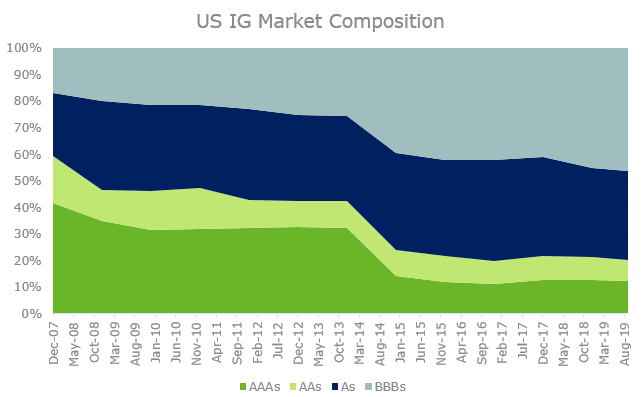

Talk about too much of a good thing…BBB-rated corporate bonds have grown about four-and-a-half times in size since 2009, making up a little over half of the $6 trillion investment-grade universe in the United States. This segment of the bond market is also more than two-and-a-half times the size of the US high-yield debt market.

The volume of BBB-rated debt—occupying the lowest rung of investment-grade securities—poses significant concern to fixed-income investors in the event of a deluge of ratings downgrades. A mass descent into the high-yield market—bonds rated BB+ and below—could fuel fire sales in portfolios that are prohibited from holding lower-quality debt or are benchmark driven. It would also increase volatility and create dislocation within US credit as investment-grade bonds with typically longer-dated maturities—the ICE BofAML US Corporate (BBB) Index had a duration of 6.9-years while the ICE BofAML US High Yield Index had a duration of 4.1-years, as of the first quarter of 20191—may not be a natural fit for high-yield investors accustomed to shorter-dated securities.

At NEPC, we believe credit selection is key, especially if credit fundamentals take a turn for the worse and lead to widespread downgrades of corporate debt in this late stage of the US economic expansionary cycle. On the upside, the recent onslaught of negative yields and monetary easing by central banks may smooth over investor concerns. However, it is hard to rule out disruptions in this late phase of the market cycle where risks are tilted more to the downside.

Source: Deutsche Bank

The explosive growth within the BBB-segment, comprising borrowers with credit ratings of BBB+, BBB and BBB-, can be traced back to the low cost of borrowing as interest rates hit rock bottom with the financial crisis. Companies issued debt cheaply to refinance existing pricier lines of credit, fund stock buybacks and finance mergers and acquisitions. Corporate leverage is also a source of concern with BBB borrowers trending above historical levels, with some more consistent with high yield. The average net leverage for the BBB index was 2.7 times, as of the first quarter; around $1 trillion of BBB bonds have net leverage ratios of over 3.2 times, in line with the average net leverage of a BB-rated high-yield bond.2 These levels also exceed the ones seen ahead of the financial crisis. Some sectors, for instance, healthcare, have lagged in deleveraging, while others, like telecom, have successfully reduced corporate debt.

Stay tuned for more on this topic as we vigilantly watch this space for potential market dislocations that could lead to investment opportunities for active investors in equity and credit.