In this second installment of a three-part series on transferring risk from defined benefit pension plans, we highlight the significant role played by insurers in these complex but increasingly popular transactions.

With more companies seeking ways to scale back their defined benefit plans, the market for pension risk transfers has experienced remarkable growth, marked by wider acceptance and greater understanding around these involved transactions.

As a result, the landscape has been inundated by new entrants and record-breaking deals, with insurers continuing to play a vital role in the group pension annuity market. They provide a strategic solution for corporate plan sponsors seeking to transfer pension liabilities. The rising involvement of insurance companies is leading to greater efficiencies in the marketplace, resulting in more competitive pricing and choices for companies. While this is good news for plan sponsors, they have to continue to exercise caution in carrying out their fiduciary responsibility and act in the best interest of plan participants.

Last year, $28.9 billion in single-premium group annuity buy-out sales and $2.3 billion in single-premium group annuity buy-in sales were recorded through September 30. During the year, at least four disclosed jumbo transactions of more than $1 billion were executed, including $8.1 billion in U.S. pension liabilities transferred by telecommunications giant AT&T Inc. In 2022—a record year for single-premium group annuity buy-out transactions—$48.3 billion of pension liabilities across 562 contracts were transferred to insurers in the U.S.1, a 42% jump compared to 2021. Jumbo-sized transactions have become more prevalent, including one executed in 2022 by technology behemoth IBM covering $16 billion in retiree liabilities, jointly insured by two carriers.

Rising costs, regulatory complexities and improvements in funded status have motivated many defined benefit plan providers to seek ways through which they can remove or transfer some or all of their pension plan’s risk, that is, their pension liabilities, to plan participants or a third party or a combination of the two. For companies, offloading these liabilities reduces the pension plan’s footprint on their balance sheet, while also reducing risk around interest rates, asset-liability mismatch and funding requirements.

The pension group annuity market has evolved with significantly more transactions being executed annually compared to a decade ago. Once a plan sponsor has decided to pursue a pension risk transfer through annuity purchases, we believe it is important to assemble a team of multiple advisors, each fulfilling a distinct role in the process. It is also important to assess the ideal time to go to market with a deal as insurer capacity could decline towards the end of any calendar year, limiting insurer options for the plan sponsor.

At NEPC, we provide advice on pension risk transfers and the long-term implications for the ongoing plan. We collaborate extensively with companies settling their pension liabilities and believe a successful transfer of pension risk calls for collaboration between the plan sponsor, the investment managers, consultants, ERISA counsel, custodians and actuaries. These highly nuanced and intricate transactions typically take several months to complete and involve multiple steps requiring precise planning and execution.

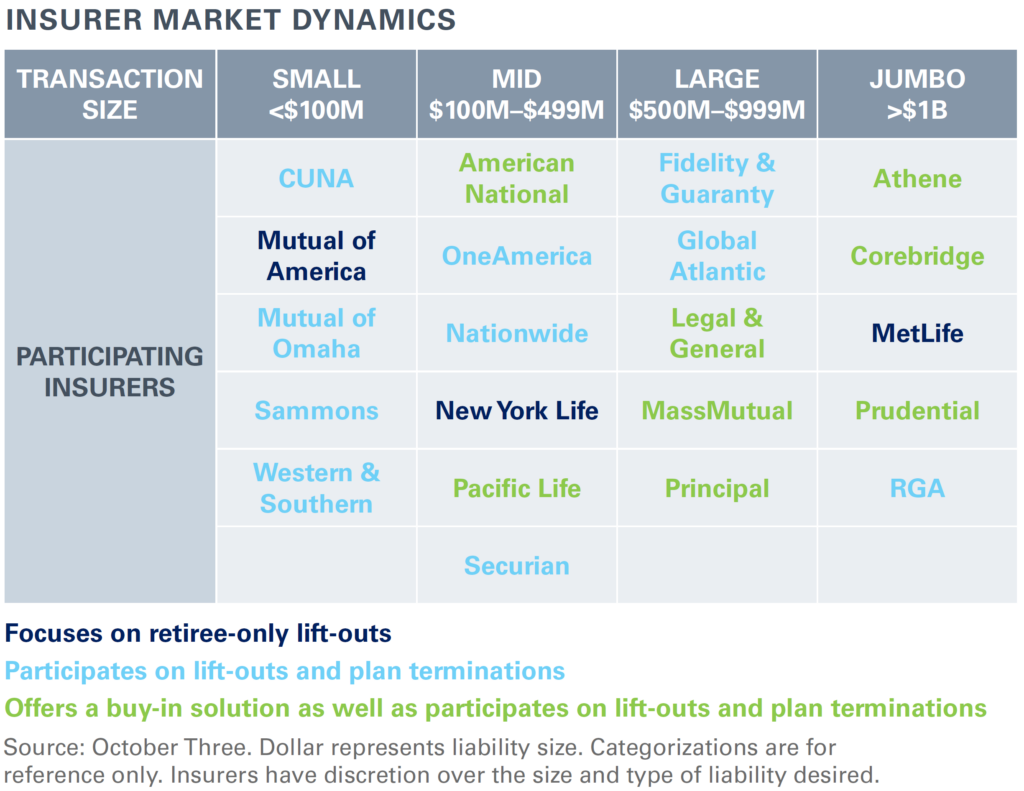

The number of insurance companies participating in pension risk transfers has steadily increased, with 21 insurers now offering various solutions to plan sponsors. The market is generally structured according to the size of the transaction, the type of plan liability, and the type of participants being transferred. While insurers can target any particular transaction, in the table below we categorize the players in the industry based on their typical market segment.

Among insurers, pricing can be obscure and unique to each carrier. Recent generic pricing has generally oscillated around the GAAP liability value, with more precise pricing available when a live deal comes to market. Milliman’s Pension Buy-out Index estimates an average pricing of 103.9% of accounting liability as of November 30, 2023, based on a pricing composite of several insurers using a representative retiree population. At NEPC, we also publish a Retiree Buy-out Index that estimates the generic pricing of a retiree liability to be 103.7% of the accounting value as of November 30, 2023. Final pricing may vary given the specifics of a live transaction.

Other insurers have offered a discount when an asset-in-kind premium delivery is an option to fulfill the premium in place of cash. Plan sponsors should understand when it is appropriate to consider an asset-in-kind delivery based on their existing investments, the size of liability being transferred, and potential portfolio needs for the residual plan.

Pricing has become increasingly competitive due to new entrants in the market, insurers attempting to grow and diversify their balance sheet exposures, and the emergence of re-insurance in the market for pension risk transfers, which creates additional capacity within balance sheets.

When selecting an insurer, plan sponsors act in a fiduciary capacity with the primary goal of doing what is in the best interest of plan participants. As a fiduciary, the plan sponsor must satisfy the Department of Labor’s Interpretive Bulleting 95-1 requirements during this process. External advisors may be engaged when evaluating insurance companies to ensure prudent selection. An advisor may be hired to help place the annuities and act as an independent expert or independent fiduciary, depending on the transaction and the plan sponsor’s legal risk mitigation approach.

In short, both will assist the plan sponsor in purchasing the annuities. The independent fiduciary selects the insurer on behalf of the plan sponsor; the independent expert presents the results of the bids to the plan sponsor, and the plan sponsor selects the insurer. These annuity placement specialists will act as a liaison between insurers and plan sponsors, helping with coordination and understanding what goes behind key decisions such as the contract structure, participant coverage in all states, and DOL 95-1 analysis.

Once a decision has been made to move forward with an annuity buy-out, it is important to reduce financial risks leading up to the selection of the insurer (more on this in Part III).

If your company is evaluating a pension risk transfer or if you want to better understand its potential impact on your firm’s defined benefit plan, we are available to discuss the process and implications. Our consultants are here to answer any questions you may have.

1 LIMRA’s Group Annuity Risk Transfer Sales Survey