In May, pension plan sponsors experienced a decline in liability discount rates amid a lower Treasury yields. During this period, positive returns from global public equities offset losses from the prior month. Through the end of May, global public equity returns were positive quarter-to-date. The Treasury yield curve declined across most tenors for the month, though total-return-focused plans likely experienced positive changes in funded status due to returns from public equities. NEPC’s hypothetical total-return pension plan saw an improvement of 1% in funded status compared to 1.6% increase for our LDI-focused plan.

Rate Movement Commentary

The Treasury yield curve dropped in May, and remained inverted from the one- to 10-year tenors. The 10-year yield decreased 18 basis points to 4.51%, while the 30-year yield ticked down 14 basis points to 4.65%. Corporate bond spreads were largely unchanged for the month and remain tight relative to historical levels.

The movement in Treasury rates and credit spreads resulted in lower pension discount rates used to value pension liabilities. The discount rates for NEPC’s hypothetical pension plans decreased about 14 basis points to 5.57% for the open total-return plan, while the discount rate for the frozen LDI-focused plan dropped 16 basis points to 5.51%.

Plan Sponsor Considerations

In May, gains from global public equities offset losses from the prior month, and long-dated fixed-income debt posted gains fueled by lower Treasury rates. Treasury yields declined last month, while credit spreads across various maturities remained largely unchanged. At NEPC, we anticipate continued market volatility and the potential for market disruption. Plan sponsors should remain diligent about monitoring sources of change in funded status versus expectations, as equities and interest rates are likely to remain volatile. This includes closely monitoring ranges of hedge ratios to avoid becoming overhedged to longer-maturity rates with a flatter yield curve.

Market Environment and Yield Curve Movement

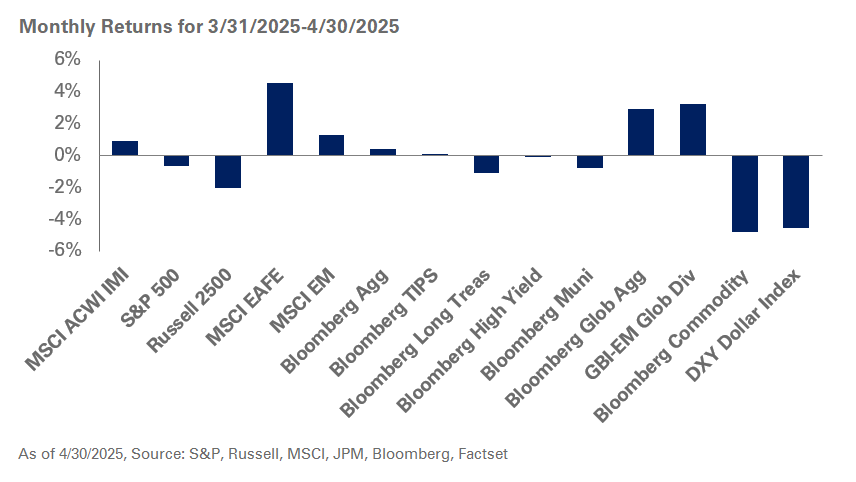

U.S. equities gained 5% in May, according to the S&P 500 Index. During the same period, non-U.S. equities also experienced gains with international developed markets up 3.9%, according to the MSCI EAFE Index. Emerging market equities underperformed the global public equities and were only up 0.6% last month, according to the MSCI EM Index. Broadly, global equities grew 4.1% during the same period, according to the MSCI ACWI Index.

In May, the Treasury curve decreased from the previous month and remained inverted from the one- to 10-year tenors. This generally resulted in gains for investment-grade fixed-income markets, with long-credit fixed income and long Treasuries performing similarly. During the month, the Bloomberg Long Treasury Index increased 2.9% and the Bloomberg Long Credit Index was up 2.8%.