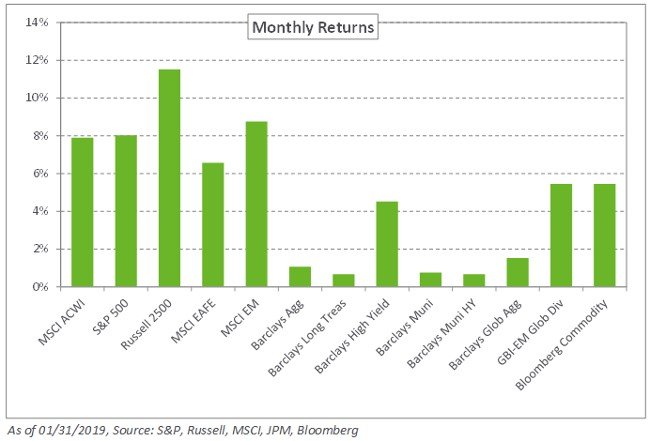

A more dovish tone from the Federal Reserve and improving trade rhetoric between the United States and China helped stocks bounce back in January after their widespread selloff a month earlier. The S&P 500 Index gained 8.0% and small-cap US equities, as measured by the Russell 2000, returned 11.2%. Internationally, the MSCI EAFE Index rose 6.6%, with Europe lagging the US amid weakening economic data, particularly in Italy. The MSCI Emerging Markets Index increased 8.8% as currency appreciation, notably in the Brazilian real and Russian ruble, provided a tailwind to returns.

Yields on 10-year US Treasuries and German Bunds declined five and nine basis points, respectively, as the Fed indicated a slower pace for rate increases in 2019. Credit spreads broadly retreated from December’s elevated levels; the Barclays US Corporate High Yield OAS declined 103 basis points to 4.23%, lifting the index 4.5% in January. In emerging markets, local- and dollar-denominated debt were in the black, with the JPM EMBI Global Diversified and JPM GBI-EM Global Diversified Indexes posting gains of 4.4% and 5.5%, respectively.

In real assets, spot WTI Crude Oil increased 18.5% following news of OPEC supply cuts to the US. Additionally, midstream energy benefitted from higher oil prices and strong earnings, fueling a 16% increase last month in the Alerian Midstream Energy Index.

The selloff at the end of 2018 and the subsequent rebound in risk assets in January serve as a reminder that volatility is likely to continue in the near term as global growth slows and the US economy advances into the late stage of the economic cycle. To this end, we remind investors to maintain a diversified, risk-balanced portfolio, with a preference for an overweight to emerging market equities and a reduction in lower-quality credit exposure.