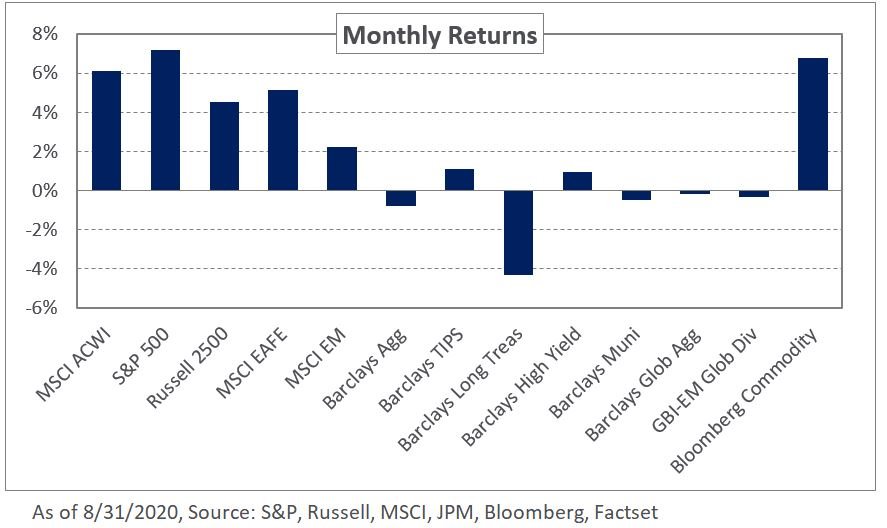

Equities continued their winning streak in August—marking the fifth straight month of gains—amid improving investor sentiment bolstered by ongoing stimulus, better than expected quarterly earnings, and optimism around a vaccine. In the US, the S&P 500 Index returned 7.2%, gaining in all but five trading days, ending the month at 3,500. Non-US equities benefited from ongoing weakness in the dollar with the MSCI EAFE and MSCI Emerging Markets indexes up 5.1% and 2.2%, respectively.

In fixed income, Federal Reserve Chair Jerome Powell, in a widely-expected move, said the central bank would seek to achieve average inflation of 2%; following periods of inflation below 2%, the Fed will allow inflation to run above 2% for some time to make up for persistently below-target inflation rates. In response, inflation expectations rose, leading to an uptick in global yields; US and German 10-year yields increased 17 and 13 basis points, respectively. The US yield curve steepened with the 30-year yield increasing 27 basis points, ending the month at 1.46%. The rise in yields, particularly at the long-end of the curve, eroded fixed-income returns with the Barclays US Long Treasury Index losing 4.3% last month.

In real assets, commodity prices continued to increase with the Bloomberg Commodity Index up 6.8% in August. The rally was driven by energy as spot WTI crude oil prices rose, reflecting improving global demand. Spot gold prices capped their rally, falling 0.4% last month after experiencing their largest one-day decline in over five years, highlighting that no asset class is immune to market volatility in the current environment.

Despite the gains from risk assets, significant economic uncertainty prevails. To that end, we expect heightened volatility across capital markets given the wide range of potential economic outcomes. We encourage investors to be disciplined and mindful of market liquidity. We maintain our recommendation of a dedicated allocation to Treasuries to support liquidity levels and cash-flow needs as potential market dislocations can introduce bouts of illiquidity across publicly-traded assets.