In the world of investment management, clients seeking guidance have the option to work with advisors who provide advice on investment decisions or to hire outsourced Chief Investment Officers (OCIOs) to manage their investments. This paper aims to clarify the differences between the advisory and OCIO model and help readers understand which approach may be better suited to their needs.

What is Advisory?

Advisory firms provide guidance and recommendations to clients on how to invest their assets. Advisory services can cover a range of topics, including asset allocation, investment manager selection and risk management consistent with a given client’s objectives. Advisors provide recommended actions and the client retains control of the decisions and, typically, implementation of those decisions.

What is OCIO?

Outsourced Chief Investment Officers (OCIOs) are investment managers who take on the responsibility of managing all or most aspects of a client’s investment portfolio. This includes setting investment objectives, creating an investment strategy, selecting and monitoring investments, implementing decisions and rebalancing the portfolio as needed. There are three main types of OCIOs, including funds-of-one, investment management firms offering funds-of-funds solutions, and discretionary consulting firms. Different OCIOs can work with a wide variety of clients or be focused on a single market segment, such as endowments.

Differences Between Advisory and OCIO

While both advisory and OCIO firms can be beneficial for clients, there are some key differences between these two approaches:

Level of Control

With advisory, clients retain ultimate control over their investment decisions. They can choose to follow or ignore the recommendations of their advisor, and they can make changes to their investment strategy as they see fit. With OCIO, the OCIO has control over the portfolio and makes most, if not all, investment decisions on behalf of the client. Some OCIO models offer greater flexibility to control the decisions of the OCIO relative to others. Bespoke discretionary consultant models typically offer the greatest flexibility, while funds-of-one offer the least control for the end client.

Customization

Advisory services can be tailored to the specific needs and goals of the client. Advisors can consider factors such as risk tolerance, time horizon, and spending needs when providing recommendations. OCIO, on the other hand, typically follows a standardized investment strategy that may not be as customized to the client’s individual needs. Again, funds-of-one offer the least amount of customization available for the end client while bespoke discretionary consulting models offer the greatest amount of customization.

Fees

The cost of advisory services is typically lower because the advisor is taking on less responsibility for investment decisions and operations, and acts at a lower fiduciary level. OCIO fees are generally higher than advisory services, as the OCIO takes on more fiduciary and operational responsibility for managing the portfolio.

Governance

Under an advisory relationship, the client retains ultimate responsibility for the investment decisions made in their portfolio. This means that the client is ultimately responsible for setting investment goals, defining risk tolerance, and approving and implementing recommendations made by their advisor. Under an OCIO relationship, the OCIO assumes a greater level of responsibility for investment decisions and implementation of those decisions, and thus will have a more active role in the governance of the portfolio.

OCIO’s typically establish a formalized governance process that may include investment policy development and review, portfolio construction and monitoring, risk management, operational responsibilities, and ongoing reporting. This process can help to ensure that the portfolio is managed in a disciplined and consistent manner, while also allowing for greater flexibility and speed in investment decision-making.

Overall, the level of governance involved in an OCIO relationship can provide clients with greater peace of mind and a more structured investment experience. However, it is important for clients to carefully consider their investment goals and objectives before deciding whether an OCIO relationship is right for them.

Investment Fees

OCIO’s are often able to offer lower underlying investment manager fees due to the scale of the OCIO’s business. OCIO providers typically manage large pools of assets on behalf of multiple clients, which allows them to negotiate lower fees with investment managers. Because investment managers are typically working with a larger investment pool and a single point of contact at an OCIO, they may be more willing to negotiate on fees than they would be with individual clients.

However, it is important for clients to carefully evaluate the fees associated with an OCIO relationship. While investment manager fees may be lower and certain aspects of the organization’s responsibilities may be outsourced to the OCIO, the OCIO typically charges additional fees for their services which can offset some or all the potential savings. Clients should carefully consider the overall value proposition of an OCIO relationship, considering factors such as customization, level of control, governance and desire to outsource certain functions to the OCIO.

OCIO Performance versus Advisory

Because the OCIO has greater control over the portfolio in an OCIO relationship, they may be able to make more timely investment decisions and react more quickly to market conditions. In addition, because OCIO providers typically manage large pools of assets, their scale may drive overall fees lower and may afford access to investment opportunities that are harder to access for individual investment programs. It is important for clients to carefully evaluate the investment track record and due diligence process of any OCIO provider before entering into a relationship.

By contrast, investment performance in an advisory relationship is largely determined by the investment decisions made by both the client, which are typically based on the recommendations of the advisor. While advisors may provide recommendations and guidance, it is ultimately up to the client to make the final investment decision. As a result, investment performance may be more variable and dependent on the client’s individual investment decisions.

Clients should carefully evaluate the investment track record and due diligence process of any potential provider, and should consider all factors – including customization, level of control, fees, governance, and investment performance – when making a decision about their investment approach.

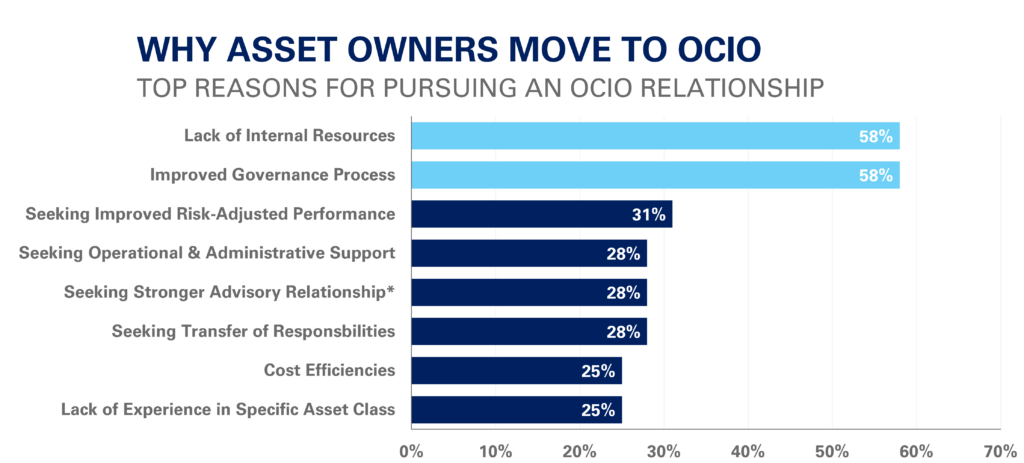

Why Clients Change from Advisory Relationships to OCIO

- Lack of internal resources: Some clients simply may not have the internal resources to manage their investment program effectively. By outsourcing to an OCIO, they can benefit from the resources and expertise of a larger investment and operations team.

- Improved governance process: An OCIO can help clients establish a more robust governance process, including setting clear investment objectives, defining risk parameters, and establishing monitoring and reporting protocols.

- Seeking operational & administrative support: An OCIO can provide operational and administrative support, such as managing custodians, legal and regulatory assistance, and asset implementation and cash movements.

- Seeking a stronger relationship: Clients may seek a closer, more collaborative relationship with their advisor and moving to an OCIO can oftentimes provide more synergies and efficiencies. The OCIO can act as a partner and fiduciary, taking on a greater level of responsibility for the success of the investment program.

- Seeking transfer of responsibilities: Clients may be looking to shift responsibility for investment decisions to a third party, freeing up their own resources to focus on other areas of their business.

- Seeking improved risk-adjusted performance: An OCIO can potentially offer a more sophisticated investment approach, including access to a wider range of investment ideas and vehicles, that may be more effective at achieving the client’s investment objectives. The day-to-day portfolio management and oversight of portfolios may also be a source of value-add of OCIOs relative to advisory services.

- Cost efficiencies: For some clients, the cost of hiring and maintaining a full investment and operations team can be prohibitive. By outsourcing most of these functions to an OCIO, clients can benefit from economies of scale and potentially lower investment costs.

- Lack of experience in a specific asset class: OCIOs can offer specialized expertise in specific asset classes that clients may not have in-house or on their investment committees. This can be particularly beneficial for smaller organizations that may not have the resources to retain experienced investment professionals.

Conclusion

Ultimately, the choice between an advisory and OCIO relationship will depend on the needs and preferences of the client. Those who want more control over their investment decisions and prefer a more customized approach may be better suited for advice. Those who want to delegate investment management and operational responsibilities and benefit from scale may prefer OCIO. By understanding the differences between these two approaches, clients can make a more informed decision about which option is right for them.