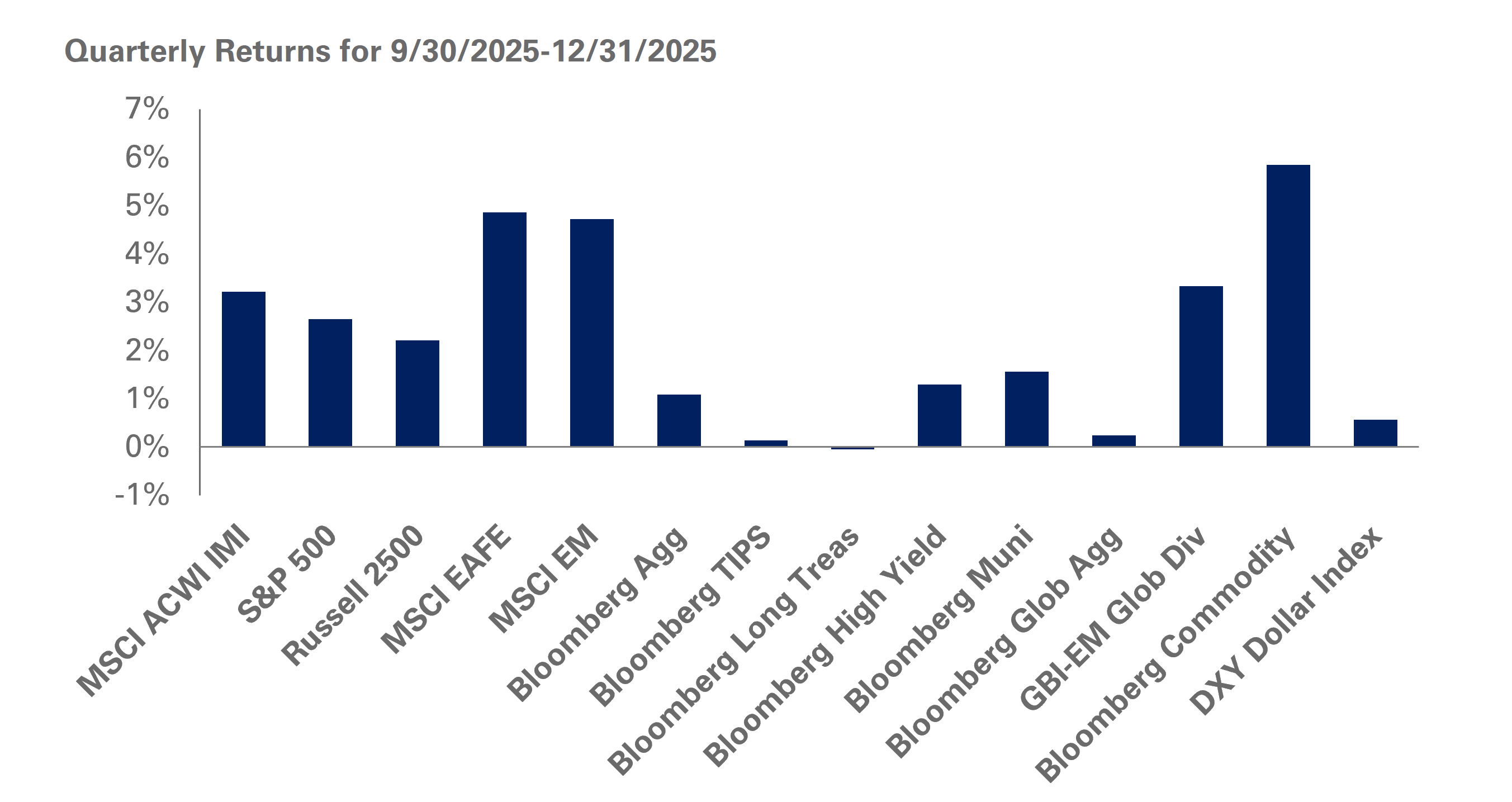

Equity markets stood their ground in the fourth quarter in the face of the longest government shutdown in U.S. history and unemployment at 4.1%. Ending 2025 on a high note, the S&P 500 Index added 2.7% for the three months ended December 31, with returns totaling 17.9% for the year; value stocks outperformed growth equities in the fourth quarter amid heightened scrutiny around the valuations of AI companies.

International equities sustained their rally with a tailwind coming from a weakening U.S. dollar. The MSCI ACWI ex-U.S. Index finished the quarter with returns of 5.1%, while the MSCI EAFE Index posted returns of 4.9%. During this period, the MSCI Emerging Markets Index—led by Korea and Taiwan capitalizing on the AI theme—gained 4.7%.

Meanwhile, fixed-income markets were in the black in the fourth quarter, benefiting from the Federal Reserve lowering the Fed Funds rate two times to the 3.5%-3.75% range. During this period, the yield curve steepened with the two-year Treasury yield falling to 3.48%, while the 10-year Treasury yield remained stable at 4.18%.

Real assets saw mixed results with gold emerging as the clear winner as the precious metal hit a record high, ending the quarter with gains of 12% with whopping returns of 64.7% for the year. Gold’s steep ascent underscored the desire of central banks to decrease exposure to the U.S. dollar and increase domestic reserves. The Bloomberg Commodity Index finished the quarter with gains of 5.8%, while WTI Crude Oil lagged with losses of 9.1%.

Given recent market dynamics, we encourage investors to remain disciplined, stick to long-term strategic asset allocation targets, and maintain exposure to equities. We advocate seeking opportunities to rebalance across equity market segments; we also suggest investors rebalance back into weaker areas of the equity market, potentially using non-U.S. stocks that have outperformed as a funding source. In addition, look to balance exposure to the earnings power of the largest S&P 500 names with value and quality companies across the globe.

At the same time, we advise being mindful of portfolio equity positions, while monitoring outsized tracking error levels associated with the top 10 names of ACWI IMI and any underweights flowing through. We also recommend investors hold high-quality, liquid assets, and encourage maintaining appropriate safe-haven fixed-income exposure for liquidity and downside protection.