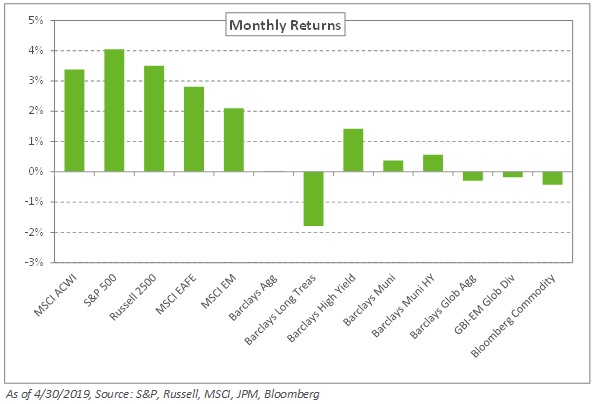

Coming off a strong first quarter, stocks continued their run in April amid the Federal Reserve’s more dovish stance. The US led the way, with the S&P 500 Index increasing 4% during the month – pushing year-to-date returns to 18.2%. International equities were up 2.8%, according to the MSCI EAFE Index, while emerging market stocks gained 2.1%, according to the MSCI Emerging Markets Index.

Within fixed income, global yields moved modestly higher while spreads declined, causing dispersion in rates and credit index returns. The 30-year Treasury yield increased 11 basis points to 2.93%, which caused the Barclays Long Treasury Index to decline 1.8% in April. High-yield spreads saw the most significant decline with the Barclays US High Yield Index falling 33 basis points to 3.58%, corresponding to returns of 1.4%. In emerging markets, local debt, as measured by the JPM GBI-EM Global Diversified Index, fell 0.2%, underscoring the strength of the US dollar, and political and economic uncertainties in Argentina and Turkey.

In real assets, spot WTI Crude Oil maintained its winning streak, up 6.1% last month – racking up returns of 41.4% so far this year. The rally was fueled by news that the United States will discontinue temporary waivers for nations, such as China and India, that import Iranian oil.

While we have seen minimal volatility in 2019 so far, we still believe the US is in the late stage of an economic cycle, a phase often characterized by greater risks and volatility. To this end, we remind investors of the importance of diversification. We encourage rebalancing in light of the hefty returns from risky assets and advocate increasing exposure to safe-haven fixed income.