Global Equities

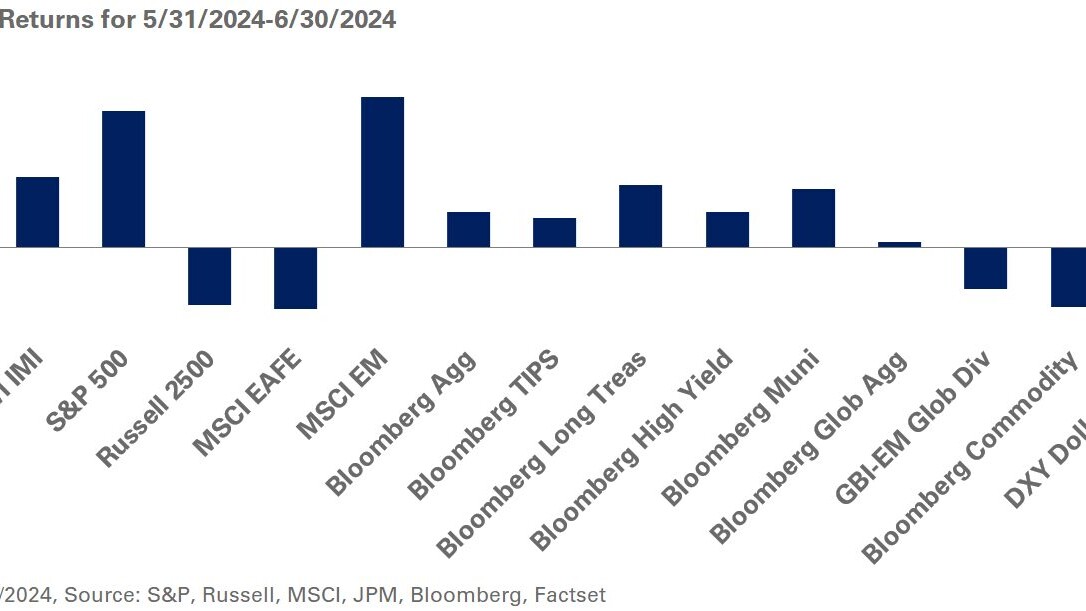

Global equities posted strong returns in the second quarter, propelled by continuing vaccine adoption, ongoing monetary and fiscal support, and a robust economic outlook. U.S. stocks led the way for a second straight quarter, with the S&P 500 up 8.5%; meanwhile, international developed-market equities gained 5.2% and emerging markets returned 5%. In the U.S. and international developed markets, small caps underperformed, while emerging market small caps bested emerging large caps. In a reversal from the first quarter, growth indexes outperformed value measures, with the Russell 1000 Growth returning 11.9% compared to gains of 5.2% for the Russell 1000 Value Index. Within sectors, real estate, information technology, energy and communication services led performance, while utilities, consumer staples, industrials and materials lagged the market.

In hedge funds, the HFRI Equity Hedge (Total) Index gained 5.5% for the three months ended June 30. During this period, technology- and healthcare-focused hedge funds underperformed, returning 3.7% and 1.1% respectively. After gross and net leverage hit their highest levels since 2010 in January, leverage modestly decreased in the second quarter.

Meanwhile, global private equity fundraising hit a quarterly high of $295.4 billion for the three months ended June 30, according to Preqin. U.S. buyout deal activity—confirmed and estimated—came in at a robust $255.1 billion, according to PitchBook data. In another quarterly high, U.S. buyout exit activity totaled $186.7 billion, according to PitchBook. In venture capital, deal activity totaled $75 billion—tying with the record set in the prior quarter—fueled mostly by large late-stage deals of $50 million or more; during the same period, exit activity was strong, totaling a record $241.3 billion, according to PitchBook.

Global Fixed Income

U.S. Treasury yields reversed course in the second quarter, with yields falling on the 10-year Treasury note. The Federal Open Market Committee announced on the heels of its meeting in June that it would keep rates unchanged at 0.00%-0.25%. Credit spreads tightened in the three months ended June 30, reflecting a broader appetite for risk-taking; the spread tightening was more pronounced in lower-quality credit with the Bloomberg Barclays U.S. High Yield Index Option-Adjusted Spread decreasing nearly 40 basis points since March. Corporate credit gained in the second quarter with the Bloomberg Barclays U.S. Aggregate Index up 1.8%, while the Bloomberg Barclays U.S. Corporate High Yield Index returned 2.7% in the second quarter.

Meanwhile, hedge fund indexes focused on structured credit and distressed debt were in the black in the second quarter and up for the year; the HFRI Relative Value: Fixed Income-Asset Backed Index returned 2.7% and the HFRI Event Driven: Distressed/Restructuring Index increased 5.5% in the second quarter. During this period, emerging market debt posted robust gains with the JPM EMBI Global Diversified Index returning 4.1% and the JPM GBI-EM Global Diversified Index increasing 3.5%.

Real Assets

Real assets continued their march upward in the second quarter with real estate investment trusts (REITs) posting strong gains of 11.7%. Residential REITs were the strongest performers, as the limited supply of housing in the country drove sharp increases in home and apartment prices.

Private core real estate posted strong gains with a preliminary 3.9% total gross return for the second quarter, according to the NCREIF ODCE Index, bringing year-to-date returns to 6.1%. This performance has largely been driven by industrial and multifamily assets, which continue to demonstrate accelerating rent growth.

Meanwhile, oil prices maintained their momentum, with WTI rising over 24% to ~$73 per barrel. Global natural resource equities gained 7% in the second quarter, benefitting from the uptick in commodity prices. With oil prices above $70 per barrel, U.S. shale producers, both public and private, have been reluctant to quickly ramp up drilling programs as they face pressure from public shareholders to return capital and deal with tepid fundraising in the private energy space.

Infrastructure indexes gained 3% in the second quarter; even though cash flows in the sector have proven to be largely resilient, the asset class still trails public real estate, energy and the broader equity markets. Within private markets, data centers and renewable energy continue to generate significant demand from institutional investors.