Returns from growth-oriented assets fueled increases in the funded status of many U.S. corporate pension plans in the second quarter of 2023. During the quarter, the Federal Reserve hiked the Fed Funds Rate by 25 basis points. Estimated plan liability discount rates were higher in the second quarter and contributed to a lower present value of liabilities. Increased rates, combined with strong returns from growth assets, led to funded status gains for the three months ended June 30. The funded status of a total-return plan rose 7.4%, and the LDI-focused plan experienced a funded status increase of 4.2%.

Rate Movement Commentary

Short- and long-term interest rates moved higher for the three months ended June 30. Longer-term interest rates moved slightly less as the 30-year Treasury yield increased 18 basis points during the quarter to 3.85%. Credit spreads contracted 11 basis points over the same time period. Overall, increases in Treasury rates resulted in increased liability discount rates in the second quarter, with the rate for the open total-return plan increasing 17 basis points to 5.23% and the discount rate for the frozen LDI-focused plan increasing 23 basis points to 5.19% as of June 30.

Plan Sponsor Considerations

Global equities were largely positive in the second quarter of 2023 while fixed-income markets experienced losses as a result of interest rate increases. While long-term interest rates are modestly lower year-to-date, the increase in shorter-term rates and strong equity market returns this year provide an opportunity for total-return plans to (re)consider LDI to better meet objectives. For certain plan sponsors, higher-funded status levels are also providing a tailwind in the form of lower required contributions and declining PBGC variable-rate premiums. NEPC consultants are available to discuss the benefits and cost of various pension finance and derisking strategies.

Market Environment and Yield Curve Movement

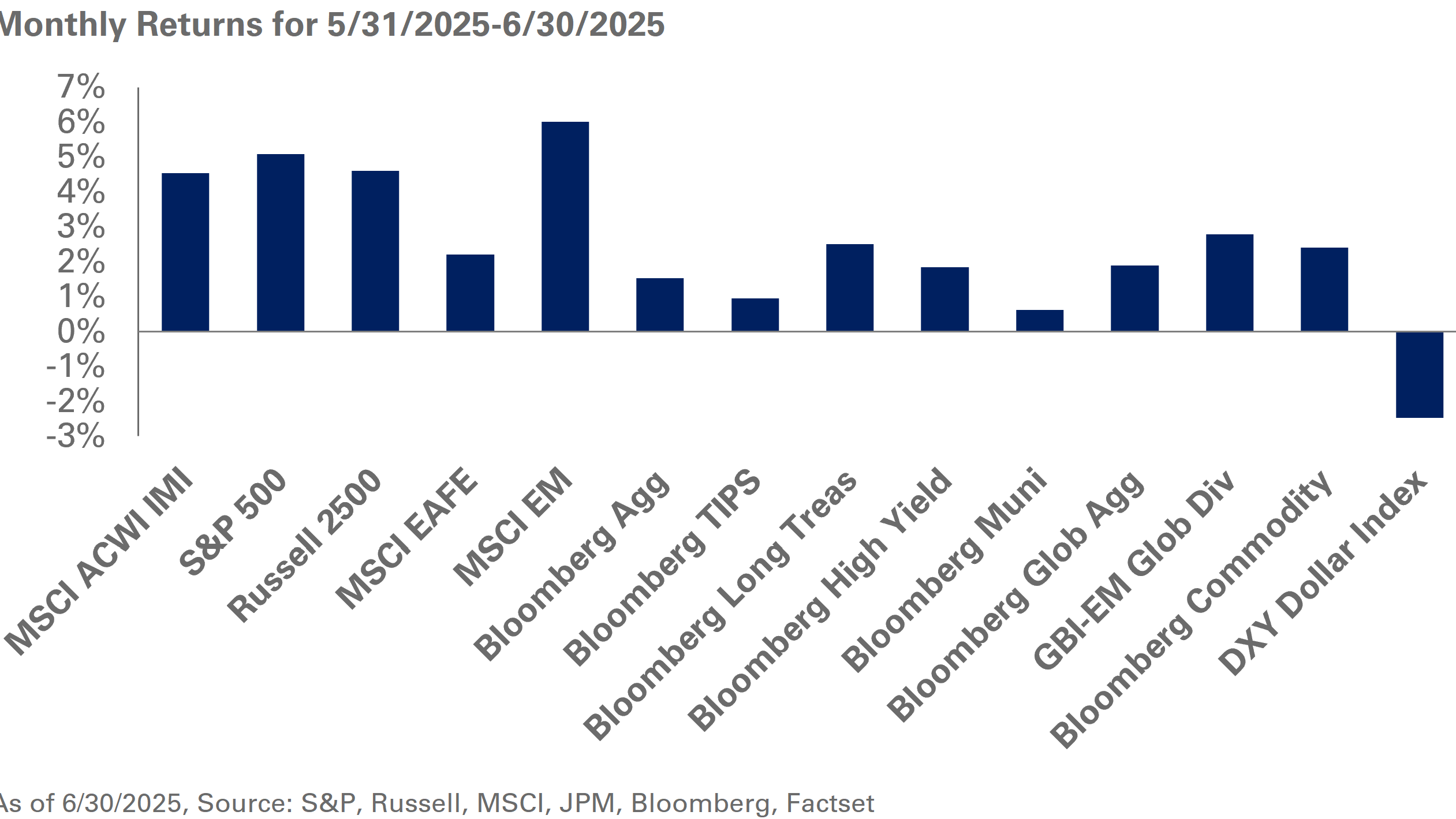

U.S. equities gained 8.7% in the second quarter of 2023. During this period, non-U.S. developed market stocks generally underperformed the U.S. as the MSCI EAFE returned 3%; the MSCI Emerging Market Index was up 0.9% in the same period.

Treasury yields increased across the yield curve and remained inverted. The 30-year Treasury yield was 18 basis points higher for the quarter, resulting in a loss of 2.3% for the Barclays Long Treasury Index; during this period, the Barclays Long Credit Index posted losses of 0.4%.