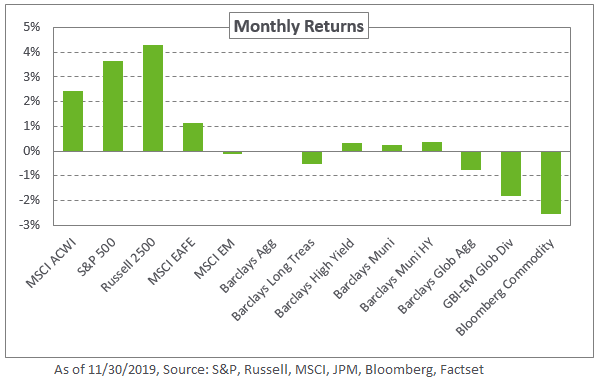

Following a relatively quiet month, developed equities ended higher as improving economic data assuaged near-term fears of a slowdown. US markets led the way with the S&P 500 Index increasing 3.6% during the month, adding to year-to-date gains of 27.6% – putting it on track for the best calendar year return since 2013. Internationally, the MSCI EAFE Index ended up 1.1% as strengthening manufacturing data and a perceived lull in trade tensions boosted sentiment. Emerging market equities lagged their developed counterparts as weakening data out of China and uncertainty in Hong Kong weighed on returns for the region. As a result, the MSCI Emerging Markets Index declined 0.1% during the month.

In the absence of any major central bank announcements, global bond yields moved marginally higher. The US and German 10-year bonds increased nine and seven basis points, respectively. In response, the Barclays US Treasury Index declined 0.3% for the month. The long end of the curve, measured by the 30-year US bond, also increased two basis points to a yield of 2.20% – resulting in a 0.5% decline for the Barclays Long Treasury Index. In credit, spreads broadly declined. The Barclays US High Yield Index eked out a 0.3% monthly return as spreads on the index declined 22 basis points. Finally, in emerging markets, modest dollar strength impacted local-currency debt, resulting in a 1.8% loss in the JPM GBI-EM Global Diversified Index.

As we head into the final month of the year, we continue to express caution on risk assets given strong performance year-to-date and the potential for heightened volatility as part of the late stage US economic cycle. As such, we maintain our recommendation to reduce return-seeking credit exposure.