Stocks and bonds sold off in October as strong economic data underscored expectations that interest rates will remain higher for longer. The U.S. economy expanded at a faster-than-expected pace, rising at an annualized rate of 4.9% in the third quarter, bolstered by robust consumer spending and higher inventory levels.

In addition, economic data reported over the month continued to point to a healthy labor market as unemployment rates in September stayed low at 3.8%, while data from the Job Openings and Labor Turnover Survey (JOLTS) remained strong. Finally, core PCE, the Federal Reserve’s preferred gauge of inflation, came in higher-than-expected, rising 0.4% in September.

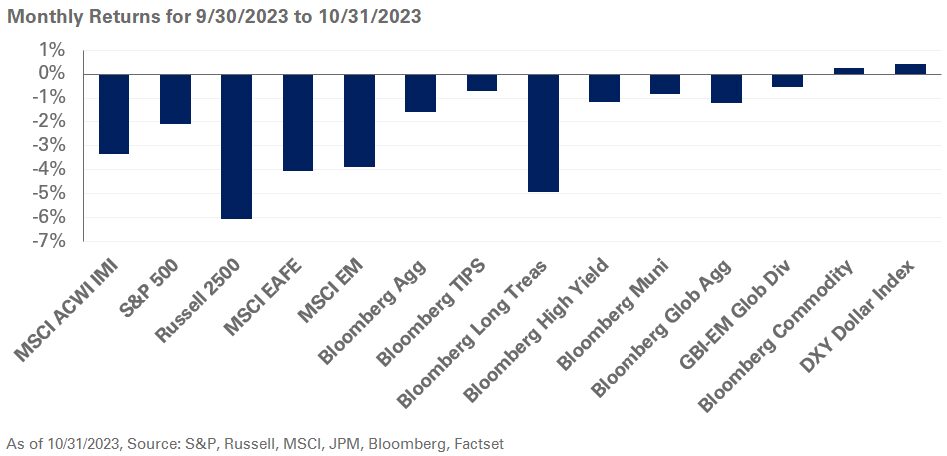

In equities, the S&P 500 Index fell 2.1%, bringing losses to 8.3% since July. Notably, the five largest companies in the index outperformed, contributing a 0.2% return to the broader index. Small-cap equities underperformed with the Russell 2000 falling 6.8%, bringing year-to-date losses to 4.5%. Outside of the U.S., a stronger U.S. dollar weighed on equity returns with the MSCI EAFE and MSCI Emerging Market indexes down 4.1% and 3.9%, respectively.

In fixed income, the Treasury yield curve steepened with the two- and 10-year Treasury yields rising two and 33 basis points, respectively, narrowing the inversion to 16 basis points. Notably, the 10-year Treasury yield briefly rose above 5% for the first time since 2007, before ending the month at 4.9%. Further, the yields on the Bloomberg U.S. Corporate High Yield Index hit 9.5% after option-adjusted spreads rose 43 basis points to 4.4%.

Elsewhere, in commodities, WTI Crude oil spot prices fell 10.8%, as easing concerns over supply and projected weaker demand weighed on prices.

Keeping in mind the market dynamics, we suggest investors reduce S&P 500 exposure, while maintaining U.S. large-cap value positions. We also recommend investors increase exposure to U.S. high-yield bonds and broadly evaluate the risk-return benefit of fixed income.

Real interest rates have risen to attractive levels and, given the continued uncertainty surrounding inflation, we encourage taking advantage of the available real yields of 2.5% and adding exposure to TIPS. Lastly, we suggest holding greater levels of cash within safe-haven fixed-income exposures to enhance portfolio liquidity.