In this blog, the first in a series of three, we highlight the importance of monitoring the funded status of a defined benefit plan.

A corporate employer on the path to terminating its defined benefit plan faces numerous complexities. This journey can bring to the forefront key issues such as asset allocation, liquidity, funded status, and hedging requirements. Risks for corporate pension plans can change suddenly and quickly, taking employers by surprise. As a result, it is important to keep a close eye on the funded status of a defined benefit plan. Enter: NEPC’s Corporate Defined Benefit Team (“DB”). The DB Team’s proactive monitoring of funded status played a decisive role in helping a client de-risk the defined benefit plan’s portfolio to lock in its fully funded position and prepare for a retiree annuity buyout transaction.

The Challenge

NEPC partnered with a long-time client to help achieve its end goal to terminate its pension plan. The plan’s funded status had exceeded 100% based on the projected benefit obligation (PBO). The client’s governance board approved a significant retiree buyout in 2025 and full plan termination in 2026.

The client began liquidating risk assets in the spring of 2025, but then quickly paused as market volatility caused funded status to drop below 100% in early April. The client wanted to avoid locking in funded status under 100% as it would require additional cash contributions to support its objective of terminating its defined benefit plan.

Enter: NEPC

NEPC had monitored the client’s PBO funded status for years. Subsequently, our scope expanded to include funded status estimates based on the Pension Benefit Guaranty Corporation (PBGC) and plan termination.

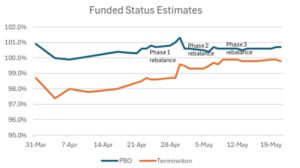

We provided more frequent estimates on funded status after the trading was paused. Our estimates confirmed the client’s plan hit above 100% funded after a week. With funded status back above 100% and the market stabilizing, the client gained confidence to move forward with its de-risking plan. We developed a phased rebalancing plan to liquidate the risk assets to ensure cash was available for the annuity buyout.

The chart below shows the estimated PBO, and termination funded status estimates over the 2025 period in question and notes when the rebalancing occurred.

The Outcome

The actions taken further reduced volatility around funded status by over 30% and positioned the client for its retiree buyout and plan termination.

By keeping our finger on the pulse of funded status during a volatile time and implementing a phased rebalancing plan, we were able to help further mitigate risk. This example highlights our ability to adapt to changing market conditions while managing the goals and objectives of the client. The result successfully positioned the client for a smooth plan termination.

Next Up

Stay tuned for the second installment of our three-part series, where we will address the client’s successful use of a pension risk transfer specialist for its large annuity buyout, and NEPC’s role in that process.

Please contact your NEPC consultant if you have any questions or would like to discuss your individual plan.