last U.S. vintage year to provide 1.0x DPI was 2016.

Fundraising

- U.S. buyout fundraising is down 20% in 2024 versus 2023 and nearly 50% in terms of number of funds.

- U.S. buyout funds raised $325 billion in 2024, down from $400 billion in 2023, and 445 funds in 2024 compared to 837 in 2023.

- Established GPs are seeing record step-ups in fund sizes, indicating a flight to quality among LPs. Mega funds raised $88 billion of capital in the first half of 2025 but accounted for only 6% of fund count; examples include Thoma Bravo ($24 billion) and Blackstone ($20 billion).

- 2025 fundraising on pace to remain slow due to two main factors:

- GPs are deploying capital more cautiously (reflected in rising dry powder).

- LPs are not receiving distributions to reinvest into new commitments.

- Dry powder is flattening as deployment begins to outpace fundraising.

Deal Activity

- As of year-end 2024, deal activity has rebounded: deal count rose 13% and value increased 8% year-over-year, totaling $839 billion.

- Drivers: slightly lower base rates and spreads eased financing costs somewhat, and banks are re-entering the syndicated loan market (now at 2x 2023 levels, though still 40% below historical norms). Valuations have realigned downward.

- Most activity is in smaller bolt-on acquisitions.

Valuations

- Entry valuations are up relative to 2023: 12.2x vs. 10.5x, indicating that high-quality deals are still transacting despite market uncertainty.

- Valuations are expected to decline in late 2025 and into 2026 as lower-quality deals come to market.

- Debt/EBITDA has risen to 5.1x (vs. 4.8x in 2023), driven not by higher debt levels but declining EBITDA.

Exits

- In Q2, the number of exits dropped to a 12-month low, totaling approximately 314 transactions with a combined value of $119 billion. Compared to the previous quarter, this marks a 46% reduction in total exit value and a 25% decline in the number of exits.

- PE inventory has grown to 12,000 deals—roughly eight years’ worth—so significantly more exits are needed.

- With valuations up and transaction volume still low, only the highest-quality assets appear to be moving; the real test will be when bid-ask spreads close on lower-tier assets.

- IPOs are up: $41 billion in 2024 (e.g., Viking River Cruises at $10 billion) versus $8 billion in 2023.

- Corporates have high cash levels and appetite for deals, but M&A is constrained by FTC and DOJ antitrust scrutiny.

- Continuation vehicle-related exits totaled $22 billion across 70 funds in the first half of 2025, up from 62 in the same period of 2024, according to data from Pitchbook. This represents a 44% increase in continuation vehicle activity year-over-year.

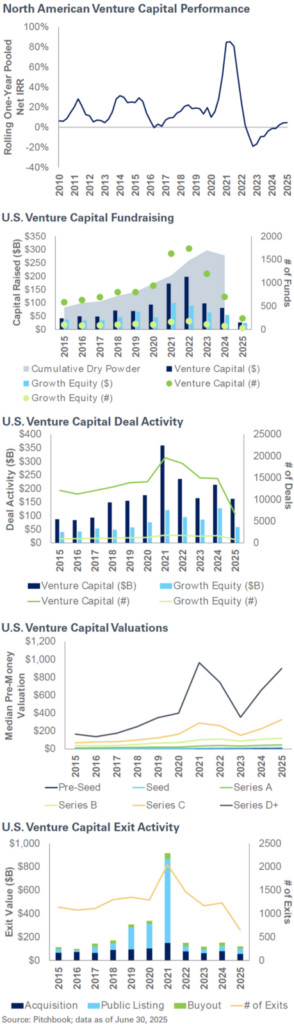

Venture Capital

Venture capital can provide return enhancement to investment programs, but manager selection is paramount. With the IPO window largely closed during the first half of 2025, exits have been hard to come by, putting strain on over-allocated portfolios. Venture capital managers have been slow to deploy capital, as finding the right deals at the right price has proven difficult. This has also contributed to a slowdown in overall fundraising. There are signs that distributions may begin to pick up toward the end of the year, considering the backlog of IPO-ready companies and assuming no major economic disruptions.

AI has dominated the narrative across the industry, with many managers crowding into the space to gain exposure. Once exit activity resumes, transaction volumes should follow. We anticipate that valuations for non-AI companies with weaker earnings quality will begin to come under pressure. This will likely result in performance degradation among lower-quality firms, leading to a wider dispersion of returns.

Market Anecdotes

- Record fundraising for venture platforms in 2024: Thrive Capital raised $4.4 billion fund, Andreessen Horowitz raised $7.2 billion fund.

- Google acquired Wiz for $32 billion — a record high for a VC backed M&A exit.

- Large VC-backed IPOs: CoreWeave, Circle, Chime, and Hinge Health.

- Figma files for IPO: valuation range below Adobe’s prior offer, but still a premium to its last private financing round.

- Tender offers outpacing IPOs: Stripe completed a $92 billion secondary tender in February.

Performance

- Performance has strengthened after bottoming out in 2023. AI companies remain key drivers of performance.

- The lack of distributions highlights that most performance is attributable to unrealized (paper) gains rather than realized capital gains returned to LPs.

Fundraising

- In the first six months of 2025, $27 billion was raised across 238 funds—significantly down from the peak in 2022, when $197 billion was raised across 1,737 funds, according to data from PitchBook.

- The decline in fund count signals a flight-to-quality among LPs.

- Fundraising remains slow due to two main factors: GPs are deploying capital more cautiously, and LPs are not receiving distributions to redeploy into new commitments.

Deal Activity

- A small number of mega-rounds dominated headlines—for example, OpenAI’s $40 billion late-stage round accounted for nearly 60% of deal value in the first six months of 2025.

- Overall deal activity is down from 2022 levels but remains ahead of the 2014–2017 period. In the first six months of 2025, 6,660 deals were completed, compared to the 2021 peak of 19,635, according to data from PitchBook.

- Bid-ask spreads remain a challenge, and GPs are cautious amid geopolitical uncertainty and policy volatility.

Valuations

- Valuations in 2025 are gradually increasing across all stages, likely driven by high-quality and AI-related companies.

- Valuations for later-stage AI companies are rising at a much faster pace than their non-AI counterparts, with AI firms accounting for over half of all unicorn deals in the first quarter of 2025.

- Later-stage rounds approaching peak valuation, but at significantly lower transaction volumes—indicating that only the highest-quality assets are continuing to trade.

Exits

- IPO activity is slow but not at a standstill. Eight U.S. companies have gone public with valuations exceeding $1 billion, including CoreWeave, Chime, Circle Internet Group, Voyager, and Hinge.

- Secondaries and tender offers have provided some liquidity, though overall exit activity remains muted. Secondaries are expected to continue playing a key role in near-term liquidity.

- As of May 30, 2025, 372 acquisitions have closed year-to-date—driven largely by VC-backed companies acquiring other VC-backed companies.

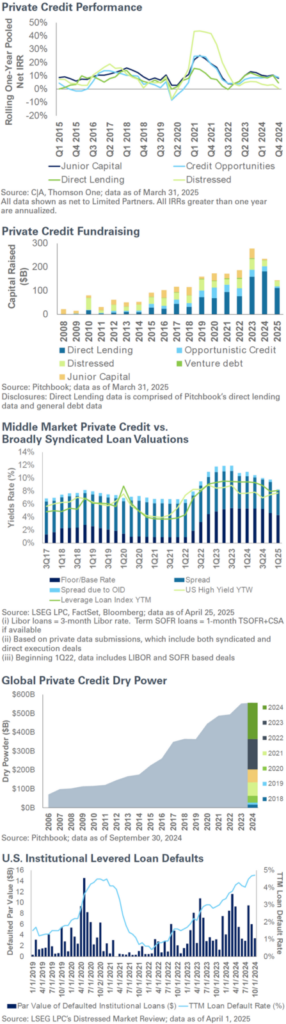

Private Credit

Private credit strategies have gained prominence over the last decade as banks and other financial institutions have stepped back their lending activity. Many institutional investors have significant allocations to private credit, taking advantage of higher yields and total returns, enjoying a premium to public markets and flexibility around portfolio construction with shorter fund lives than private equity. Private credit is more than just direct lending; other investment strategies include opportunistic/transitional capital, junior debt and strategies focused on collateral outside of corporate credit including asset-based lending. Borrowers include private companies and private equity sponsored companies, and the demand for capital continues to grow. As long-standing private credit investors, NEPC focuses on the themes below.

Market Anecdotes

- Industry consolidation continues.

- Man Group bought Bardin Hill (private credit shop with $3 billion in assets under management).

- Blackstone Inc. entered credit partnership with Legal & General.

- Banks entered the private credit space – JPMorgan announced a new team to provide alternative financing for its corporate and sponsor clients; CEO Jamie Dimon announced the bank would be providing close to $50 billion in balance sheet capital.

- Proliferation of semi-liquid private credit vehicles continues.

- Several Business Development Companies cut their dividends earlier in the year as net investment income fell, reflecting the impact of declining interest rates and tightening spreads.

Performance

- Yields have compressed due to lack of realizations

- Overall yields have compressed in the first quarter due to lower base rates, spread and OID compression – driven primarily by competition for high-quality deals.

- Base rates for floating-rate private credit loans today are tied to SOFR (Secured Overnight Financing Rate). As of July 2025, SOFR is approximately 4.2%.

- Larger borrowers are able to get sub-500 spreads; 36% of deals were done in the SOFR +450-499 range.

- Middle market continues to be 100-200 basis points wide of broadly syndicated loans in the public markets.

Fundraising

- Fundraising slowing in 2025, although overall capital may be understated due to non-institutional (semi-liquid) funds.

- $208 billion was raised in 2024, in line with $209 billion in 2023.

- Dry powder, hovering around $557 billion, has sustained market liquidity reflecting investors continued interest but also lack of deal activity.

- Distressed and credit opportunities’ fundraising has dramatically slowed down after a significant uptick in 2021-2023.

Deal Activity

- Market remains receptive to high quality deals – seeing a lot more competition at the larger end of the market.

- Despite the number of buyout deals remaining modest in 2025, direct lending volume has risen this year – driven by a few mega deals (Dun & Bradstreet by Clearlake and Boeing’s Digital Aviation Services by Thoma Bravo).

- Direct lending volume supporting LBOs rose to $22 billion in the second quarter in 2025 (highest since the second quarter of 2022); however, 2025 issuance is running in-line with 2024’s annual pace.

- Direct lenders continue to take market share especially in the larger end of the market – direct lenders finance 49% of buyouts exceeding $1 billion this year.

- As M&A remains muted, sponsors have increased the level of refinancing and recapitalization (30% of deals) as exits continue to stall.

- Year to date refinancings have outpaced new money issuance ($42.7 billion versus $33.5 billion).

Valuations

- Leverage levels have crept up as competition has returned post-Liberation Day—the term used to refer to April 2, 2025, the date the Trump administration announced stiff tariffs on its trade partners—and continued competition over high-quality deals.

- Direct lenders are still wary of selling positions to avoid crystallizing a loss.

Exits

- Exit activity has slowed, but distributions, in the form of current income/coupon, continue to be healthy.

Real Estate

Private real estate can play multiple roles in a portfolio, from more income-oriented core and core-plus strategies, to the total-return-seeking opportunistic ones at the other end of the spectrum. In recent years, real estate has experienced swings in valuations driven by the rapid fall and rise in interest rates. As the market finds its footing, we observe that markets are generally liquid, but many real estate investors continue to hold out for more favorable pricing which has slowed distributions to investors.

Market Anecdotes

- Alternative property types (such as student housing, senior housing, medical office) have risen in popularity, driven by investors looking for enhanced yield as well as managers seeking ways to differentiate themselves, a trend we expect will continue.

- Data center vacancy rates are around 3%1 (lower in top markets), even as the sector continues to attract billions of dollars in new capital, with new funds being launched (and oversubscribed) focused on new development projects.

- Investor activity (i.e., fund commitment volumes) has picked up during the second quarter.

- Redemption queues continue to hamper core real estate markets, but are improving – as of March 31, aggregate redemption queues across NCREIF ODCE constituents represented about 13% of net asset value, down from a peak of over 18%2.

Performance

- 2015-2019 vintage funds returns were dampened by impact of the Covid pandemic, but returns vary widely by property type.

- U.S. core real estate continues to post modest gains but with roughly flat appreciation returns.

Fundraising

- 2024 was the lowest year for value-add and opportunistic real estate fundraising since 2011, with just over $100 billion raised, according to data from PitchBook; fundraising was off to a slow start in 2025 but has picked up steam.

- Some signs that investors are cautiously returning to core and core-plus real estate; gross flows into ODCE funds exceeded $2 billion in the first quarter for the first time since 2022, though net flows remain negative and the recovery for these funds has been uneven.

- Overall commitment volumes continue to be hampered by a slow return of capital from older vintage funds.

Deal Activity

- There is liquidity in the market – acquisition activity from private funds rebounded in 2024 and this continues through 2025.

- Avison Young reports a nearly 70% increase in office asset transactions relative to a year ago3.

- Tariff uncertainty is impacting markets, particularly for industrial properties, though lack of new supply and strong embedded rent growth makes industrial still an attractive investment opportunity.

Valuations

- Transaction cap rates, or “going-in yields,” for apartments have stabilized, while other property types experience a slight decline in recent quarters.

- Industrial is the only property type with recent transaction cap rates below 5%.

- Investors view grocery-anchored retail and senior housing as having favorable outlooks, and resulting capital flows lead to increasing valuations.

Exits

- Transaction markets have recovered from lows, but fund managers are still slow to bring assets to the market as they hold out for higher pricing.

- As a result, investors in closed-end funds continued to experience a slower pace of distributions as managers wait for capital markets to improve.

1 Source: Goldman Sachs “Powering the AI Era” report

2 Source: NEPC analysis

3 Source: Avison Young Q2 2025 U.S. Office Market Overview (https://www.avisonyoung.us/us-office-market-overview)

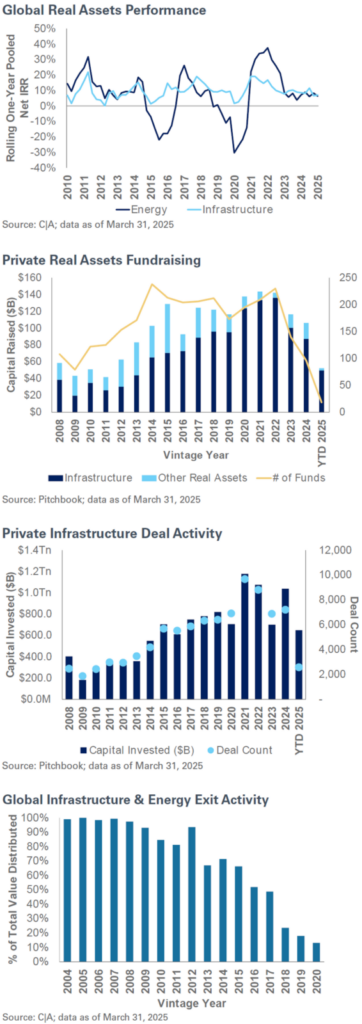

Real Assets

Real assets represent a broad array of underlying asset classes and sectors, including hard assets, for instance, infrastructure, and natural resources such as energy private equity. Real assets exhibit differentiated returns relative to other asset classes, offering potential diversification benefits for investors. Many real asset investments include a current income component, the potential for capital appreciation, and a partial hedge against spikes in inflation. In recent years, infrastructure has received a lot of attention from investors, resulting in the rapid growth and evolution of the infrastructure investment landscape.

Market Anecdotes

- Growing AI spending pushes the need for more power generation and digital infrastructure, with total capital needs estimated to be in the trillions of dollars over the next few years.

- Google announced $25 billion data center investment alongside Brookfield.

- Meta announced “hundreds of billions” investment on AI-related investing and infrastructure needs.

- Geopolitical uncertainty causing volatility in commodity prices is impacting natural resource strategies; at the same time, it highlights the stability that an infrastructure investment can offer to a portfolio.

Performance

- Private equity energy strategies exhibit robust performance in recent vintage years, benefiting from limited competition and healthy balance sheets, with older vintages experiencing more volatility in commodity prices.

- Infrastructure funds exhibit greater stability.

Fundraising

- Fundraising for infrastructure strategies has retreated from the historically high levels seen in 2020-2022, but remains robust overall as other real asset strategies (such as energy) attempt to rebound.

- Investors are returning to energy private equity after several years of significant pullback.

- In the first quarter of 2025, European-focused infrastructure funds led the way, representing about 75% of the capital raised.

Deal Activity

- Mega deals dominate the headlines (BlackRock GIP’s Panama ports deal, Brookfield acquisition of $4.4 billion railcar portfolio) but deal volumes are much higher in the smaller end of the market.

- By both count and deal value, infrastructure deal volumes remain high, with nearly $650 billion of capital invested in the first quarter, according to data from PitchBook.

Valuations

- Infrastructure has experienced some downward pressure on asset values due to rising interest rates, though the long-term nature of infrastructure assets has contributed to less volatility.

- Investor capital returning to private energy markets has provided support for valuations in the sector, but entry yields remain relatively high, with managers reporting mid-teens cash yields on new acquisitions.

Exits

- Hold periods for investments have been extended, with lower levels of realizations and distributions for funds in years three to six of their lifecycle, relative to historical norms.

- The energy private equity segment is also experiencing a rise in continuation vehicles as an avenue for generating liquidity for investors.

For questions on your private markets portfolio, or to discuss current market trends and opportunities, please reach out to your NEPC consultant.