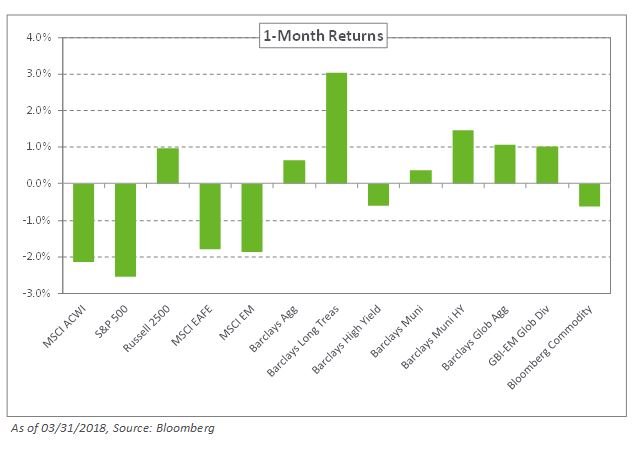

Volatility hobbled equity markets in March amid escalating tensions over a potential trade war between the United States and China. With a tit-for-tat tariff battle underway between the world’s two largest economies, the S&P 500 Index slumped 2.5% and the MSCI Emerging Markets Index declined 1.9% last month; the S&P 500 fell 0.8% for the three months ended March 31, its first negative quarter in over two years.

The Federal Reserve raised rates in its first meeting under new chair Jerome Powell. In response, the Treasury curve flattened as the long-end of the curve declined with the 10-year Treasury yield down 12 basis points to 2.74%, and the 30-year Treasury yield falling 15 basis points to 2.97%. As such, long duration fared well with the Barclays Long Treasury Index up 3% on the month. Additionally, credit spreads widened slightly, with the Barclays US High Yield Index declining 0.6%. Similar to February, liquid real assets fell sharply with the Alerian MLP Index losing 6.9% as higher Treasury yields took some of the shine off risky assets.

Despite the recent volatility, our global outlook remains broadly unchanged. While we are likely to experience continued volatility, strong economic growth and fundamentals underscore a positive outlook for international and emerging market equities. As such, we remind clients to stay committed to a risk-balanced approach and to evaluate market opportunities should short-term dislocations occur as a result of escalating trade tensions.