Realizing gains is a sign of capitalizing on a successful investment. Still, for many it is an anxious process as paying taxes can take a significant bite out of returns and hinder the investment’s ability to help meet the portfolio’s financial objectives.

At NEPC, we believe it is important to not become paralyzed by large unrealized gains as the specter of taxes shouldn’t override the principles of portfolio management. The idiosyncratic risk in individual assets can be meaningful with a market correction capable of decimating their value. To this end, we recommend to our private wealth clients that they have the tools in place to understand the risk of these positions, how they contribute to portfolio volatility and potential ways to mitigate the impact of taxes.

In a previous paper—Evaluation of Tax Liabilities—we discussed a framework that takes into account the level of embedded gains, the holding period and the return delta (return of the existing investment versus a potential replacement) as the primary determinants of the breakeven point for a given tax liability. For example, take the sale of an investment with a cost basis of 80% of the market value. It will take two-to-six years to breakeven/recover the taxes paid, assuming the new security has an expected return 1% to 3% greater than the investment being sold. In this paper, we explore the different ways to handle a position in an individual security with a large embedded gain that requires an extended time horizon—for instance 10 or more years—to reach its breakeven point post-taxes.

Investors can find themselves holding individual or multiple low-basis assets in situations including:

- Receipt of equity in a company from an IPO or sale of operating company shares

- Positions tied to stock grants or options received as compensation from a company

- Positions that have been gifted and held for a very long time

- Personal stock investments

Certain factors should be considered when a portfolio holds low-basis assets. These include the percentage of total wealth tied up in assets with a low basis and their role in the portfolio. It is vital to discern if these assets are creating an undesired exposure and whether their position can be managed by underweighting or avoiding the sector. It is also important to study the asset’s risk profile to determine its stability or volatility. There will be a quantifiable tradeoff between the desired portfolio and the level of taxes incurred; in addition, the emotional aspects of a sale or elements of behavioral finance may come into play as well.

For investors, it is worth noting that inertia may come at a price. For instance, dramatic movements in individual stock prices can happen over both relatively short or extended time periods. Take the case of the S&P 500, which has experienced losses of around 40% twice between 2000 and 2010, with many individual stocks losing much more than that. The dotcom bubble serves as an example of volatility, where technology stocks posted outsized returns in the 1990s only to crash in the early 2000s. Similarly, energy stocks can also be temperamental.

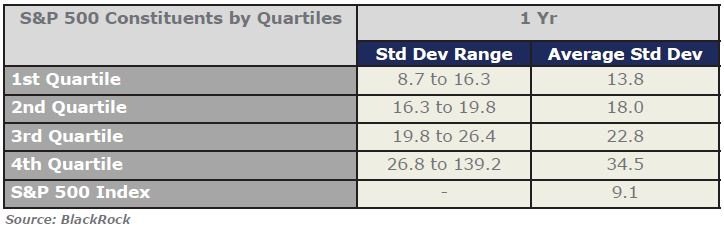

The volatility, measured by the standard deviation, of individual stocks is highlighted in the table below, which breaks the S&P 500 into four quartiles. The volatility of the S&P 500 over the past year has been roughly 9% while each quartile—even the lowest-risk one—has a standard deviation that is much higher than that of the index, underscoring the benefits of diversification and the idiosyncratic return profiles of individual stocks.

We believe the treatment of these low-basis stocks should be viewed within the framework of risk management with potential strategies which include:

- Offsetting gains with losses over time: This requires managing the overall portfolio from a tax perspective. This will likely be easier if holdings are in separate accounts and clients can work with managers instead of trying to sell mutual funds or similar collective vehicles.

- Moving a security into a tax-managed account: This approach allows a manager to balance the exposure with the other stocks in the portfolio. This works best if investors also give the manager additional funds to refresh the basis in the account.

- Spreading out the pain: This involves creating a taxable capital-gains budget each year and reducing exposure gradually over time.

- Continuing to hold the position: If the position is not material and one is comfortable with the risk, then doing nothing could be the right answer. It is important to note that this could be more attractive if the asset is still held in someone’s estate and will receive a step up in basis upon their passing.

- Using options to manage exposure while maintaining position: Different strategies with varying degrees of complexity could be evaluated as potential solutions.

- Gifting the security: Under the recent tax law changes, wealthy investors will be able to deduct charitable gifts only if they are able to itemize. The potential benefit is simply the unrealized gain multiplied by the effective tax rate. Clients could also gift the security to subsequent generations but need to recognize that the cost basis is typically retained and it may be a case of moving the problem from one generation to the next.

At NEPC, we believe having a plan in place to address low-basis assets is part of a prudent approach to portfolio management. Evaluating portfolio returns with and without low-basis assets included in the return calculation can help quantify their impact; in addition, volatility can be measured against an appropriate benchmark. If you are concerned about these holdings in your portfolio or want to further this discussion, please call your NEPC consultant today.