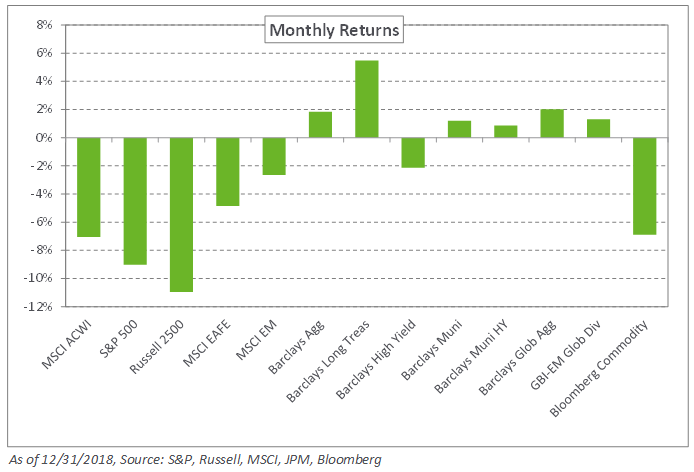

Equities came up for air in November after a widespread selloff a month earlier. Emerging market stocks led the way, with the MSCI Emerging Markets Index gaining 4.1% last month as currencies broadly appreciated relative to the US dollar. In the US, value outperformed growth as technology stocks lagged. Despite the drag on performance from the so-called FAANG equities, comprising tech giants Facebook, Apple, Amazon, Netflix and Google, the S&P 500 eked out a 2% gain during the month. In Europe, the MSCI EAFE Index was mostly unchanged, losing 0.1% in November, amid a waning economic and political outlook in Germany and volatility stemming from contentious Brexit negotiations.

In fixed income, a decline in global yields underscored the current wave of risk aversion with the 10-year US Treasury and the 10-year German bund yields falling 16 and seven basis points, respectively. As a result, rate-based instruments were moderately higher last month with the Barclays US Treasury Index up 0.9%. In contrast, credit spreads widened during the month. The Barclays US Corporate High Yield Index declined 0.9% as spreads increased 0.47% to 4.18%. Local emerging market debt rose 2.8%, according to the JPM GBI-EM Global Diversified Index, amid modest currency appreciation.

Within real assets, WTI crude oil fell 22% during the month, weighed down by ample supply and an uncertain outlook for global demand.

As we head into the last month of 2018 with a likely rate hike from the Federal Reserve on the horizon, we encourage the addition of safe-haven fixed-income debt as rates continue to rise.