Global equities sold off in September as inflationary concerns pushed yields higher. The Federal Open Market Committee assumed a more hawkish tone in its meeting last month as the median policy rate forecast increased to three hikes in the Fed Funds rate by the end of 2023. Furthermore, Fed minutes indicated that tapering of Treasury and mortgage-backed securities bond purchases “may soon be warranted.”

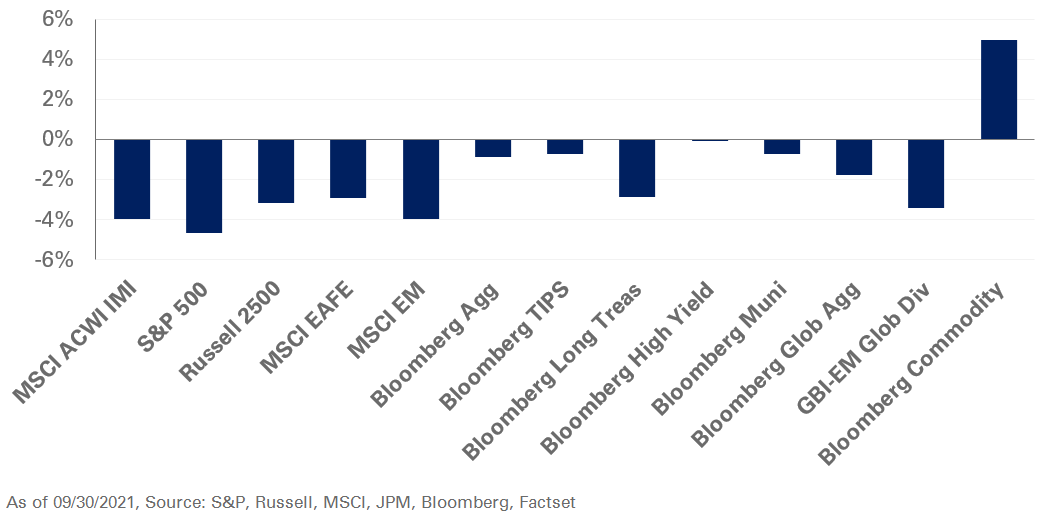

In the U.S., the S&P 500 Index fell 4.7% in September – marking the largest monthly decline since March 2020. Value outperformed growth, as rising interest rates pressured valuations of companies with cashflows further out in the future. As a result, Russell 1000 Growth Index lost 5.6%, while the Russell 1000 Value Index was down 3.5%. International markets also lagged with both the MSCI EAFE and the Emerging Market indexes declining 2.9% and 4%, respectively. Chinese equities continued to weigh on emerging markets—the MSCI China Index fell 5%—as investors fretted over regulatory risk and contagion from a potential default by struggling Chinese real estate conglomerate Evergrande.

In fixed income, global yields broadly moved higher. The yield curve shifted higher with the five- and 10-year Treasury yields increasing 22 and 23 basis points, respectively. As a result, safe-haven assets declined, and longer-duration assets underperformed, with the Bloomberg Long Treasury Index down 2.9%.

In real assets, the Bloomberg Commodity Index increased 5%, supported by higher energy prices. WTI crude oil spot prices rose 9.6% to $75.9 a barrel as U.S. crude oil inventory levels fell to their lowest levels since 2014; the natural gas spot price increased 28.9% in September.

While the market environment remains supportive for equities, credit spreads in the public-debt space imply muted forward-looking returns. As a result, we recommend reducing exposure to lower-quality credit. At the same time, we caution investors to brace for potentially higher inflation relative to market expectations and the resulting disruption in equities and real-interest rates.