Wealth brings with it a sense of responsibility…and complexity.

In order to simplify, many high-net-worth families collectively pool the assets of individual family members to form a legal partnership entity. The resulting economies of scale can not only lead to significant fee savings, but also open the door to a larger universe of investment choices for smaller accounts. The challenge is finding the right balance between flexibility and simplicity. While flexibility can take some of the pressure off the investment process, it can increase cost and complexity; on the other hand, simplicity lowers costs and complexity, but affords less customization.

In this paper we share some best practices around partnership structures, which can take the form of limited partnerships or limited liability corporations.

Partnership Structure

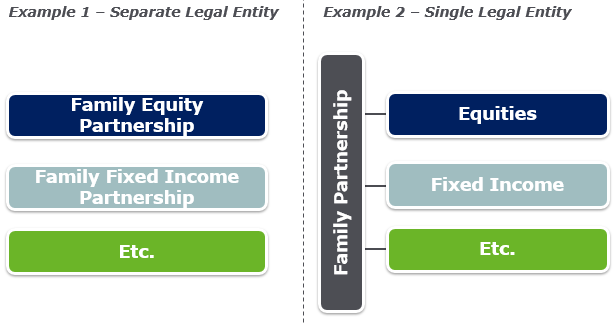

In our experience, families typically do one of the following:

- Set up each investment pool as a

separate legal entity, or - Set up each investment pool as a

sleeve within a single investment

entity

From an investment perspective, there is no material difference between these options; however, they have different tax or legal implications. To this end, we recommend engaging advisors across each of these disciplines as a collaborative decision-making process will optimize tax, legal and investment considerations.

CASH OR IN-KIND CONTRIBUTIONS

Although it is simpler to fund new partnerships with cash, it may be advantageous from a tax perspective to opt for in-kind contributions if there are embedded gains in positions that will be retained. Since markets can move significantly in short periods of time, we recommend that an initial gain/loss review be conducted relatively early in the process. We also suggest holding off on final decisions until just before the actual funding date to accommodate changes in the gain/loss figures.

To the extent that accounts have a net loss or immaterial gain, we usually advocate selling, funding with cash, then repurchasing (if desired) within the partnership. For accounts with material gains, we typically suggest an in-kind contribution (assuming the account is to be retained) unless there are losses elsewhere that could be used to offset the gains.

LIQUIDITY PROVISIONS

Partnerships can be structured with a wide range of liquidity provisions. It is important to understand that frequent liquidity provisions offer more flexibility but increase administrative costs and complexity. Striking the right balance can be tricky: offer too little liquidity and family members may chafe at the restrictions or, to the extent they have control, look to move their assets elsewhere; offer too much liquidity and family members may treat the pooled vehicles like a checking account, raising costs for everyone with repeated transactions.

To this end, we have found a quarterly liquidity provision is often the optimal solution for most clients. Some manage with more infrequent windows of liquidity but may retain more assets outside the partnerships and/or have lines of credit to meet unexpected liquidity needs.

To be sure, the partnership must also consider the liquidity of the underlying investments. For longer-dated assets, such as investments in private markets, a different approach is necessary. It is often possible, for families with a relatively small number of portfolios and consistent allocations to establish an evergreen partnership and let it run until there is a need to change ownership. At that time, commitments in the existing fund will cease and a new fund with fresh ownership allocations can be established for future commitments. For families with a larger number of portfolios or a greater propensity for change, it is often preferable to structure a rolling series of funds, with a new fund created every three-to-four years. This allows enough time to construct a robust portfolio within each fund while still providing family members with regular opportunities to change their desired level of participation.

INVESTMENT OPTIONS

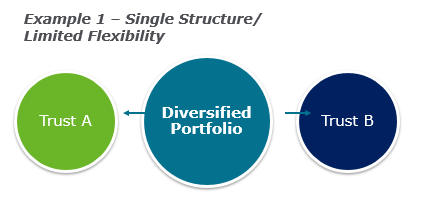

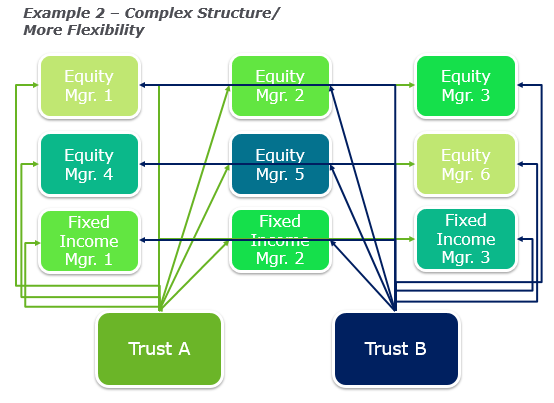

The tradeoff between complexity and flexibility usually dictates the number of partnership options. In our experience, it is usually advisable to err on the side of simplicity at the outset and increase the level of flexibility over time when and if the needs of the family warrant it. The two examples below represent either end of the spectrum:

|

|

Most families choose an approach that falls between the extremes as illustrated in the graph below. Partnerships are established at the asset-class level so that family members can customize their risk profile through the asset allocation process but retain exposure to the same lineup of managers within each asset class. Partnerships can be set at a broader level (global equities, for instance) or more narrowly defined (US equities, non-US equities, for example) to provide the amount of flexibility desired.

ADDITIONAL CONSIDERATIONS

Although we are not delving into them in this paper, there are additional factors to consider when establishing family-pooled investment vehicles.

The list below contains some of the most frequently asked questions:

- Should we use a Limited Liability Corporation (LLC) or a Limited Partnership (LP)?

- Should the partnership make pre-determined, pro-rata distributions or pay out withdrawals on demand?

- Should interest and dividend income be reinvested in the partnership or paid out?

- Under what conditions can the assets of a family foundation be commingled with the family’s taxable assets?-

- How should cash be handled for partnerships holding private markets funds which are subject to capital calls and distributions?

- What level of discount can be applied when gifting shares in a family partnership?

CONCLUSION

There are significant advantages to wealthy families when pooling the assets of individual family members. These partnership structures can offer flexibility but, if left unchecked, can also create unwanted complexity. If you want to learn more about these partnerships, please contact your NEPC consultant today.