At 25, a career in retirement planning isn’t exactly the stuff that makes me the life of a dinner party with friends.

However, it has taught me a valuable thing or two. For starters, it’s never too early to start planning for your retirement. And when you do, don’t brush past seemingly minor decisions around saving and investing, for the choices you make in your 20s can make a sizable dent in your retirement income in your 70s.

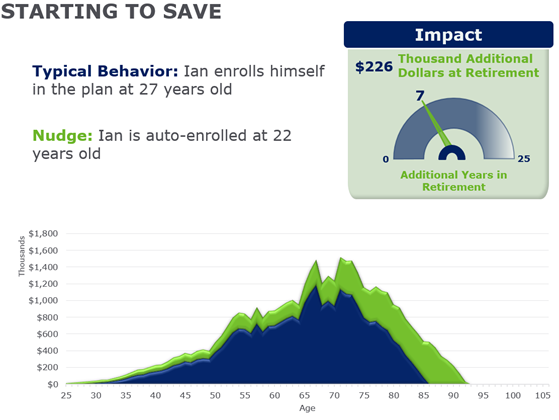

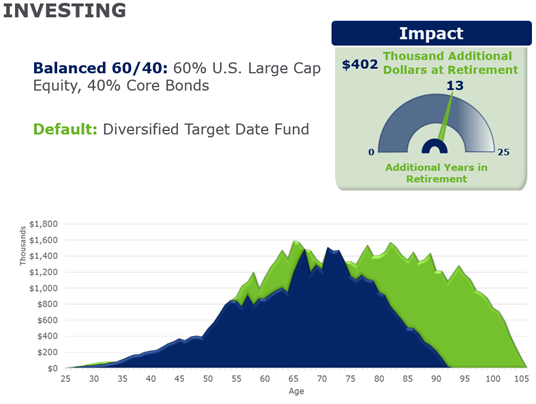

Case in point: My boyfriend Ian, 27, a newbie in the world of retirement planning. His company’s Qualified Default Investment Alternative (QDIA)—into which every new employee is auto-enrolled—is a balanced fund. This one invests 60% in equity and 40% in fixed income. He is confident this early start will hold him in good stead for retirement. Not to burst his bubble, but if Ian had started investing when he first entered the workforce at 22, he could have had an additional $226,000 in retirement or 7 more years of financial security.1 That’s not all: if at 22, Ian selected an age-appropriate target date fund with an equity focus instead of the balanced fund, he would have had an extra $402,000 upon retirement, or 13 more years of financial security.2

NEPC’s Defined Contribution team believes there are multiple ways plan sponsors can help participants achieve greater financial security in retirement. Moves, ranging from making a diversified target date fund the QDIA, to auto-enrollment to ensure participants are benefitting from compounded interest, auto-escalation to increase savings rates, and restricting loans are just some of the ways in which employers can set their employees up for success.

Ask your plan sponsor to reach out to their NEPC DC consultant to ensure your plan’s features or default fund option are leaving no extra dollars on the table. Also, while Ian can’t turn back time, I am happy to say that he has moved out of the balanced fund and is putting his tax-free contributions to better use in retirement planning!

Source: “Dollars and Cents: Translating Decisions into Dollars.” NEPC 2019 Client Conference Presentation. Kristen Colvin, Brian Donoghue and Tim Wasgatt.

1Assumption: Enrollment at a deferral rate of 6% with auto-escalation to 10% (increases 1% a year). Company match of 100% on first 3%. Salary of $50,000. A raise of 2.25% a year. Inflation of 2.25%. Decumulation uses a replacement ratio of 50% of final salary increased annually for inflation. Return assumptions are based on a 60% US large cap/40% core bond allocation and NEPC’s 5-to-7-year capital market assumptions. Annual Monte Carlo simulation produced an average return of 5.77%.

2Assumption: Enrollment at a deferral rate of 6% with auto-escalation to 10% (increases 1% a year). Company match of 100% on first 3%. Salary of $50,000. A raise of 2.25% a year. Inflation of 2.25%. Decumulation uses a replacement ratio of 50% of final salary increased annually for inflation. Return assumptions are based on the Morningstar average target date fund glidepath, a 60% US large cap/40% core bond allocation and NEPC’s 5-to-7-year capital market assumptions. Annual Monte Carlo simulation produced an average return of 6.26% for a target date allocation and 5.77% return for a static 60% US large cap/40% core bond allocation.