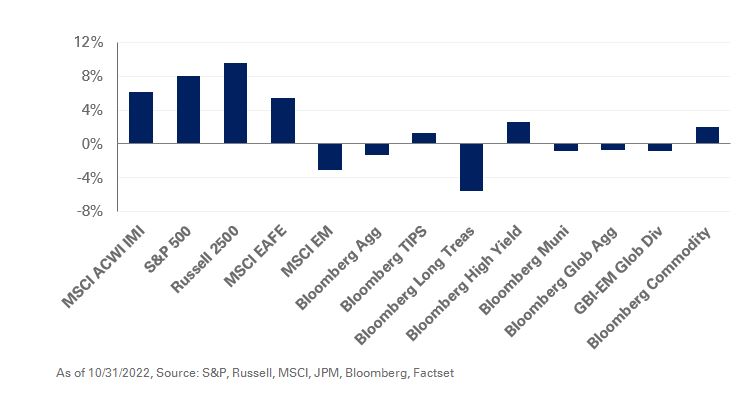

Risk assets sharply rebounded in October despite tighter monetary conditions in the face of persisting inflationary pressures. U.S. equities outperformed with the S&P 500 Index posting gains of 8.1%; the MSCI ACWI ex U.S. Index was up 3%. Value stocks maintained their lead over growth equities with the Russell 1000 Value and Growth indexes up 10.3% and 5.8%, respectively—widening year-to-date outperformance to 17.3%. Outside of the U.S., MSCI China Index suffered its largest daily loss since 2008, falling 8.2% after China’s 20th National Congress; the MSCI China Index ended the month down 16.8%.

In the U.S., a robust labor market pushed inflation higher. Headline CPI was up 0.4% over September, while core CPI, which excludes food and energy, rose 0.6%. Despite elevated inflation levels, the U.S. real economy expanded at an annualized rate of 2.6% in the third quarter as a rise in consumer spending and net exports offset a decline in residential investments. The higher interest-rate environment increased the cost of housing. As a result, pending home sales declined 10.2% over September, marking the largest decline since April 2020.

In fixed income, higher inflation pressured developed market government yields higher. In the U.S., one- and 10-year Treasury yields increased 85 basis points and 28 basis points, respectively. Inflation expectations rose with the 10-year U.S. breakeven inflation rate increasing 38 basis points to 2.5%. High-yield assets outperformed as tighter credit spreads offset higher rates. As a result, the Bloomberg U.S. Corporate High Yield Index added 2.6% after spreads tightened by 88 basis points to 464 basis points.

NEPC’s stance towards risk assets remains unfavorable given the uncertain growth and inflation dynamics. We recommend building exposure to short-term investment-grade credit as higher yields offer an attractive defensive position. We also suggest adding exposure to value stocks in U.S. large-cap equity to mitigate the portfolio impact of rising interest rates and inflation normalizing above market expectations. In addition, we still encourage a dedicated allocation to assets that support liquidity needs in periods of stress.