February marked a particularly volatile month for capital markets with fears intensifying over the new coronavirus (COVID-19) turning into a pandemic as the number of new cases appearing outside of China outpaced those within China. In response, the CBOE Volatility Index shot up to 40.11, a new high since 2015.

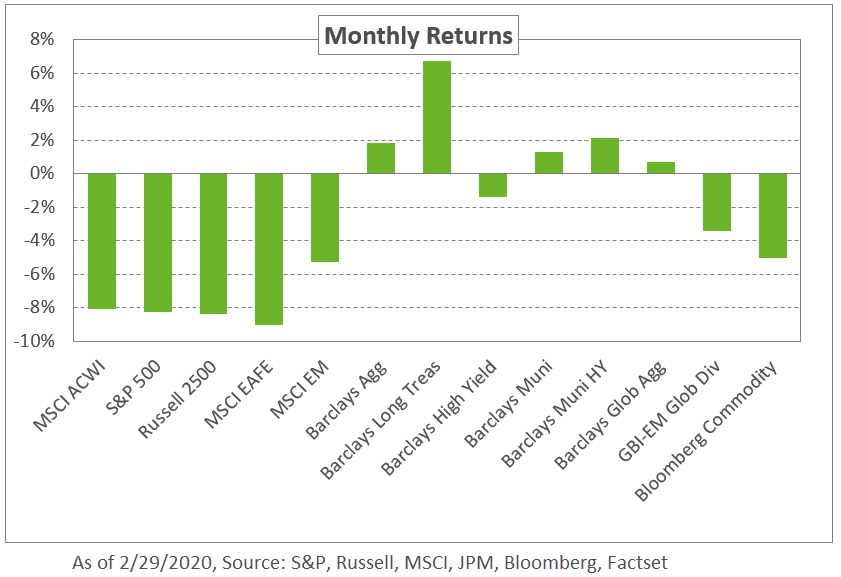

Global equities were the hardest hit amid a wave of risk aversion, reflecting heightened uncertainty around future earnings and the growth outlook for multinational corporations; the S&P 500 declined 8.2% last month but is still in the black at 8.2% on a trailing one-year basis following the tremendous gains of 2019. Losses extended to international and emerging market equities as well, leading to declines of 9.0% and 5.3%, according to the MSCI EAFE and MSCI Emerging Markets indexes, respectively.

Within fixed income, global yields plunged. Treasury yields hit record lows across the curve, with the 10-year and 30-year bonds declining 37 and 34 basis points, respectively. In response, the Barclays US Treasury and Barclays US Long Treasury Indexes increased 2.7% and 6.7%, respectively, during the month. As markets digested the potential economic impact of the virus, futures markets priced in a significant response by the Federal Reserve; Fed Funds Futures contracts now anticipate three cuts to occur during 2020 compared to only one expected cut as of the end of 2019. Credit spreads widened with lower-quality securities bearing the brunt; the Barclays US Corporate High Yield option-adjusted spread increased 110 basis points to 5%, corresponding to a 1.4% decline in returns for February.

In real assets, commodities ended broadly lower reflecting uncertain demand. Energy was the most affected with spot WTI crude oil declining 12.3% for the month with year-to-date losses totaling 26%. Additionally, gold, which typically rallies when equities fall, suffered its largest daily decline since 2013 and ended the month in the red, underscoring the broader market volatility.

With uncertainty around the full economic impact of the coronavirus, we anticipate heightened market volatility in the near term. To this end, we encourage investors to maintain a diversified portfolio to help weather further selloffs. Additionally, we advise investors to use this opportunity to realize significant gains in government debt, deploying these as dry powder in the event of further market dislocation.