Volatility roared back into US equity markets in the first quarter, snapping an 18-month benign streak. Stoked by fears of rising Treasury yields and a tumultuous unwinding in the short-equity volatility trade, the S&P 500’s run of 15 straight months in the black ended in February. Markets fared no better in March amid an escalation in trade tensions between the United States and China. The prospect of disruption in economic trade between the world’s two largest economies rattled markets globally, sending stocks lower and pushing credit spreads higher.

The tit-for-tat tariffs levied by the US and China underscore our concerns around the backlash against globalization—one of our key market themes for 2018—as decades of unevenly distributed economic gains and loss of manufacturing jobs fuel a rise in populism. Politically, this fatigue with globalization is broadly expressed as a desire to shy away from multilateral relations and to turn inward as a nation, as demonstrated by the Brexit vote in 2016. We view this as a long-term trend as the underlying drivers—unequal wealth distribution and a shrinking middle class in the developed world—are unlikely to reverse course in the foreseeable future. We believe the result is a persistent anti-establishment political bias, as a disenchanted electorate in Europe and the US challenges political norms and economic conventions.

To this end, the tensions surrounding the trade relations between the United States and China strike at the heart of the global economy’s free trade orthodoxy. US trade with China totals nearly $650 billion and the combined value of trade amongst its main trading partners—China, Canada and Mexico—is nearly $2 trillion. With these trade balances playing a prominent role in the global economy, US trade policy has been a major area of focus within our globalization backlash theme. While we maintain our belief that a shift to an aggressive US protectionist trade policy is a lower probability tail-risk, a sharp decline in trade with the US’s main trading partners would significantly disrupt global economic activity.

Viewing the ongoing US-China trade dispute through a basic game theory lens, our expectation is that an all-out, no-holds-barred trade war is a low-probability event. If we assume the two nations act in their self-interest, then each side is heavily incentivized to avoid a full-blown trade war as the outcome is adverse for both. The two countries’ leaders and their advisors are also keenly aware that a trade war would radically destabilize the global economy and equity markets. So, on the table are three basic strategies:

- China chooses to not respond to the tariffs levied by the US, which is an unlikely outcome.

- China and the US reach a negotiated settlement, which is possible but requires a mutual win for both nations. The challenge will be to find a narrow agreement that offers economic gains to the US and China but doesn’t compromise their longer-term strategic interests. At the same time, both leaders would need to highlight successes to claim victory on the issue to their audience back home.

- Let the current game of tariff tit-for-tat play on with the US and China matching the response of the opposing player’s most recent move; their self-interest in avoiding a global trade war ensures a calibrated response to not let the situation get out of hand. In our view, this is the likely outcome for US-China trade relations, paving the way for greater volatility but not materially altering the equilibrium in the capital markets and the global economy.

To this end, our slate of current opportunities remains largely unchanged. Global growth conditions are on the upswing supported by easy financial conditions and an improved corporate earnings outlook. We believe equities outside the US are best positioned to benefit from this combination and encourage investors to maintain an overweight to emerging market stocks and increase exposure to small-cap equities in the developed world, specifically Japan and Europe. Looking to the US, while the current economic expansion can continue to support domestic stocks, valuations and profit margins are hovering around cyclical highs; as a result, we recommend trimming gains from US equities. Similarly, we suggest reducing credit exposure as we feel current spread levels for return-seeking fixed income, such as high-yield debt and dollar-based emerging market bonds, are not adequately compensating investors. Furthermore, we encourage the addition of safe-haven fixed-income exposure, for instance, Treasury Inflation-Protected Securities (TIPS) and Treasuries, to mitigate potential market drawdowns and maintain a diversified risk-balanced portfolio against the backdrop of US-China trade tensions and higher volatility in equities.

Global Equities

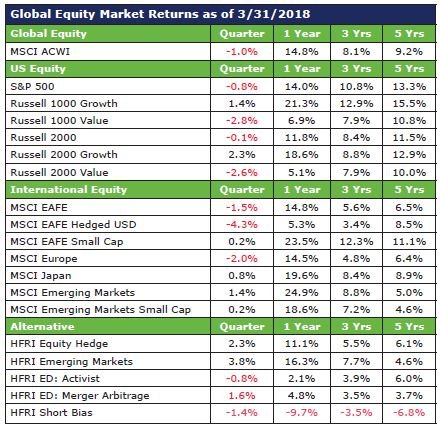

Volatility dulled returns in the first quarter amid heightening concerns around trade tensions between the United States and China. Developed market stocks outside of North America declined 1.5%, according to the MSCI EAFE Index, while emerging market equities eked out gains of 1.4%. The currency-hedged MSCI EAFE Index lost 4.3% during the quarter as most currencies strengthened against the dollar. US stocks fell 3.7% in February, snapping their 15-month winning streak; they ended the quarter in the red, losing a modest 0.8%. Information technology dominated sector performance, posting strong returns globally.

Within private equity, the fundraising run rate in North America fell in the first quarter from a year ago; in contrast, fund raising in Europe touched a record high. Driven by larger deals, global buyout volume also scaled a new peak for the three months ended March 31, up nearly 90% over the first quarter of 2017; buyout exits continued to decline, modestly down from the same period a year ago.

Equity hedge funds initially rallied, led by fundamental- and market-neutral strategies, but market volatility eroded returns with the HFRI Equity Index ending the quarter at 2.3%. Within sectors, technology outperformed, returning 4.78%.

Global Fixed Income

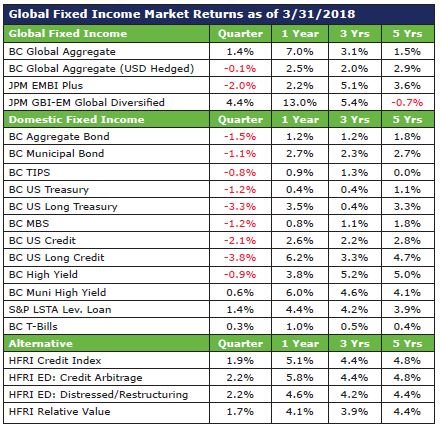

Credit was mostly subdued in the first quarter with the Bloomberg Barclays Aggregate down 1.5% and the Bloomberg Barclays High Yield Index losing 0.9%; breaking from the pack, the S&P LSTA Leveraged Loan Index was up 1.4%. US long credit was down 3.8%, while long Treasuries fell 3.3% with yields on the 10-year note at 2.74%.

Outside the US, emerging markets continued to rally with local debt leading the way. The JPM GBI-EM Index returned 4.4% in the first quarter, bolstered by emerging market currencies which were up 2.5%. Hard-currency sovereign debt didn’t fare as well, falling 2.0% as spreads widened.

Within hedge funds, long/short credit strategies suffered losses in March with the HFRI Credit Index ending the quarter at 1.9%. Relative-value arbitrage, convertible, global-credit and yield-alternative approaches also pared gains for the quarter in March. Mortgage-backed securities outperformed other asset-backed investments for the quarter due to their lower sensitivity to traditional credit risk.

Real Assets

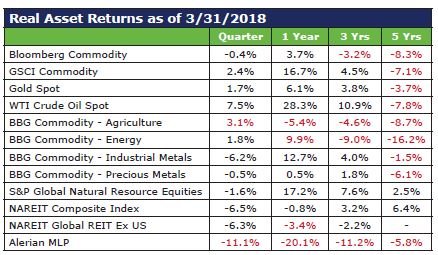

Commodities declined 0.4% in the first quarter, according to the Bloomberg Commodity Index. Agriculture and energy were in the black while industrial metals lagged. We remain positive on natural resources equities; we also recommend midstream energy equities (MLPs) with security selection being key.

Within private real assets, we favor energy-focused private equity and credit opportunities. The recent strength in the underlying commodities has stabilized prices but transaction volumes are sharply down. Opportunities exist as publicly-traded companies or those aiming to go public struggle to tap capital markets, especially to issue equity. We are also constructive on the mining sector over the mid-to-longer-term.

Within real estate, fundamentals remain healthy in the US core property market, but the pace of value appreciation is moderating amid rising interest rates and slowing growth in net operating income. A disconnect between asset values, underscored by publicly-traded REITs and private transactions, appears to be widening as most REITs are changing hands at double-digit discounts to their net asset values; if this dynamic persists, public markets may be more attractive for core US real estate. For non-core US real estate, relative-value opportunities remain more appealing. We favor demographically-driven property sectors and managers that are attentive to duration risk in the later innings of the expansion cycle.

Final Thoughts

US trade policies for China and NAFTA are at the forefront of investors’ minds today. At NEPC, we have been examining the disruption surrounding free trade and globalization for nearly two years now and believe this theme is here to stay. That said, we think a willingness to weather uncertainty, paired with appropriate returns as compensation for risk, has the potential to improve returns over the long term. To this end, we encourage investors to overweight equities outside the US as the outlook for corporate earnings remains strong. We also ask investors to look to areas of the portfolio that may not offer adequate compensation for risk and reduce exposure to high-yield bonds, while adding to TIPS and Treasury bonds.

We hope to expand on these themes and more at NEPC’s 23rd Annual Investment Conference on May 14-15 in Boston. We plan to explore a wide variety of topics through the prism of this year’s theme of ‘disruption.’ In addition, we are excited to bring you a roster of accomplished external speakers. We hope you can join us and we look forward to seeing you this month.