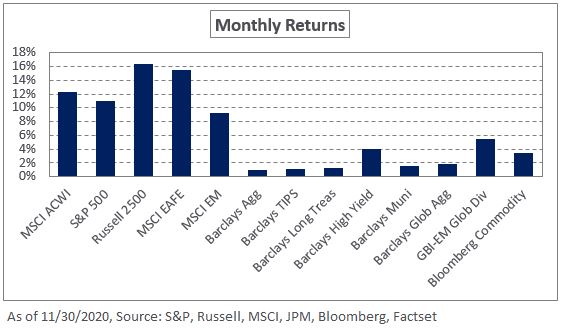

November was a momentous month as investors, emboldened by the results of the U.S. elections and the potential success of multiple COVID-19 vaccines, bid up equities. The twin prospects of a divided government resulting in the likelihood of a diminished agenda for President-elect Biden, and the imminent implementation and distribution of the coronavirus vaccines fueled gains of 10.9% for the S&P 500 Index; not to be outdone, the Russell 2000 Index returned 18.4% last month. Value stocks largely drove performance, especially buoyed by the news of the vaccines given that these companies have been some of the hardest hit by the restrictions and lockdowns imposed by the pandemic. Outside the U.S., weakness in the dollar boosted local-currency returns, with the MSCI EAFE and MSCI Emerging Markets indexes up 15.5% and 9.2%, respectively.

In fixed income, yields were relatively flat during the month with 10- and 30-year Treasury yields falling one and six basis points, respectively. While nominal yields were mostly unchanged, the 10-year Treasury breakeven rate increased 10 basis points to 1.77%, underscoring an increase in inflation expectations due to the potential for further fiscal stimulus. In credit, spreads—especially of lower-quality issues—tightened. The option-adjusted spread on the Barclays U.S. Corporate High Yield Index fell 97 basis points in November, fueling returns of 4% for the index.

In real assets, broad commodity indexes rallied with higher spot prices across the energy sector. Spot WTI Crude Oil increased 27.2% last month but is still down 25.8% for the year. In addition, gold spot prices fell 5.5% in November as demand waned for the safe-haven asset amid the wave of risk-on sentiment.

While the performance of risk assets has been encouraging, there are still significant uncertainties surrounding the global economy. We expect continued volatility across capital markets and encourage investors to be disciplined and mindful of market liquidity. We would like to remind our clients that disciplined rebalancing is not only about buying undervalued or overlooked assets, but also selling them when they have delivered robust returns and outperformed the rest of a diversified portfolio. To that end, we recommend rebalancing before the end of the year. We also encourage investors to maintain a dedicated allocation to Treasuries to support liquidity levels and cash flow needs as potential market dislocations can introduce bouts of illiquidity across publicly-traded markets.