Key Takeaways

Recent regulatory changes have put private equity into the spotlight for defined contribution (DC) retirement plans, touting newfound access to substantial assets. Yet, what receives far less attention is the reality that success in private markets hinges on thoughtful implementation and rigorous fiduciary oversight.

- Pro-Private Markets Administration: On August 7, 2025, the U.S. administration issued an executive order directing the Department of Labor (DOL), Treasury, and the Securities and Exchange Commission to expand access to alternative assets for retirement plans. Days later, the DOL rescinded its 2021 statement cautioning against private equity in DC plans, signaling broader acceptance and potential access to $12.2 trillion in DC assets.

- Natural Fit with Caveats: While DC plans’ long investment horizons align well with private equity, challenges remain – illiquidity, high fees, limited transparency, and litigation risk require diligent plan design and oversight. Slowing distributions to paid-in capital raise timing concerns.

- Hidden Exposure and Emerging Solutions: Some traditional equity managers already hold private equity, often unnoticed by plan sponsors. DC-specific products with daily valuation proxies now enable inclusion in target date funds (TDFs). Evergreen vehicles and collective investment trusts (CITs) support operational viability. Success requires coordination among plan sponsors, consultants, recordkeepers, and trustees to ensure transparency, risk management, and participant protection.

- TDFs as the Gateway: Target date funds hold nearly half of DC plan assets and serve as the Qualified Default Investment Alternative (QDIA) for many plans, making fiduciary decisions regarding private equity allocations particularly critical. Yet, over half of plans use passive TDFs, limiting private equity’s reach.

- Allocation Strategy: NEPC believes a practical private equity allocation is approximately 5%. We have seen DC plans accomplish this by potentially reducing U.S. small-cap exposure. Begin with buyouts and secondaries to mitigate the J-curve effect and improve cash flow predictability. Expand exposure gradually as governance and liquidity structures mature.

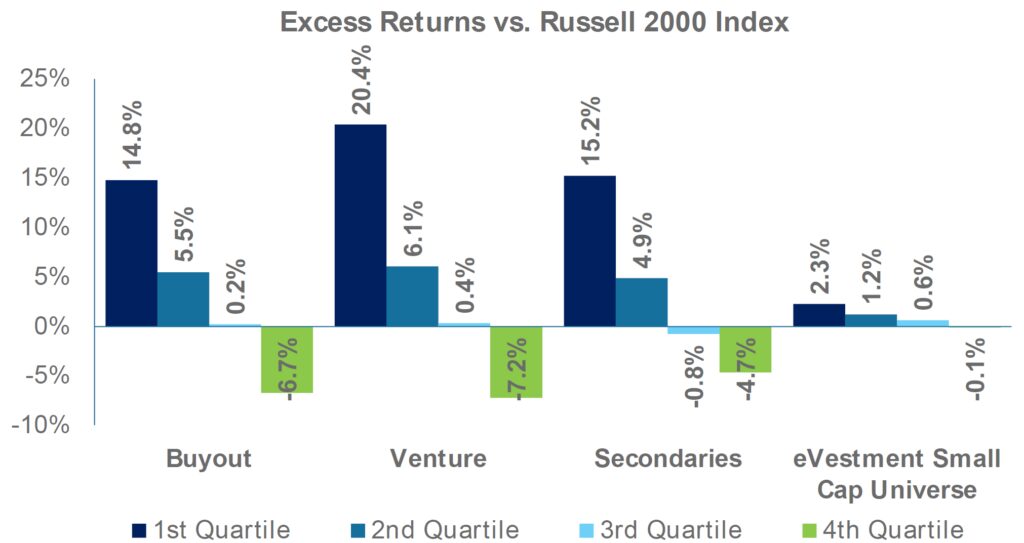

- Manager Selection Matters: Performance dispersion is significant – top quartile managers outperform by 20–30% net of fees1. Access to high-quality managers is essential to avoid underperformance relative to public markets. Rigorous sourcing and fee alignment are key.

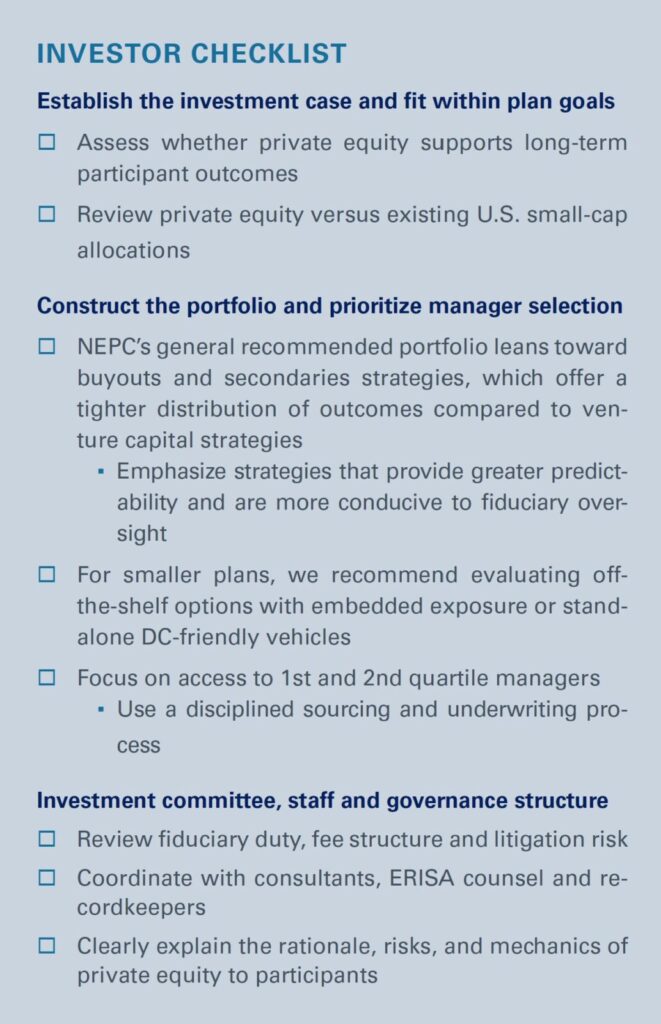

- Investor Checklist: NEPC has developed a private equity investor checklist, covering goals and rationale, prioritizations, focus areas, fees, and governance.

Introduction

Private market assets—once the domain of large institutional investors—are pushing their way into defined contribution (DC) plans, propelled by evolving regulatory guidance. These assets, including private equity, private debt, direct real estate, infrastructure, offer promising new sources of return. However, they also bring challenges: illiquidity, high fees, opaque structures, and complex manager selection. Missteps can result in underperformance and heightened litigation risk.

Among alternatives, private real estate stands out as a success story in DC plans. It blends private equity and debt to acquire physical buildings, and its adoption raises a compelling question: if DC plans already use these structures to invest in buildings, why not apply the same approach to invest directly in the private companies who own and operate them?

This paper explores recent developments that address many of the long-standing investment and operational concerns, making private markets – especially private equity – more viable for DC plan sponsors. We focus on all aspects of the investment process, from asset allocation and portfolio construction to implementation and manager selection.

Private Equity in DC Plans: Overview

Historical Resistance

Private equity has been the domain of large institutional investors – defined benefit plans, endowments and foundations, and ultra-high-net-worth investors – where it serves as a well-established diversifier and return enhancer within private market programs.

Most DC plans have traditionally steered clear of private equity due to concerns around illiquidity, higher fees, limited transparency and operational complexity. Fiduciary risk – especially the potential for litigation tied to performance and fees – has also been a significant deterrent. While applying leverage to public-markets’ returns is a lower-cost way to enhance performance, it lacks the behavioral and structural advantages associated with private equity.

Exposure in DC Plans

Despite perceptions that private equity is new to DC plans, it has been hiding in plain sight for decades. Some of the largest active U.S. growth equity managers hold modest private equity allocations within their portfolios – often without plan sponsors’ full awareness. This means some DC plans already have indirect exposure to private equity through their selected managers.

More recently, bespoke private equity offerings have emerged for DC plans, particularly within custom target date funds (CTDFs) or multi-asset portfolios. These products are designed with DC-friendly features such as daily valuation proxies and enhanced liquidity mechanisms, making operational integration more feasible.

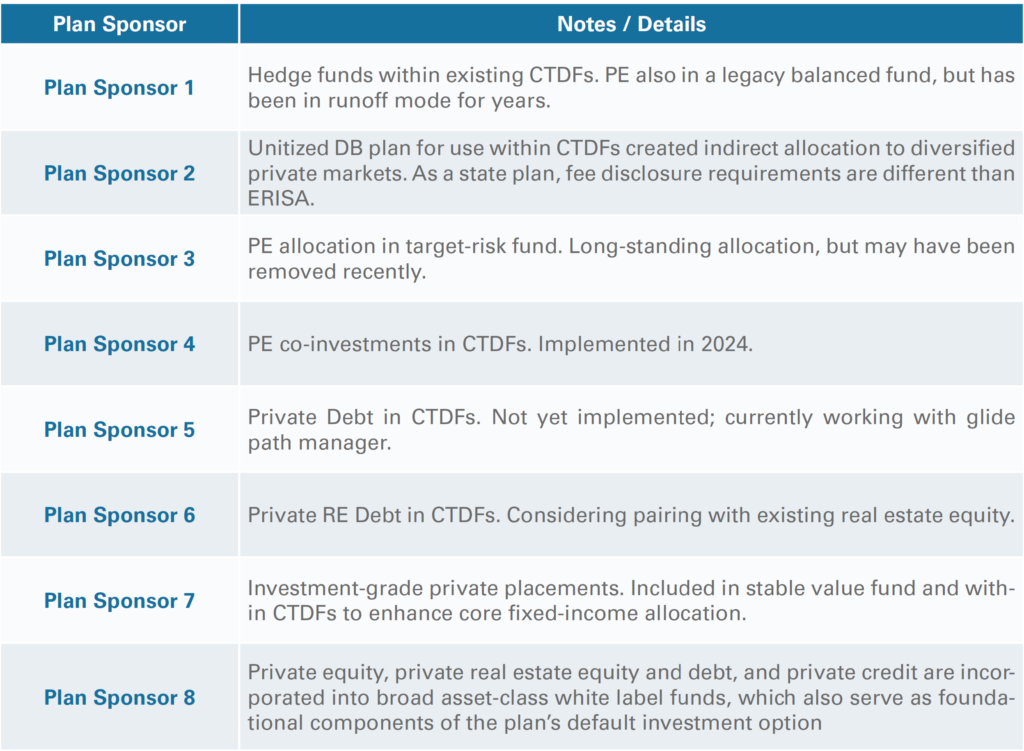

The table below highlights plan sponsors that have incorporated private market investments into their DC plans.

Real-Life Plan Sponsor Examples

Transforming Concepts into Reality

Private equity is, in theory, a natural fit for DC plans. These plans are designed to accumulate assets over a 40-year working life, with distributions typically beginning only at retirement – an ideal match for private equity’s long-term investment horizon.

Momentum towards inclusion began in June 2020, when the Department of Labor issued an information letter to the Groom Law Group permitting 401(k) plan fiduciaries to prudently include private equity within an ERISA plan’s diversified investment option. This followed the Supreme Court opinion related to Intel Corp., which dismissed legal challenges to the inclusion of private equity and hedge funds in its plan. The movement accelerated in August 2025, with the release of a Presidential Executive Order, calling for the DOL to revisit guidance that had historically limited alternative assets in DC plans. Just five days later, the DOL withdrew its 2021 cautionary statement, signaling that private equity is now considered a permissible and appropriate option under ERISA standards.

The Marketplace

As of the first quarter of 2025, DC plans held $12.2 trillion in assets, with another $16.8 trillion in Individual Retirement Accounts (IRA). While this represents a massive pool of capital, only a fraction is realistically accessible to private equity.

TDFs are widely viewed as the most viable entry point. With 40+ year investment horizons and steady cash inflows, TDFs are structurally well-suited for private equity. Their dominance is clear: 97% of DC plans offer TDFs, and they hold nearly half of plan assets. As Willie Sutton said, “…because that’s where the money is.” For context, 46% of NEPC DC client assets are in TDFs, and nearly 70% of new DC plan contributions flow into them – largely because TDFs often serve as the plan’s Qualified Default Investment Alternative (QDIA). This dynamic makes the role of fiduciary paramount, as it places risk of manager selection squarely on the plan’s named fiduciaries, that is, the plan sponsors. However, a major hurdle remains: 54% of plan sponsors have selected a low-cost passive TDF. This limits the addressable market and raises important questions about how much of the DC landscape is truly accessible to private market managers2.

Private Equity in DC Plans: Asset Allocation

At NEPC, we are happy to guide DC plan sponsors through the full gamut of incorporating private equity. Our recommendations are grounded in rigorous research and agile consulting. Our goal is to deliver actionable insights across strategic asset allocation, manager selection, and portfolio implementation.

Funding Sources

Introducing private equity into a DC plan requires re-allocating from existing exposures. A commonly cited “fixed” 10% allocation to private equity across a TDF’s full glide path raises questions—especially since TDFs are designed to reduce risk as participants near retirement. This figure may reflect operational constraints more than strategic intent, especially given the SEC’s Rule 22e-4 of the Investment Company Act of 1940, which caps illiquid assets including mutual funds at 15%. Many managers maintain a buffer below this threshold for legal and operational flexibility.

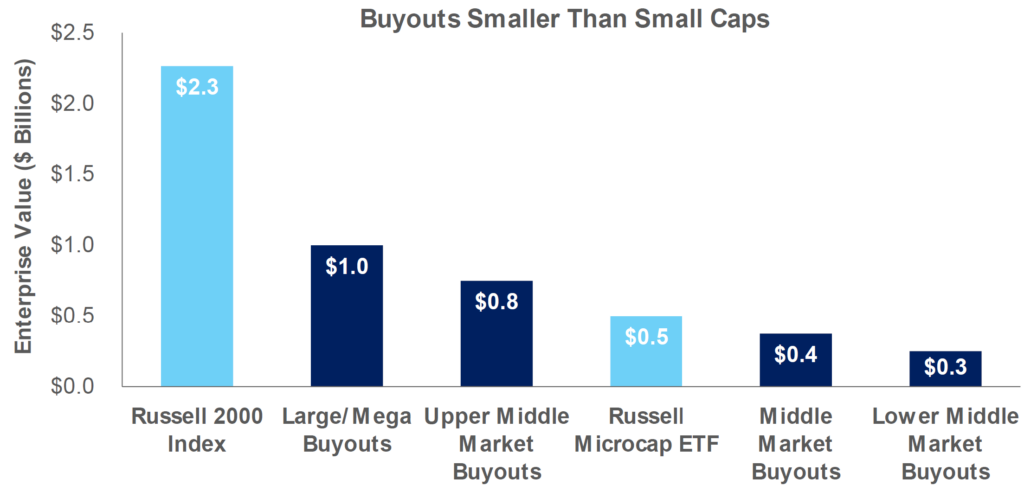

From a strategic standpoint, U.S. small-cap stocks are a logical funding source. While they represent about 13%3 of the global equity market, their allocation within a TDF—especially one that derisks to a 60/40 stock/bond mix—can shrink to around 6%. If half of that exposure is reallocated to private equity, the resulting allocation would be approximately 3%.

While each plan sponsor’s unique requirements must be considered, taking into account operational feasibility, opportunity set, and glide path dynamics, NEPC believes an approximately 5% allocation to private equity is a practical starting point for most DC plans.

Why U.S. Small Cap Stocks?

Private equity and U.S. small-cap stocks serve as complementary asset classes. With companies remaining private for longer, private equity provides investors access to early-stage growth opportunities. This shift supports a strategic reallocation that can be executed with clear operational guardrails.

Importantly, we continue to see value in U.S. small-cap stocks. They provide diversification and represent larger, more mature companies than those typically found in private equity portfolios – reinforcing the view that these asset classes are complements, not substitutes.

Private Equity in DC Plans: Implementation

DC-Friendly Structures and Operational Efficiency

The prevailing “1.0”4 DC private markets’ structure centers on evergreen vehicles—open-ended funds without a fixed end date—marking a significant shift from traditional closed-end private equity models. These structures offer greater flexibility and liquidity through continuous capital contributions and periodic redemptions.

Today, single managers are launching evergreen funds focused on buyouts, secondaries, and co-investments to address liquidity and operational needs. Looking ahead, “2.0”5 structures will likely evolve into multi-manager models, offering diversified deal flow and smoother capital return. Asset managers are already developing daily-valued CITs and other vehicles to support this shift. Semi-liquid structures may also introduce redemption options and more favorable fees—key innovations for broader adoption in DC plans. However, while evergreen and daily-valued structures provide access to private markets within DC plans, the desire for liquidity and daily valuation may come at the cost of the traditional long-term illiquidity premium associated with biggest driver in the return advantage for private equity.

To be viable in DC plans, private markets must be embedded within structures like TDFs, which use public market liquidity to enable operational safeguards.

However, solving for entry alone doesn’t guarantee better participant outcomes. Access and availability remain major hurdles. Top-performing managers are often capacity-constrained and selective. Sponsors with access to large asset pools, for instance, defined benefit plans, endowments and foundations, have an edge, while smaller sponsors may face barriers or end up with diluted, suboptimal solutions.

Is 2025 the Right Time to Enter?

A growing concern is timing. Is 2025 the right moment to enter private equity, given the current slowdown in capital distributions to existing investors? Assets acquired during the low-interest rate period (2020–2023) are now facing refinancing at significantly higher rates, leading to depressed distributed to paid-in capital (DPI) metrics. Notably, the last U.S. vintage to deliver a 1.0x DPI was 20166.

This raises a strategic dilemma for DC plan sponsors: enter now despite headwinds, or wait for market conditions to stabilize? We believe long-term success will hinge on thoughtful portfolio construction and manager selection, which we explore in the following sections.

Private Equity Implementation in DC Plans: Portfolio Construction

Phased Portfolio Construction

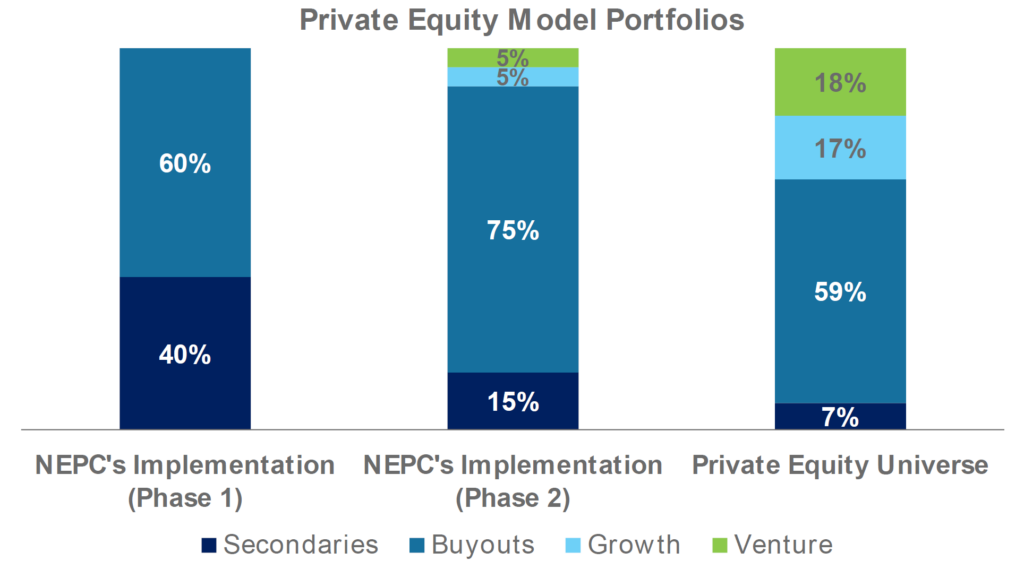

We believe a phased approach is essential for effectively implementing private equity in DC plans. Starting with strategies that offer more predictable outcomes – such as buyouts and secondaries – helps mitigate the J-curve and allows sponsors to build exposure thoughtfully. Evergreen structures support this process by balancing operational realities, vintage-year diversification, and liquidity needs. As allocations grow, higher-dispersion strategies can be layered in over time. The plan should also be designed to taper commitments as participants near retirement, managing liquidity and risk. Below is an example of a phased approach:

Phase 1: Begin with a blended allocation—for instance, 80% U.S. small-cap equities and 20% private equity—focusing on buyouts and secondaries. These strategies offer earlier cash flows and more predictable performance, making them ideal for initial implementation.

Phase 2: Gradually increase private equity exposure while reducing the small-cap allocation, potentially shifting towards a portfolio where private equity exceeds small-cap holdings.

Asset Class Composition

A five-year allocation window allows time for operational readiness and governance alignment. As the program matures, smaller allocations to growth and venture capital can be introduced to enhance diversification and risk-adjusted returns. These higher-dispersion strategies should be added cautiously and only after establishing a stable foundation.

Vintage-year diversification should ideally be achieved during this period, with commitments tapering around participant age 45 to allow the portfolio to wind down naturally before retirement. Given the limited weight of small-cap equity in global market capitalization, the maximum feasible allocation to private equity is likely capped at 6%.

Private Equity Implementation in DC Plans: Manager Selection

Performance Dispersion

Manager selection is critical to the success of private equity in DC plans. While first-quartile private equity managers consistently deliver significant excess returns over benchmarks, those in the bottom half often match or underperform the Russell 2000 Index. For context, a fourth-quartile U.S. small-cap manager may lag the index by just -0.1%, whereas buyout, venture, and secondaries strategies can underperform by -6.7%, -7.2%, and -4.7%, respectively. Given private equity’s higher fees, outperforming public markets net of fees is essential.

Given the wide dispersion in net-of-fee returns, private equity performance hinges not only on manager selection but also on securing access to top-tier managers. For instance, the average excess return spread between first- and fourth-quartile managers is 28.0% in venture and 22.0% in buyouts—highlighting significant variability even within the same sub-asset class. Simply allocating to private equity without access to first- or second-quartile managers may result in long-term net-of-fee performance that, at best, mirrors public markets—or, at worst, significantly underperforms.7

Access to Top Managers

Access is a major challenge. Many top-performing private equity firms are highly selective and don’t actively market to DC plans. In contrast, underperforming peers—often driven by fundraising pressures—may prioritize aggressive marketing over investment quality. This creates adverse selection risk, where plan sponsors may unknowingly choose suboptimal managers simply because they are more visible or available. The strong performance of elite managers skews industry averages, masking the underperformance of less capable firms. For DC sponsors, gaining access to top-tier managers is not just preferable but essential.

Fee Considerations/Alignment

Fee structure is a critical consideration. Some TDF providers are negotiating performance-based arrangements with private market managers to better align incentives with outcomes. Plan sponsors should be mindful of acquired fund fees and expenses (AFFEs), which are indirect costs passed on to participants through the TDF or wrapper. Additionally, sponsors must understand the gross- versus net-of-fee spread for sub-advisors within the wrapper, including any fees not captured by the AFFE. It is essential to ensure participants aren’t overpaying for overlapping exposures or poorly structured vehicles—especially as some managers may overlook these details in a rush to launch.

Mitigating Adverse Selection Risk

Buyer beware! Given the wide dispersion in net-of-fee returns across private equity sub-asset classes, a one-size-fits-all implementation approach is ill-advised. More conservative strategies – such as buyouts and secondaries – tend to exhibit tighter return dispersion than venture capital, helping reduce manager selection risk. However, this narrower range may also limit long-term performance.

Plan sponsors should ensure that the asset classes used to market trailing performance are consistent with those being used going forward—including the same level of leverage—to avoid exposing participants to mismatched performance expectations and potential unfavorable outcomes.

Conclusion

The success of private equity in DC plans ultimately relies on collaboration. It takes a coordinated effort among plan sponsors, consultants, investment managers, recordkeepers, trustees and custodians. The goal is to build meaningful allocations to high-quality managers within well-structured, transparent vehicles that meet fiduciary standards, while delivering the long-term, top-quartile net-of-fee results that make the asset class compelling.

Not all alternative asset classes or private equity strategies are created equal. Even offerings from the same manager may vary in quality or underlying strategy mix, making rigorous due diligence essential. At NEPC, we are well-positioned to support plan sponsors in evaluating off-the-shelf and customized solutions, helping implement private equity strategies in DC plans that are aligned with fiduciary standards.

For plan sponsors interested in continuing the conversation, we encourage you to review this information and reach out to your NEPC consultant.

1 Refer to chart on page 8

2 NEPC’s 19th Annual Defined Contribution (DC) Plan Trends and Fee Survey. Respondents to the 2024 survey included 137 clients representing $408 billion in aggregate assets and 3.2 million plan participants.

3 FactSet, as of 6/30/2025

4 Typical private markets’ implementation structure

5 NEPC’s view of forward-looking structures

6 Pitchbook, as of June 30, 2025

7 eVestment US Small Cap Equity Universe, based on excess time-weighted net of fee returns versus the Russell 2000 Index for the period 01/2004–03/2025. Average quartile returns presented for eVestment Universe. Private equity data from Cambridge Associates, presented net of fees to Limited Partners. Returns reflect pooled net IRRs for vintage years 2004–2020 and reflect net performance after manager fees. Data is based on performance as of March 31, 2025, which is periodically updated and subject to change.