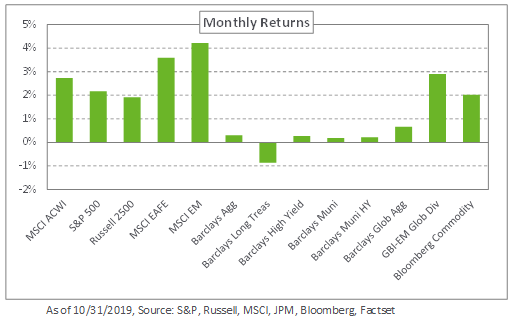

Investors embraced risk assets in October amid more accommodative monetary policies from the Federal Reserve and the European Central Bank, and renewed optimism around the outcomes of Brexit, and the trade war between the United States and China. In equities, international and emerging markets led the way with the MSCI EAFE Index and MSCI Emerging Markets Index returning 3.6% and 4.2%, respectively; the outperformance underscored a softness in the US dollar and improving sentiment around trade which has weighed heavily on many export-heavy economies in 2019. In the US, the S&P 500 Index hit a new high, up 2.2% for the month and 23.2% for the year so far.

Following the Fed’s third rate cut this year, the short end of the US Treasury curve moved slightly lower. That said, the curve still steepened at the 10- and 30-year points, which increased one- and five-basis points, respectively. Outside the US, yields moved higher with 10-year German and Japanese bonds rising by 17- and nine-basis points, respectively. In emerging markets, the JPM EMBI Global Diversified Index increased 0.3% last month, in response to spread compression of 15 basis points. Within local emerging debt, the JPM GBI-EM Global Diversified Index was up 2.9% in October, reflecting modest currency strength relative to the US dollar.

In real assets, MLPs faced a difficult October with negative fund flows and significant regulatory changes. Performance between MLPs and C-Corps has continued to diverge, with the Alerian MLP Index down 6.2% for the month, while the Alerian Midstream Energy Index lost 3.8%.

As 2019 draws to a close, we remain cautious on risk assets given their robust performance so far this year. To this end, we maintain our recommendations to rebalance overall equity exposure and reduce return-seeking credit.