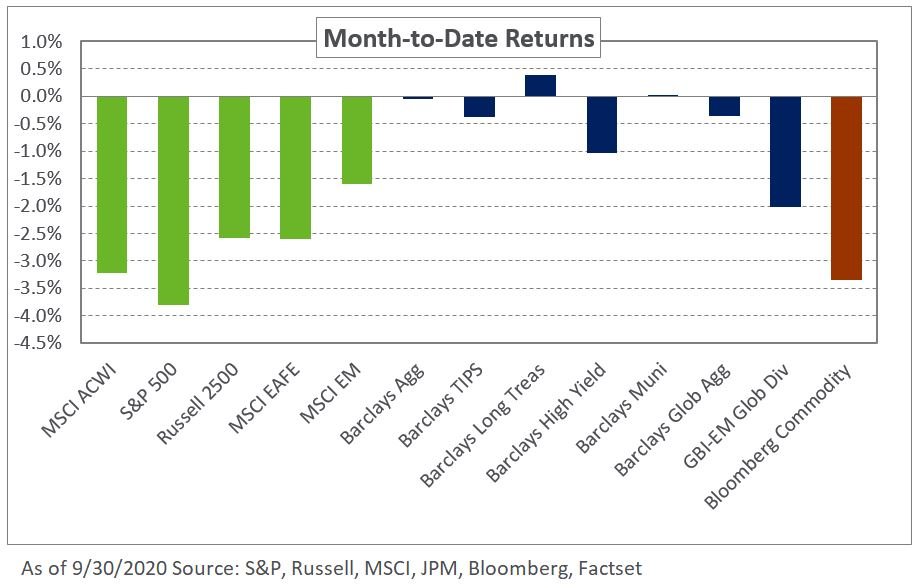

U.S. equities snapped their winning streak in September, upending five straight months of gains as technology heavyweights came under pressure and the pandemic continued to roil the economy; the S&P 500 Index fell 3.8% last month but ended the third quarter with returns of 8.9%. While non-US equities were also in the red in September, international and emerging market returns modestly outpaced domestic markets as the dollar fell relative to the Japanese yen and the MSCI Emerging Markets Currency Index; the MSCI EAFE and MSCI Emerging Markets indexes lost 2.6% and 1.6%, respectively.

Meanwhile, interest rates moved modestly lower in the U.S. and around the world, with the largest move occurring in European bonds as rising COVID-19 cases fueled a wave of risk aversion in the region. An updated dot-plot from the Federal Reserve’s meeting in September showed median expectations for no rate hikes through 2023 – reinforcing investors’ beliefs that the central bank will keep interest rates low for longer.

In credit, spreads widened, especially in lower-quality securities. The Barclays US High Yield Index option-adjusted spread increased 40 basis points during the month – pushing returns down 1%. In emerging markets, local- and hard-currency debt declined reflecting widespread risk-off sentiment and 13 basis points of spread widening on the JPM EMBI Global Index.

In real assets, the Bloomberg Commodity Index fell 3.4% as energy prices continue to be pressured. Spot WTI Crude oil prices declined 5.6% last month as persisting concerns around demand pushed prices lower.

The recent weakness in the equity market and associated volatility serve as a reminder of the fragility of the current market rally. Despite the impressive performance of risk assets over the past few months, significant economic uncertainty remains with the weak macroeconomic backdrop. In the face of such uncertainty, we expect heightened volatility across capital markets given the wide range of potential economic outcomes. To that end, we encourage investors to be disciplined and mindful of market liquidity. We also recommend a dedicated allocation to Treasuries to support liquidity levels and cash flow needs as potential market dislocations can introduce bouts of illiquidity across publicly-traded assets.