Spurred on by rising interest rates and a contribution incentive provided by the new tax law, corporate employers are increasingly exploring ways to offload their pension liabilities. For companies, transferring pension risk not only reduces the plan’s footprint on their balance sheet, but also reduces business risk over the long term related to interest rates, asset-liability mismatch and funding requirements.

At NEPC, we believe these are complex transactions where governance, partnership, risk management and planning are key. A pension risk transfer involves a series of finely calibrated steps, potentially stretching across a number of years. A successful transfer of pension risk requires strong communication between the plan sponsor, the investment managers, consultants, ERISA counsel, custodians and actuaries. To this end, we have significant experience working with plans settling liabilities and their advisors, while providing investment advice on pension risk transfers and the long-term implications for the ongoing plan.

In this paper, we review the various dynamics at play while transferring risk from defined benefit pension plans and the investment decisions to consider while evaluating appropriate solutions. In particular, we will focus on partial annuitizations, a popular strategy used by employers to transfer pension risk.

Pension Risk Transfer: Types and Trends

Activity around transferring pension risk has been intensifying in recent years as sharply rising Pension Benefit Guaranty Corporation (PBGC) premiums paid by plan sponsors have made pension plans costlier. Further compounding these costs are increased life expectancy and the resulting mortality table updates required by the Internal Revenue Service. While these costs increased, so did funded status amid higher interest rates and a spurt in contributions driven by the tax law that made funding more appealing through September 15, 2018.

As a result, more and more defined benefit plan providers are exploring ways through which they can eliminate or transfer some or all of their plan’s risk, that is, their pension liabilities. This can be done by offering vested plan participants a lump-sum payout to voluntarily exit the plan or by negotiating with an insurance company to assume payments for all or a portion of the plan’s retirement benefit obligations.

Lump-sum payouts, which allow plan sponsors to directly reduce liabilities and associated costs of running a pension plan, have been popular in recent years. Looking ahead, we believe more risk transfer activity will be in annuity buyouts. A plan sponsor can decide to purchase a group annuity buy-out contract and transfer liabilities to an insurance company. About 34% of respondents in our 2017 Defined Benefit Trends Survey were considering a partial annuitization, a 15% jump from 2016.

While each plan’s potential savings are different, an analysis of a plan with 13,000 participants and $375 million in pension benefit obligations conducted by the plan’s actuary revealed that the present value of PBGC premiums, investment management fees, administrative and other costs were about $45 million. In this case, if the plan sponsor chose to purchase a group annuity for these participants instead of maintaining the plan, it would result in these cost savings offsetting the premium paid to the insurer and advisory costs to execute this transaction. A common counter to this is that active management may be used to potentially offset associated costs of running a pension plan had the plan sponsor chosen to retain the risk and manage the plan until the last dollar of benefits was paid out; while we acknowledge this premise, the focus of this paper is on partial annuitizations.

Practically speaking, most plan sponsors choose to target only the retiree population—as opposed to those who are not eligible to receive retirement benefits yet—as this is the most economical way to partially annuitize, given an annuity cost that is generally close to the carrying value of the liabilities in accounting terms. Annuitizing active employees or the term-vested population (former employees who are due annuities at retirement age) is much more expensive, as insurers price in risk of data quality and multiple benefit contingencies. One current trend is targeting partial annuitization at those retirees and beneficiaries with the lowest monthly benefit. This produces the largest relative reduction in annual per-head PBGC premiums.

Employers looking to completely terminate their pension plan typically choose a combination of lump-sum payments offered to current (active) and former employees with a deferred-vested benefit, that is those who aren’t eligible to receive retirement benefits. The actives and deferred-vested plan participants have the option to receive a lump-sum payout or an annuity contract. If participants elect to receive a lump-sum distribution, they can rollover the proceeds into a defined contribution plan or an IRA with no tax implications. Alternatively, they can opt to receive a cash payment subject to taxes and an early withdrawal penalty. A group annuity buy-out contract is purchased for the retiree population and the active and deferred-vested participants who did not elect to receive a lump sum.

How NEPC Can Help

We believe a successful pension risk transfer requires diligent planning and an emphasis on risk management and governance. Once a decision to settle pension liabilities has been made, we work with the plan sponsor and actuary to understand the changing profile of the liability, timing of the risk transfer activity and key assumptions such as “take-up” rates for lump sum elections. Since each pension risk transfer transaction is unique, we provide tailored investment recommendations and solutions, while identifying risks (Exhibit 1) leading up to the settlement of the liabilities.

Exhibit 1: Risks Leading up to a Pension Risk Transfer

| Risk | Source |

| Interest Rates | Duration of liabilities |

| Curve exposure | Timing of liabilities along yield curve (key rates) |

| Credit spreads | Insurance company annuity pricing |

| Performance of return-seeking assets | Assets invested in equities, multi-asset portfolios, private equity and real estate |

| Take-up rate | Percentage of deferred-vested and actives that elect a lump sum |

| Timing of lump-sum payout | Lump sums have no duration in the year they are paid out; however, if they are paid in a different year than originally anticipated, lower rates would raise amounts |

| Liquidity | Investments with illiquid terms or lock-up periods |

Source: NEPC

Often, plan sponsors will seek to mitigate risks leading up to a pension risk transfer, for instance, moving towards a more insurance-ready portfolio as part of a partial annuitization process to minimize future transaction costs. Asset allocation strategies can be segmented to address lump sums and annuitizations in isolation. For partial risk transfers, it is also vital to consider the long-term investment implications of the ongoing plan. Since any transfer of pension risk activity alters the liability profile of a plan, the investment structure of the ongoing plan could potentially change. As a result, plan sponsors should re-evaluate if a change in asset allocation or investment structure is necessary given this key event.

Most annuitization projects utilize a liability-driven investing (LDI) framework. Pricing of the liability by insurance companies is largely influenced by changes in interest rates and credit spreads; as a rule of thumb, that pricing generally lies between long Treasury yields and high-quality long-duration corporate bond yields. A bond portfolio comprising long-duration corporate bonds, Treasuries and STRIPS, that is, traditional Treasury bonds whose principal has been separated from its interest (coupon), can be used to hedge pricing risk. Solutions vary, ranging the gamut from utilizing mutual funds and passive investments, to specialized bond managers.

There are merits to an asset-in-kind transfer to an insurance company; however, plan sponsors ought to evaluate if the discount received from an in-kind transfer relative to a cash delivery offsets the costs to create that portfolio or the replacement cost of those assets, particularly when there is an ongoing plan that still needs those assets. Regardless of the solution, plan sponsors need to ensure that the hedging strategy is liquid since the premium will need to be delivered as soon as a deal is struck.

With accelerated pension contributions, spurred by the new tax reforms, improving funded status for most plans, we expect assets to flow to liability-hedging strategies as glide paths are triggered. Top of mind for most is the supply and demand dynamics of long-duration bonds as demand is widely expected to exceed supply over time. Given a flattening yield curve and high transaction costs in credit markets, we recommend clients consider a blended government/credit mandate with flexibility to enable managers to opportunistically increase credit inventory as new supply comes to market.

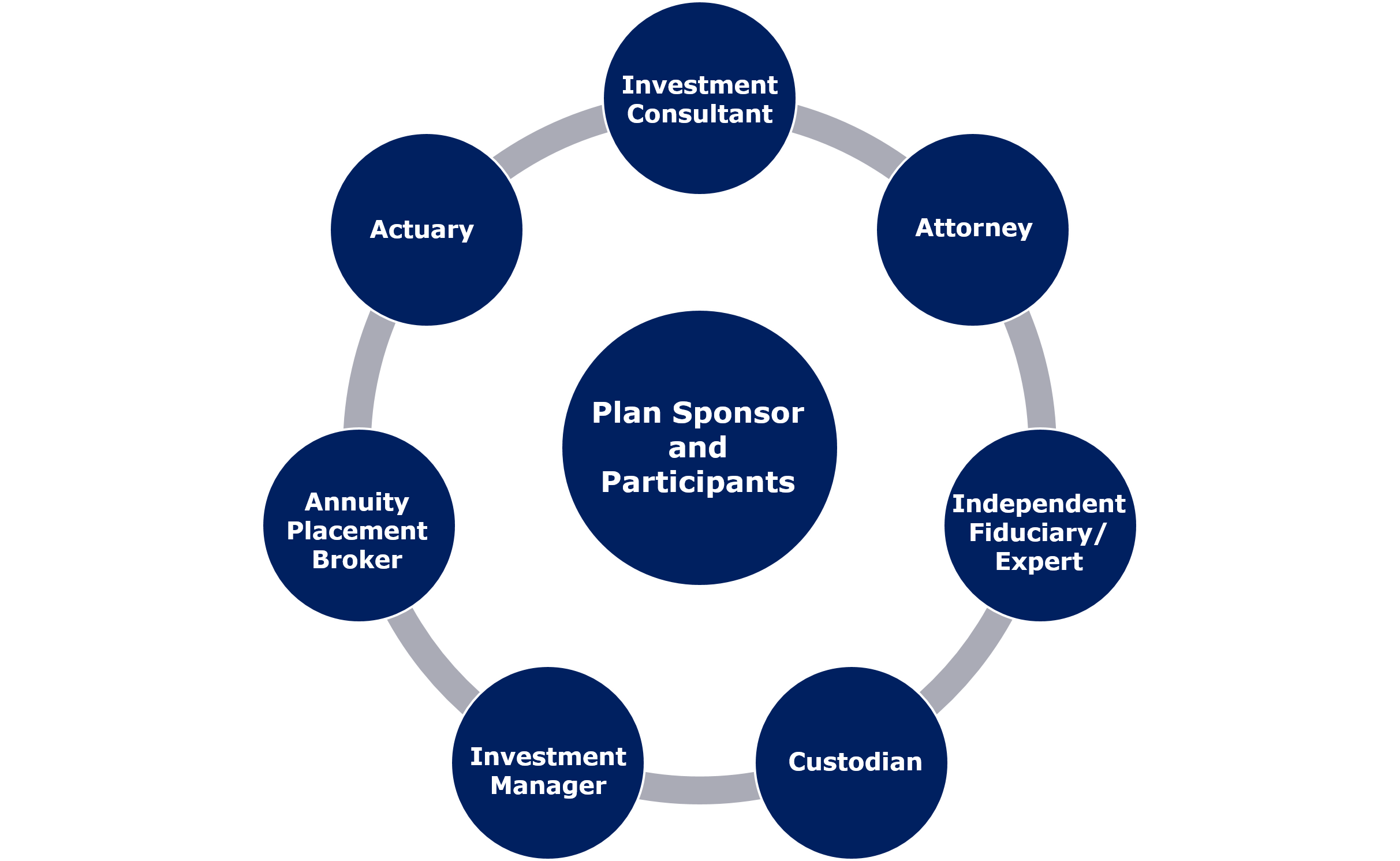

In our experience, executing annuity buyouts requires sound coordination, robust partnerships (Exhibit 2), and a very detailed project plan highlighting responsibilities and timing of expectations.

Exhibit 2: The Partnerships in a Pension Risk Transfer

Source: NEPC

Pension Buyout Market

The market for buy-out solutions has steadily evolved to meet growing demand from defined benefit plan providers faced with significantly higher PBGC premiums and revised mortality assumptions that increase pension liabilities. Just under $10 billion in single-premium buy-out transactions were executed in the first half of 2018, compared to $5.5 billion for the same period last year, according to LIMRA. At this pace, the market is on track to exceed last year’s total of $23 billion. In general, pension liabilities act as a diversifier to a life insurance company’s risk posture and, therefore, tend to be an attractive space for them. A life insurer’s risk is that people die sooner than anticipated, while pension liabilities carry the risk of longer life expectancy of participants.

Pricing pension liabilities and taking on a new group annuity buyout contract is complex and requires dedicated resources. An insurance company’s interest in taking on pension liabilities will be dictated by the size and composition of the liability in terms of number of individuals, amount of monthly benefit payments, overall total liability and populations involved. In addition, capacity generally determines which insurers are interested in taking on pension liabilities. To this end, deals coming to the market at the end of the year may have limited options when selecting a carrier. The larger end of the buyout market focuses on transactions exceeding $1 billion, while the mid-market segment ranges from $100 million to $1 billion.

Some recent pricing proposals have involved quotes from multiple insurers with a lead insurer administering benefit payments while another jointly insures the liability. Plan sponsors are required to meet the requirements of the Department of Labor 95-1 rule when selecting an insurance company. It requires plan sponsors to select the safest available annuity provider when a plan intends to transfer liability for benefits to an insurer. Insurers should not only be reviewed solely on their ratings, but also on their size relative to the liability, their level of capital, and surplus and availability of additional protection through state guarantee associations

Conclusion

With improvements in funded status brought on by rising interest rates and increased plan contributions, we expect intensifying activity in pension risk transfers with annuitizations being more prevalent than lump-sum distributions. Timing and meticulous planning are key to executing annuitization projects. Even if a buy-out is not imminent, a plan sponsor can undertake steps to enhance governance and risk management to ease the way for a future transaction and to streamline execution. Please reach out to your NEPC consultant to discuss a tailored investment solution for any pension risk transfer strategy under consideration.